Comcast 2015 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

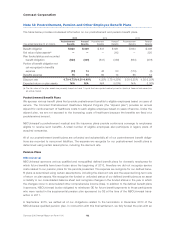

Comcast Corporation

additional contribution of $20 million and recorded expenses of $27 million in other operating and admin-

istrative expenses.

Other

In August 2013, we settled all of our obligations related to the termination in February 2012 of the qualified

pension plan that provided benefits to former employees of a company we acquired as part of the AT&T

Broadband transaction in 2002. In connection with this final settlement, we fully funded the plan with an addi-

tional contribution of $55 million and recorded expenses of $74 million in other operating and administrative

expenses, which was previously recorded in accumulated other comprehensive income (loss).

Other Employee Benefits

Deferred Compensation Plans

We maintain unfunded, nonqualified deferred compensation plans for certain members of management and

nonemployee directors (each, a “participant”). The amount of compensation deferred by each participant is

based on participant elections. Participant accounts, except for those in the NBCUniversal plan, are credited

with income primarily based on a fixed annual rate. Participants in the NBCUniversal plan designate one or

more valuation funds, independently established funds or indices that are used to determine the amount of

investment gain or loss in the participant’s account. Participants are eligible to receive distributions from their

account based on elected deferral periods that are consistent with the plans and applicable tax law.

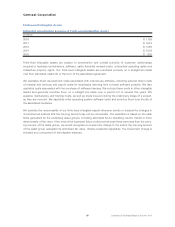

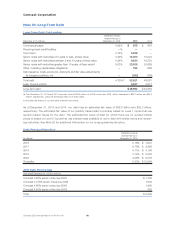

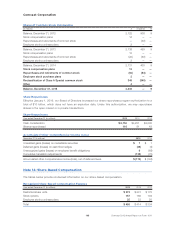

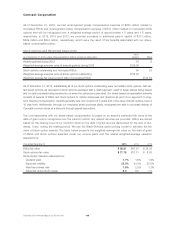

The table below presents the benefit obligation and interest expense for our deferred compensation plans.

Year ended December 31 (in millions) 2015 2014 2013

Benefit obligation $ 2,038 $ 1,774 $ 1,434

Interest expense $ 171 $ 149 $ 128

We have purchased life insurance policies to recover a portion of the future payments related to our deferred

compensation plans. As of December 31, 2015 and 2014, the cash surrender value of these policies, which

is recorded to other noncurrent assets, was $658 million and $628 million, respectively.

Retirement Investment Plans

We sponsor several 401(k) defined contribution retirement plans that allow eligible employees to contribute a

portion of their compensation through payroll deductions in accordance with specified plan guidelines. We

make contributions to the plans that include matching a percentage of the employees’ contributions up to

certain limits. In 2015, 2014 and 2013, expenses related to these plans totaled $416 million, $379 million and

$324 million, respectively.

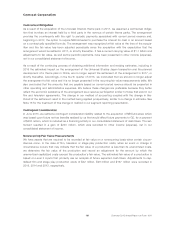

Split-Dollar Life Insurance Agreements

Pursuant to pre-existing contractual obligations, we have collateral assignment split-dollar life insurance

agreements with select key current and former employees that require us to incur certain insurance-related

costs. Under some of these agreements, our obligation to provide benefits to the employees extends beyond

retirement.

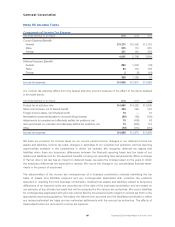

The table below presents the benefit obligation and expenses related to our split-dollar life insurance agree-

ments.

Year ended December 31 (in millions) 2015 2014 2013

Benefit obligation $ 233 $ 217 $ 212

Other operating and administrative expenses $67 $52 $50

103 Comcast 2015 Annual Report on Form 10-K