Comcast 2015 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

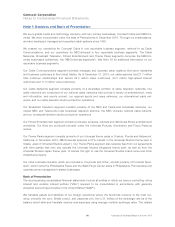

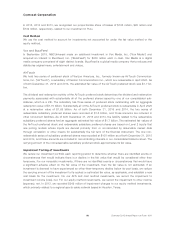

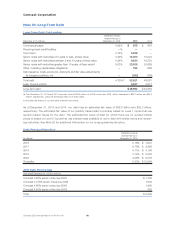

Investment Income (Loss), Net

Year ended December 31 (in millions) 2015 2014 2013

Gains on sales and exchanges of investments, net $12 $ 192 $ 484

Investment impairment losses (59) (50) (29)

Unrealized gains on securities underlying prepaid forward sale agreements 42 66 1,601

Mark to market adjustments on derivative component of prepaid forward sale

agreements and indexed debt instruments (42) (56) (1,604)

Interest and dividend income 115 116 111

Other, net 13 28 13

Investment income (loss), net $81 $ 296 $ 576

Fair Value Method

We classify publicly traded investments that are not accounted for under the equity method as available-for-

sale (“AFS”) or trading securities and record them at fair value. For AFS securities, we record unrealized gains

or losses resulting from changes in fair value between measurement dates as a component of other compre-

hensive income (loss), except when we consider declines in value to be other than temporary. For trading

securities, we record unrealized gains or losses resulting from changes in fair value between measurement

dates as a component of investment income (loss), net. We recognize realized gains and losses associated

with our fair value method investments using the specific identification method. We classify the cash flows

related to purchases of and proceeds from the sale of trading securities based on the nature of the securities

and the purpose for which they were acquired.

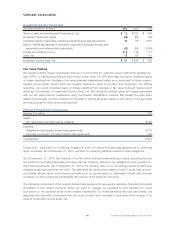

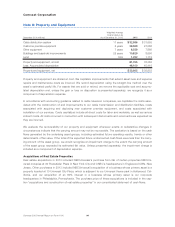

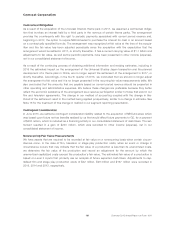

Prepaid Forward Sale Agreements

December 31 (in millions) 2014

Assets:

Fair value equity securities held as collateral $ 523

Liabilities:

Obligations under prepaid forward sale agreements $ 119

Derivative component of prepaid forward sale agreements 356

Total liabilities $ 475

During 2015, we settled our remaining obligations under our prepaid forward sale agreements by delivering

equity securities. As of December 31, 2015, we have no remaining liabilities related to these obligations.

As of December 31, 2014, the majority of our fair value method investments were equity securities that we

accounted for as trading securities and were held as collateral related to our obligations under prepaid for-

ward sale agreements. As of December 31, 2014, the carrying value of our remaining prepaid forward sale

obligations approximated their fair value. The estimated fair values were based on Level 2 inputs that use pric-

ing models whose inputs were derived primarily from or corroborated by observable market data through

correlation or other means for substantially the full term of the financial instrument.

The derivative component of the prepaid forward sale agreements were equity derivative financial instruments

embeddedintherelatedcontracts,whichweusedto manage our exposure to and benefits from price

fluctuations in the common stock of the related investments. For these derivative financial instruments, we

separated the derivative component from the host contract and recorded in each period the change in its

value to investment income (loss), net.

91 Comcast 2015 Annual Report on Form 10-K