Comcast 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Programming and production costs increased in 2015 primarily due to our continued investment in program-

ming, including the premiere of NASCAR programming and other sports programming rights costs. These

increases were partially offset by costs in the prior year associated with our broadcast of the 2014 Sochi

Olympics. Programming and production costs increased in 2014 primarily due to costs associated with our

broadcast of the 2014 Sochi Olympics, as well as our continued investment in programming, including origi-

nal programming at our entertainment networks and sports programming rights costs. The increase in sports

programming rights costs in 2014 included the impact of a new rights agreement with a professional sports

team and costs associated with the first full year of our airing of English Premier League soccer.

Other Operating and Administrative Costs and Expenses

Other operating and administrative costs and expenses include salaries, employee benefits, rent and other

overhead expenses.

Other operating and administrative costs and expenses increased in 2015 primarily due to an increase in

employee-related costs. Other operating and administrative costs and expenses decreased in 2014 primarily

due to lower employee-related costs and the absence of the Style network and Fandango in 2014.

Advertising, Marketing and Promotion Expenses

Advertising, marketing and promotion expenses consist primarily of the costs associated with promoting our

cable networks programming and costs associated with our related digital media properties.

Advertising, marketing and promotion expenses increased in 2015 primarily due to an increase in marketing

expenses related to the launch of new programming on our cable networks. Advertising, marketing and

promotion expenses remained relatively flat in 2014.

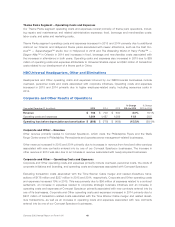

Broadcast Television Segment Results of Operations

Year ended December 31 (in millions) 2015 2014 2013

% Change

2014 to 2015

% Change

2013 to 2014

Revenue

Advertising $ 5,747 $ 5,888 $ 4,930 (2.4)% 19.4%

Content licensing 1,784 1,569 1,447 13.7 8.4

Other 999 1,085 743 (7.8) 46.0

Total revenue 8,530 8,542 7,120 (0.1) 20.0

Operating costs and expenses

Programming and production 5,950 6,127 5,192 (2.9) 18.0

Other operating and administrative 1,276 1,199 1,204 6.4 (0.4)

Advertising, marketing and promotion 524 482 379 8.9 27.0

Total operating costs and expenses 7,750 7,808 6,775 (0.7) 15.3

Operating income before depreciation and

amortization $ 780 $ 734 $ 345 6.3% 112.5%

Broadcast Television Segment – Revenue

Advertising

Advertising revenue is generated from the sale of advertising units sold on our broadcast networks, our

owned local television stations and our related digital media properties. Advertising revenue is primarily based

on the price we receive for each advertising unit, which is generally based on audience ratings and the value

of our viewer demographics to advertisers, and the number of advertising units we can place in our broadcast

55 Comcast 2015 Annual Report on Form 10-K