Comcast 2015 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

Note 14: Income Taxes

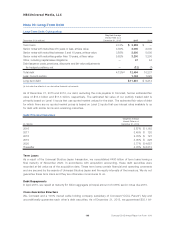

Components of Income Tax Expense

Year ended December 31 (in millions) 2015 2014 2013

Foreign

Current income tax expense $81 $33 $77

Deferred income tax expense 2(8) (16)

Withholding tax expense 139 108 123

U.S. domestic tax expense 510 22

Income tax expense $ 227 $ 143 $ 206

We are a limited liability company, and our company is disregarded for U.S. federal income tax purposes as

an entity separate from NBCUniversal Holdings, a tax partnership. NBCUniversal and our subsidiaries are not

expected to incur any significant current or deferred U.S. domestic income taxes. Our tax liability is com-

prised primarily of withholding tax on foreign licensing activity and income taxes on foreign earnings. As a

result of our tax status, the deferred tax assets and liabilities included in our consolidated balance sheet at

December 31, 2015 and 2014 were not material.

In jurisdictions in which we are subject to income taxes, we base our provision for income taxes on our cur-

rent period income, changes in our deferred income tax assets and liabilities, income tax rates, changes in

estimates of our uncertain tax positions, and tax planning opportunities available in the jurisdictions in which

we operate. We recognize deferred tax assets and liabilities when there are temporary differences between

the financial reporting basis and tax basis of our assets and liabilities and for the expected benefits of using

net operating loss carryforwards. When a change in the tax rate or tax law has an impact on deferred taxes,

we apply the change based on the years in which the temporary differences are expected to reverse. We

record the change in our consolidated financial statements in the period of enactment.

We classify interest and penalties, if any, associated with our uncertain tax positions as a component of

income tax expense.

Uncertain Tax Positions

We retain liabilities for uncertain tax positions where we are the tax filer of record. GE and Comcast have

indemnified NBCUniversal Holdings and us with respect to our income tax obligations attributable to periods

prior to the close of the joint venture transaction, including indemnification of uncertain tax positions for these

periods. The liabilities for uncertain tax positions included in our consolidated balance sheet were not material

as of December 31, 2015 and 2014.

Various domestic and foreign tax authorities are examining our tax returns through 2014. The majority of the

periods under examination relate to tax years 2005 and forward.

Note 15: Supplemental Financial Information

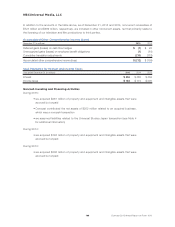

Receivables

December 31 (in millions) 2015 2014

Receivables, gross $ 5,949 $ 5,258

Less: Allowance for returns and customer incentives 469 356

Less: Allowance for doubtful accounts 69 60

Receivables, net $ 5,411 $ 4,842

Comcast 2015 Annual Report on Form 10-K 168