Comcast 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fair value adjustments to contractual obligations and $35 million of expenses related to an indemnification

receivable associated with the adjustment to our accruals for uncertain tax positions.

Other income (expense), net for 2013 included a $108 million gain related to our sale of wireless communica-

tions spectrum licenses, which was more than offset by the net impact of an impairment of $236 million of

our equity method investment in, and loans with, a regional sports cable network based in Houston, Texas

and $136 million of expenses related to fair value adjustments to contractual obligations.

Consolidated Income Tax Expense

Income tax expense reflects federal and state income taxes and adjustments associated with uncertain tax

positions. Our effective income tax rate in 2015, 2014 and 2013 was 37.1%, 31.1% and 35.8%, respectively.

In 2014, we reduced our accruals for uncertain tax positions and the related accrued interest on these tax

positions and, as a result, our income tax expense decreased by $759 million. See Note 15 to Comcast’s

consolidated financial statements for additional information on the changes in our accruals for uncertain tax

positions and related interest on these tax positions. Our 2013 income tax expense was reduced by $158

million due to the nontaxable portion of the increase in tax basis associated with the redemption of our Lib-

erty Media Series A common stock in October 2013.

Our income tax expense in the future may continue to be impacted by adjustments to uncertain tax positions

and related interest, and changes in tax laws. We expect our 2016 annual effective tax rate to be in the range

of 37% to 39%, absent changes in tax laws or significant changes in uncertain tax positions.

Consolidated Net (Income) Loss Attributable to Noncontrolling Interests and

Redeemable Subsidiary Preferred Stock

The increase in net income attributable to noncontrolling interests and redeemable subsidiary preferred stock

in 2015 was primarily due to NBCUniversal’s acquisition of Universal Studios Japan. The decrease in 2014

was primarily due to the NBCUniversal redemption transaction.

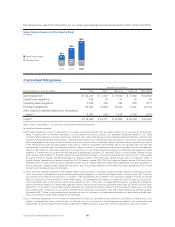

Liquidity and Capital Resources

Our businesses generate significant cash flows from operating activities. We believe that we will be able to

continue to meet our current and long-term liquidity and capital requirements, including fixed charges,

through our cash flows from operating activities; existing cash, cash equivalents and investments; available

borrowings under our existing credit facilities; and our ability to obtain future external financing. We anticipate

that we will continue to use a substantial portion of our cash flows to meet our debt repayment obligations, to

fund our capital expenditures, to invest in business opportunities and to return capital to shareholders.

We also maintain significant availability under our lines of credit and our commercial paper programs to meet

our short-term liquidity requirements.

Our commercial paper programs provide a lower-cost source of borrowing to fund our short-term working

capital requirements. The Comcast commercial paper program is fully and unconditionally guaranteed by us

and our 100% owned cable holding company subsidiary, Comcast Cable Communications, LLC (“CCCL

Parent”), as well as by NBCUniversal. The maximum borrowing capacity under the Comcast commercial

paper program is $6.25 billion, and it is supported by the Comcast and Comcast Cable Communications,

LLC $6.25 billion revolving credit facility due June 2017 (“Comcast revolving credit facility”). The maximum

borrowing capacity under the NBCUniversal Enterprise, Inc. (“NBCUniversal Enterprise”) commercial paper

program is $1.35 billion, and it is supported by NBCUniversal Enterprise’s $1.35 billion revolving credit facility

due March 2018.

Comcast 2015 Annual Report on Form 10-K 62