Comcast 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

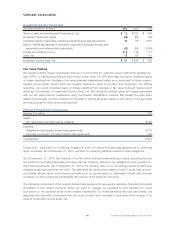

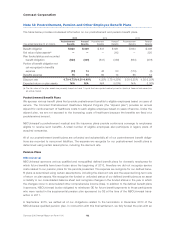

Note 10: Long-Term Debt

Long-Term Debt Outstanding

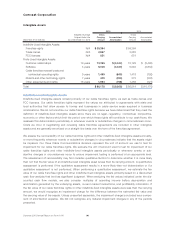

December 31 (in millions)

Weighted-Average

Interest Rate as of

December 31, 2015 2015 2014

Commercial paper 0.62% $ 975 $ 845

Revolving bank credit facilities —% ——

Term loans 2.74% 3,259 —

Senior notes with maturities of 5 years or less, at face value 4.40% 14,300 15,223

Senior notes with maturities between 5 and 10 years, at face value 4.24% 9,630 10,530

Senior notes with maturities greater than 10 years, at face value(a) 5.63% 23,925 20,989

Other, including capital lease obligations — 794 689

Debt issuance costs, premiums, discounts and fair value adjustments

for hedged positions, net — (262) (195)

Total debt 4.70%(b) 52,621 48,081

Less: Current portion 3,627 4,217

Long-term debt $ 48,994 $ 43,864

(a) The December 31, 2015 and 2014 amounts include £625 million of 5.50% notes due 2029, which translated to $921 million and $974

million, respectively, using the exchange rates as of these dates.

(b) Includes the effects of our derivative financial instruments.

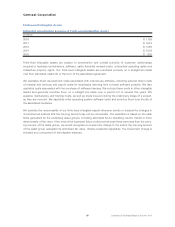

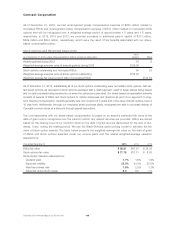

As of December 31, 2015 and 2014, our debt had an estimated fair value of $58.0 billion and $55.3 billion,

respectively. The estimated fair value of our publicly traded debt is primarily based on Level 1 inputs that use

quoted market values for the debt. The estimated fair value of debt for which there are no quoted market

prices is based on Level 2 inputs that use interest rates available to us for debt with similar terms and remain-

ing maturities. See Note 20 for additional information on our cross-guarantee structure.

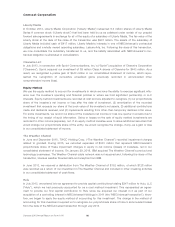

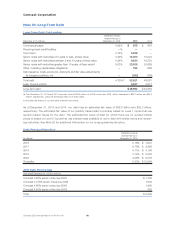

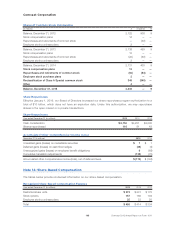

Debt Principal Maturities

(in millions)

Weighted-Average

Interest Rate as of

December 31, 2015

2016 2.79% $ 3,627

2017 6.75% $ 2,695

2018 4.11% $ 4,194

2019 3.14% $ 2,445

2020 4.09% $ 6,076

Thereafter 5.23% $ 33,846

2015 Debt Borrowings

Year ended December 31, 2015 (in millions)

Comcast 4.60% senior notes due 2045 $ 1,700

Comcast 3.375% senior notes due 2025 1,500

Comcast 4.60% senior notes due 2046 1,490

Comcast 4.40% senior notes due 2035 800

Total $ 5,490

Comcast 2015 Annual Report on Form 10-K 98