Comcast 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

Note 15: Income Taxes

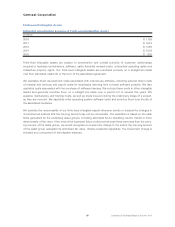

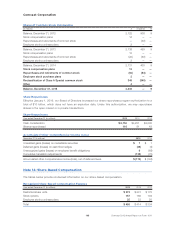

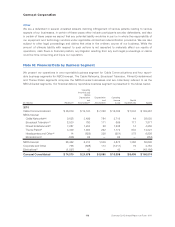

Components of Income Tax Expense

Year ended December 31 (in millions) 2015 2014 2013

Current Expense (Benefit):

Federal $ 3,210 $ 2,392 $ 3,183

State 570 174 581

Foreign 221 142 200

4,001 2,708 3,964

Deferred Expense (Benefit):

Federal 890 1,000 (76)

State 66 173 108

Foreign 2(8) (16)

958 1,165 16

Income tax expense $ 4,959 $ 3,873 $ 3,980

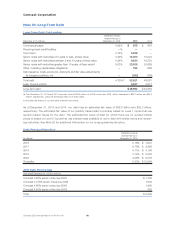

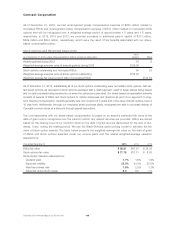

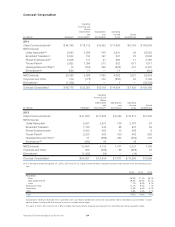

Our income tax expense differs from the federal statutory amount because of the effect of the items detailed

in the table below.

Year ended December 31 (in millions) 2015 2014 2013

Federal tax at statutory rate $ 4,680 $ 4,363 $ 3,890

State income taxes, net of federal benefit 326 329 319

Foreign income taxes, net of federal credit 13 —15

Nontaxable income attributable to noncontrolling interests (69) (62) (103)

Adjustments to uncertain and effectively settled tax positions, net 15 (408) 58

Accrued interest on uncertain and effectively settled tax positions, net 73 (235) 114

Other (79) (114) (313)

Income tax expense $ 4,959 $ 3,873 $ 3,980

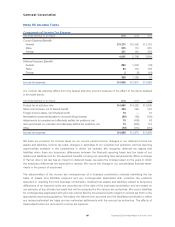

We base our provision for income taxes on our current period income, changes in our deferred income tax

assets and liabilities, income tax rates, changes in estimates of our uncertain tax positions, and tax planning

opportunities available in the jurisdictions in which we operate. We recognize deferred tax assets and

liabilities when there are temporary differences between the financial reporting basis and tax basis of our

assets and liabilities and for the expected benefits of using net operating loss carryforwards. When a change

in the tax rate or tax law has an impact on deferred taxes, we apply the change based on the years in which

the temporary differences are expected to reverse. We record the change in our consolidated financial state-

ments in the period of enactment.

The determination of the income tax consequences of a business combination includes identifying the tax

basis of assets and liabilities acquired and any contingencies associated with uncertain tax positions

assumed or resulting from the business combination. Deferred tax assets and liabilities related to temporary

differences of an acquired entity are recorded as of the date of the business combination and are based on

our estimate of the ultimate tax basis that will be accepted by the various tax authorities. We record liabilities

for contingencies associated with prior tax returns filed by the acquired entity based on criteria set forth in the

appropriate accounting guidance. We adjust the deferred tax accounts and the liabilities periodically to reflect

any revised estimated tax basis and any estimated settlements with the various tax authorities. The effects of

these adjustments are recorded to income tax expense.

107 Comcast 2015 Annual Report on Form 10-K