Comcast 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Comcast Corporation

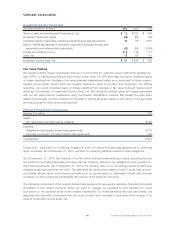

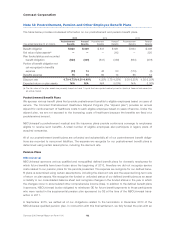

Contractual Obligation

As a result of the acquisition of the Universal Orlando theme park in 2011, we assumed a contractual obliga-

tion that involves an interest held by a third party in the revenue of certain theme parks. The arrangement

provides the counterparty with the right to periodic payments associated with current period revenue and,

beginning in 2017, the option to require NBCUniversal to purchase the interest for cash in an amount based

on a contractually specified formula. The arrangement was recognized at fair value at the time of the acquis-

ition and the fair value has been adjusted periodically since the acquisition with the expectation that the

arrangement would be settled in 2017, or shortly thereafter. It has a current carrying value of $1.1 billion and

adjustments to fair value, as well as the periodic payments, have been presented in other income (expense),

net in our consolidated statement of income.

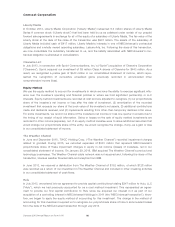

As a result of the continuing process of obtaining additional information and revising estimates, including in

2015 the estimated impact on the arrangement of the Universal Studios Japan transaction and the planned

development of a theme park in China, we no longer expect the settlement of the arrangement in 2017, or

shortly thereafter. Accordingly, in the fourth quarter of 2015, we concluded that we should no longer adjust

the arrangement to fair value and it is no longer presented in the recurring fair value measurements table. We

also concluded that the amounts that are payable based on current period revenue should be presented in

other operating and administrative expenses. We believe these changes are preferable because they better

reflect the economic substance of the arrangement as a revenue participation similar to those that exist in our

film and television agreements. The change in our method of accounting coupled with the change in like-

lihood of the settlement result in the method being applied prospectively, similar to a change in estimate. See

Note 18 for the treatment of this change in method in our segment reporting presentation.

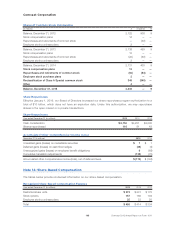

Contingent Consideration

In June 2015, we settled a contingent consideration liability related to the acquisition of NBCUniversal, which

was based upon future net tax benefits realized by us that would affect future payments to GE, for a payment

of $450 million, which is included as a financing activity in our consolidated statement of cash flows. The set-

tlement resulted in a gain of $240 million, which was recorded to other income (expense), net in our

consolidated statement of income.

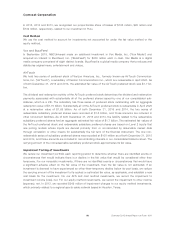

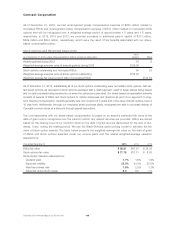

Nonrecurring Fair Value Measurements

We have assets that are required to be recorded at fair value on a nonrecurring basis when certain circum-

stances occur. In the case of film, television or stage play production costs, when an event or change in

circumstance occurs that may indicate that the fair value of a production is less than its unamortized costs,

we determine the fair value of the production and record an adjustment for the amount by which the

unamortized capitalized costs exceed the production’s fair value. The estimated fair value of a production is

based on Level 3 inputs that primarily use an analysis of future expected cash flows. Adjustments to cap-

italized film and stage play production costs of $42 million, $26 million and $167 million were recorded in

2015, 2014 and 2013, respectively.

101 Comcast 2015 Annual Report on Form 10-K