Comcast 2015 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

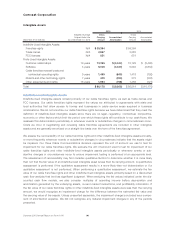

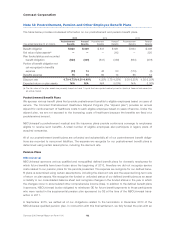

Finite-Lived Intangible Assets

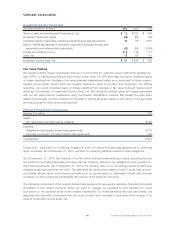

Estimated Amortization Expense of Finite-Lived Intangible Assets

(in millions)

2016 $ 1,785

2017 $ 1,612

2018 $ 1,365

2019 $ 1,039

2020 $ 902

Finite-lived intangible assets are subject to amortization and consist primarily of customer relationships

acquired in business combinations, software, cable franchise renewal costs, contractual operating rights and

intellectual property rights. Our finite-lived intangible assets are amortized primarily on a straight-line basis

over their estimated useful life or the term of the associated agreement.

We capitalize direct development costs associated with internal-use software, including external direct costs

of material and services and payroll costs for employees devoting time to these software projects. We also

capitalize costs associated with the purchase of software licenses. We include these costs in other intangible

assets and generally amortize them on a straight-line basis over a period not to exceed five years. We

expense maintenance and training costs, as well as costs incurred during the preliminary stage of a project,

as they are incurred. We capitalize initial operating system software costs and amortize them over the life of

the associated hardware.

We evaluate the recoverability of our finite-lived intangible assets whenever events or substantive changes in

circumstances indicate that the carrying amount may not be recoverable. The evaluation is based on the cash

flows generated by the underlying asset groups, including estimated future operating results, trends or other

determinants of fair value. If the total of the expected future undiscounted cash flows were less than the carry-

ing amount of the asset group, we would recognize an impairment charge to the extent the carrying amount

of the asset group exceeded its estimated fair value. Unless presented separately, the impairment charge is

included as a component of amortization expense.

97 Comcast 2015 Annual Report on Form 10-K