Comcast 2015 Annual Report Download - page 57

Download and view the complete annual report

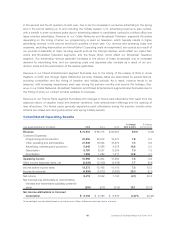

Please find page 57 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Network in 2015. These increases were partially offset by a decrease in revenue from the decline in sub-

scribers at some of our cable networks. Distribution revenue increased in 2014 primarily due to our broadcast

of the 2014 Sochi Olympics and increases in contractual rates charged under distribution agreements.

Excluding $177 million of revenue associated with the 2014 Sochi Olympics, distribution revenue increased

6.5% and 4.6% in 2015 and 2014, respectively.

Advertising

Advertising revenue is generated from the sale of advertising units sold on our cable networks and related

digital media properties. Advertising revenue is primarily based on the price we charge for each advertising

unit, which is generally based on audience ratings and the value of our viewer demographics to advertisers,

and the number of advertising units we can place in our cable networks’ programming schedules. Advertising

revenue is affected by the success and ratings of our programming, the strength of the national advertising

market, general economic conditions, and cyclicality related to political campaigns and issue-oriented adver-

tising. Audience ratings at some of our cable networks have declined and may continue to decline as the

number of programming choices continues to increase and as more viewers use DVRs and video on demand

services to view content outside of audience ratings measurement periods.

Advertising revenue decreased in 2015 primarily due to revenue in the prior year associated with our broad-

cast of the 2014 Sochi Olympics. In addition, while we continued to experience audience ratings declines that

negatively affected advertising revenue, the impact of audience ratings was partially offset by higher prices

for, and an increase in the volume of, advertising units sold, as well as increased advertising revenue asso-

ciated with the broadcast of NASCAR programming. Advertising revenue decreased slightly in 2014 primarily

due to continued declines in audience ratings at our cable networks and the absence of the Style network

and Fandango in 2014. In 2014, we began presenting the operations of Fandango, our movie ticketing and

entertainment business, in the Filmed Entertainment segment. The decrease was partially offset by higher

prices for, and an increase in the volume of, advertising units sold and our broadcast of the 2014 Sochi

Olympics. Excluding $80 million of revenue associated with the 2014 Sochi Olympics, advertising revenue

increased slightly in 2015 due to the broadcast of NASCAR programming and decreased 3.5% in 2014 due

to continued declines in audience ratings at our cable networks.

Content Licensing and Other

We generate other revenue primarily from the licensing of our owned programming in the United States and

internationally to cable and broadcast networks and subscription video on demand services, as well as from

the sale of our owned programming through digital distribution services such as iTunes. In addition, our cable

television production generates revenue from programming it produces for third-party networks and sub-

scription video on demand services.

Content licensing and other revenue decreased in 2015 primarily due to the timing of content provided under

our licensing agreements. Content licensing and other revenue remained flat in 2014.

In 2015, 2014 and 2013, 13%, 12% and 13%, respectively, of our Cable Networks segment revenue was

generated from our Cable Communications segment. These amounts are eliminated in Comcast’s con-

solidated financial statements but are included in the amounts presented above.

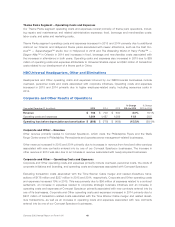

Cable Networks Segment – Operating Costs and Expenses

Programming and Production Costs

Programming and production costs include the amortization of owned and acquired programming, sports

rights, direct production costs, residual and participation payments, production overhead, costs associated

with the distribution of our programming to third-party networks and other distribution platforms, and on-air

talent costs.

Comcast 2015 Annual Report on Form 10-K 54