Comcast 2015 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NBCUniversal Media, LLC

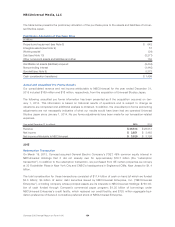

Filmed Entertainment Segment

Our Filmed Entertainment segment generates revenue primarily from the worldwide distribution of our pro-

duced and acquired films for exhibition in movie theaters, from the licensing of our owned and acquired films

through various distribution platforms, and from the sale of our owned and acquired films on standard-

definition video discs and Blu-ray discs (together, “DVDs”) and through digital distribution services. Our

Filmed Entertainment segment also generates revenue from producing and licensing live stage plays, from the

distribution of filmed entertainment produced by third parties, and from Fandango, our movie ticketing and

entertainment business. We recognize revenue from the distribution of films to movie theaters when the films

are exhibited. We recognize revenue from the licensing of a film when the film is available for use by the

licensee, and when certain other conditions are met. We recognize revenue from DVD sales, net of estimated

returns and customer incentives, on the date that DVDs are delivered to and made available for sale by

retailers.

Theme Parks Segment

Our Theme Parks segment generates revenue primarily from ticket sales and guest spending at our Universal

theme parks in Orlando, Florida; Hollywood, California; and, as of November 2015, Osaka, Japan, as well as

from licensing and other fees. We recognize revenue from advance theme park ticket sales when the tickets

are used. For annual passes, we recognize revenue on a straight-line basis over the period following the acti-

vation date.

Advertising Expenses

Advertising costs are expensed as incurred.

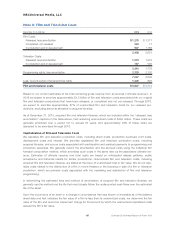

Cash Equivalents

The carrying amounts of our cash equivalents approximate their fair values. Our cash equivalents consist

primarily of money market funds and U.S. government obligations, as well as commercial paper and certifi-

cates of deposit with maturities of three months or less when purchased.

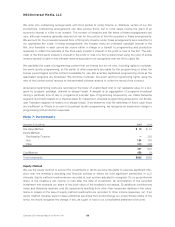

Derivative Financial Instruments

We use derivative financial instruments to manage our exposure to the risks associated with fluctuations in

foreign exchange rates and interest rates. Our objective is to manage the financial and operational exposure

arising from these risks by offsetting gains and losses on the underlying exposures with gains and losses on

the derivatives used to economically hedge them.

Our derivative financial instruments are recorded in our consolidated balance sheet at fair value. The impact

of our derivative financial instruments on our consolidated financial statements was not material for all periods

presented.

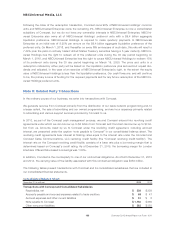

Note 3: Recent Accounting Pronouncements

Revenue Recognition

In May 2014, the Financial Accounting Standards Board (“FASB”) updated the accounting guidance related to

revenue recognition. The updated accounting guidance provides a single, contract-based revenue recognition

model to help improve financial reporting by providing clearer guidance on when an entity should recognize

revenue, and by reducing the number of standards to which an entity has to refer. In July 2015, the FASB

voted to defer the effective date by one year to December 15, 2017 for annual reporting periods beginning

after that date. The updated accounting guidance provides companies with alternative methods of adoption.

We are currently in the process of determining the impact that the updated accounting guidance will have on

our consolidated financial statements and our method of adoption.

Comcast 2015 Annual Report on Form 10-K 152