Comcast 2015 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Comcast Corporation

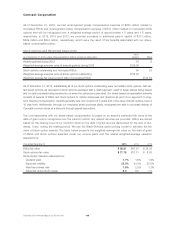

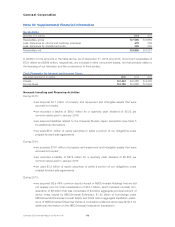

As of December 31, 2015, we had unrecognized pretax compensation expense of $635 million related to

nonvested RSUs and unrecognized pretax compensation expense of $337 million related to nonvested stock

options that will be recognized over a weighted-average period of approximately 1.8 years and 1.8 years,

respectively. In 2015, 2014 and 2013, we recorded increases to additional paid-in capital of $311 million,

$299 million and $244 million, respectively, which were the result of tax benefits associated with our share-

based compensation plans.

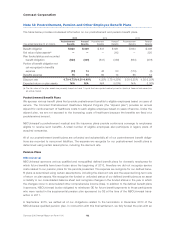

Stock Options and Restricted Share Units

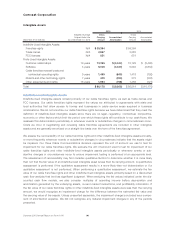

As of December 31, 2015, unless otherwise stated (in millions, except per share data)

Stock

Options RSUs

Awards granted during 2015 18 9

Weighted-average exercise price of awards granted during 2015 $ 59.39

Stock options outstanding and nonvested RSUs 94 23

Weighted-average exercise price of stock options outstanding $ 36.63

Weighted-average fair value at grant date of nonvested RSUs $ 44.19

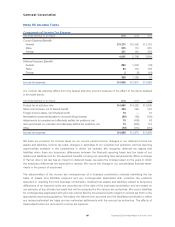

As of December 31, 2015, substantially all of our stock options outstanding were net settled stock options. Net set-

tled stock options, as opposed to stock options exercised with a cash payment, result in fewer shares being issued

and no cash proceeds being received by us when the options are exercised. Our share-based compensation primarily

consists of awards of RSUs and stock options to certain employees and directors as part of our approach to long-

term incentive compensation. Awards generally vest over a period of 5 years and in the case of stock options, have a

10 year term. Additionally, through our employee stock purchase plans, employees are able to purchase shares of

Comcast common stock at a discount through payroll deductions.

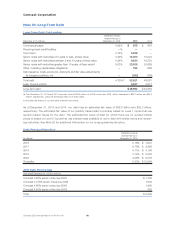

The cost associated with our share-based compensation is based on an award’s estimated fair value at the

date of grant and is recognized over the period in which any related services are provided. RSUs are valued

based on the closing price of our common stock on the date of grant and are discounted for the lack of divi-

dends, if any, during the vesting period. We use the Black-Scholes option pricing model to estimate the fair

value of stock option awards. The table below presents the weighted-average fair value on the date of grant

of RSUs and stock options awarded under our various plans and the related weighted-average valuation

assumptions.

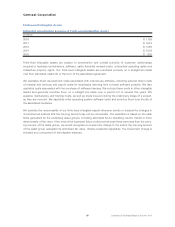

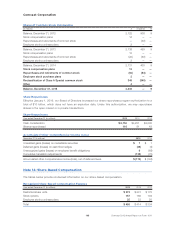

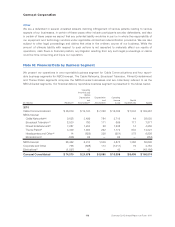

Year ended December 31 2015 2014 2013

RSUs fair value $ 58.81 $47.91 $ 38.28

Stock options fair value $ 11.78 $11.11 $ 8.80

Stock Option Valuation Assumptions:

Dividend yield 1.7% 1.8% 1.9%

Expected volatility 23.0% 24.0% 25.0%

Risk-free interest rate 1.6% 2.2% 1.3%

Expected option life (in years) 6.0 6.5 7.0

Comcast 2015 Annual Report on Form 10-K 106