Comcast 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

broadcast of the 2015 Super Bowl, the timing of content provided under our licensing agreements and higher

studio production costs. Programming and production costs increased in 2014 primarily due to costs asso-

ciated with our broadcast of the 2014 Sochi Olympics, as well as our continued investment in original

programming.

Other Operating and Administrative Costs and Expenses

Other operating and administrative costs and expenses include salaries, employee benefits, rent and other

overhead expenses.

Other operating and administrative costs increased in 2015 primarily due to an increase in employee-related

costs. Other operating and administrative costs and expenses remained flat in 2014.

Advertising, Marketing and Promotion Expenses

Advertising, marketing and promotion expenses consist primarily of the costs associated with promoting our

owned and licensed television programming, as well as the marketing of DVDs and costs associated with our

related digital media properties.

Advertising, marketing and promotion expenses increased in 2015 and 2014 primarily due to increased

spending on marketing associated with our NBC primetime lineup.

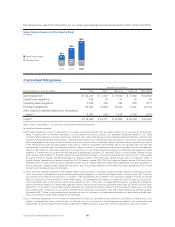

Filmed Entertainment Segment Results of Operations

Year ended December 31 (in millions) 2015 2014 2013

% Change

2014 to 2015

% Change

2013 to 2014

Revenue

Theatrical $ 2,829 $ 1,101 $ 1,568 156.9% (29.8)%

Content licensing 1,923 1,792 1,654 7.3 8.3

Home entertainment 1,801 1,457 1,828 23.6 (20.3)

Other 734 658 402 11.5 63.7

Total revenue 7,287 5,008 5,452 45.5 (8.2)

Operating costs and expenses

Programming and production 3,488 2,331 2,982 49.6 (21.8)

Other operating and administrative 872 849 716 2.8 18.5

Advertising, marketing and promotion 1,693 1,117 1,271 51.7 (12.2)

Total operating costs and expenses 6,053 4,297 4,969 40.9 (13.5)

Operating income before depreciation and

amortization $ 1,234 $ 711 $ 483 73.5% 47.3%

Filmed Entertainment Segment – Revenue

Theatrical

Theatrical revenue is generated from the worldwide theatrical release of our owned and acquired films for

exhibition in movie theaters and is significantly affected by the timing of each release and the number of films

we distribute, as well as their acceptance by audiences. Theatrical revenue is also affected by the number of

exhibition screens, ticket prices, the percentage of ticket sale retention by the exhibitors and the popularity of

competing films at the time our films are released. The success of a film in movie theaters is a significant

factor in determining the revenue a film is likely to generate in succeeding distribution platforms.

Theatrical revenue increased in 2015 primarily due to the strong performance of our larger 2015 film slate,

including Furious 7,Jurassic World and Minions. Theatrical revenue decreased in 2014 primarily due to the

57 Comcast 2015 Annual Report on Form 10-K