Comcast 2015 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

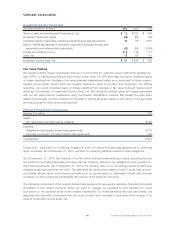

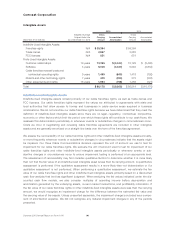

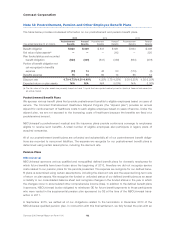

2015 Debt Redemptions and Repayments

Year ended December 31, 2015 (in millions)

NBCUniversal 3.65% senior notes due 2015 $ 1,000

Comcast 5.90% senior notes due 2016(a) 1,000

Comcast 6.50% senior notes due 2015 900

Comcast 5.85% senior notes due 2015(a) 750

Comcast 8.75% senior notes due 2015 673

Other 55

Total $ 4,378

(a) The early redemption of these senior notes resulted in $47 million of additional interest expense in 2015.

Debt Instruments

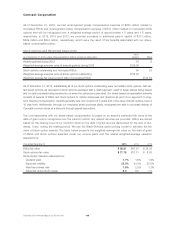

Revolving Credit Facilities

As of December 31, 2015, Comcast and Comcast Cable Communications, LLC had a $6.25 billion revolving

credit facility due June 2017 with a syndicate of banks (“Comcast revolving credit facility”). The interest rate

on this facility consists of a base rate plus a borrowing margin that is determined based on our credit rating.

As of December 31, 2015, the borrowing margin for London Interbank Offered Rate (“LIBOR”) based borrow-

ings was 1.00%. This revolving credit facility requires that we maintain certain financial ratios based on our

debt and our operating income before depreciation and amortization, as defined in the credit facility. We were

in compliance with all financial covenants for all periods presented.

As of December 31, 2015, NBCUniversal Enterprise had a $1.35 billion revolving credit facility due March

2018 with a syndicate of banks (“NBCUniversal Enterprise revolving credit facility”). The interest rate on this

facility consists of a base rate plus a borrowing margin that is determined based on our credit rating. As of

December 31, 2015, the borrowing margin for LIBOR-based borrowings was 1.00%.

As of December 31, 2015, amounts available under our consolidated credit facilities, net of amounts out-

standing under our commercial paper programs and outstanding letters of credit, totaled $6.4 billion, which

included $775 million available under the NBCUniversal Enterprise revolving credit facility.

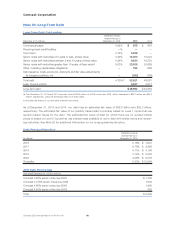

Term Loans

As a result of the Universal Studios Japan transaction, we consolidated ¥400 billion of term loans having a

final maturity of November 2020. In accordance with acquisition accounting, these debt securities were

recorded at fair value as of the acquisition date. These term loans contain financial and operating covenants

and are secured by the assets of Universal Studios Japan and the equity interests of the investors. We do not

guarantee these term loans and they are otherwise nonrecourse to us.

Commercial Paper Programs

Our commercial paper programs provide a lower-cost source of borrowing to fund our short-term working

capital requirements. The maximum borrowing capacity under the Comcast commercial paper program is

$6.25 billion and it is supported by the Comcast revolving credit facility. The maximum borrowing capacity

under the NBCUniversal Enterprise commercial paper program is $1.35 billion and it is supported by the

NBCUniversal Enterprise revolving credit facility.

Letters of Credit

As of December 31, 2015, we and certain of our subsidiaries had unused irrevocable standby letters of credit

totaling $464 million to cover potential fundings under various agreements.

99 Comcast 2015 Annual Report on Form 10-K