Comcast 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

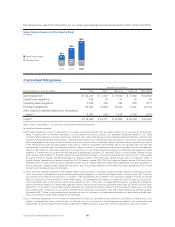

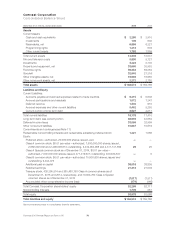

The table below sets forth information on our share repurchases and dividends paid in 2015, 2014 and 2013.

(in billions)

Share Repurchases and Dividends Paid

Dividends Paid

Share Repurchases

20142013 2015

$2.0

$4.0

$2.0

$2.4

$9.2

$6.8

$6.6

$4.3

$2.3

Contractual Obligations

Payment Due by Period

As of December 31, 2015 (in millions) Total Year 1 Years 2-3 Years 4-5 More than 5

Debt obligations(a) $ 52,727 $ 3,597 $ 6,842 $ 8,482 $ 33,806

Capital lease obligations 156 30 47 39 40

Operating lease obligations 3,459 452 782 608 1,617

Purchase obligations(b) 53,644 10,848 10,080 8,537 24,179

Other long-term liabilities reflected on the balance

sheet(c) 6,280 590 1,245 2,390 2,055

Total(d)(e) $ 116,266 $ 15,517 $ 18,996 $ 20,056 $ 61,697

Refer to Note 10 and Note 17 to Comcast’s consolidated financial statements.

(a) Excludes interest payments.

(b) Purchase obligations consist of agreements to purchase goods and services that are legally binding on us and specify all significant

terms, including fixed or minimum quantities to be purchased and price provisions. Our purchase obligations related to our Cable

Communications segment include programming contracts with cable networks and local broadcast television stations; contracts with

customer premise equipment manufacturers, communications vendors and multichannel video providers for which we provide advertising

sales representation; and other contracts entered into in the normal course of business. Cable Communications programming contracts

in the table above include amounts payable under fixed or minimum guaranteed commitments and do not represent the total fees that

are expected to be paid under programming contracts, which we expect to be significantly higher because these contracts are generally

based on the number of subscribers receiving the programming. Our purchase obligations related to our NBCUniversal segments consist

primarily of commitments to acquire film and television programming, including U.S. television rights to future Olympic Games through

2032, Sunday Night Football on the NBC network through the 2022-23 season, including the Super Bowl in 2018 and 2021, NHL games

through the 2020-21 season, Spanish-language U.S. television rights to FIFA World Cup games through 2022, U.S television rights to

English Premier League soccer games through the 2021-22 season, certain PGA TOUR and other golf events through 2030 and certain

NASCAR events through 2024, as well as obligations under various creative talent and employment agreements, including obligations to

actors, producers, television personalities and executives, and various other television commitments. Purchase obligations do not include

contracts with immaterial future commitments.

(c) Other long-term liabilities reflected on the balance sheet consist primarily of subsidiary preferred shares; deferred compensation obliga-

tions; and pension, postretirement and postemployment benefit obligations. A contractual obligation with a carrying value of $1.1 billion is

not included in the table above because it is uncertain if the arrangement will be settled. The contractual obligation involves an interest

held by a third party in the revenue of certain theme parks. The arrangement provides the counterparty with the right to periodic pay-

ments associated with current period revenue and, beginning in 2017, the option to require NBCUniversal to purchase the interest for

cash in an amount based on a contractually specified formula, which amount could be significantly higher than our current carrying value.

See Note 11 to Comcast’s consolidated financial statements for additional information related to this arrangement. Reserves for uncertain

tax positions of $1.1 billion are not included in the table above because it is uncertain if and when these reserves will become payable.

Payments of $2.1 billion of participations and residuals are also not included in the table above because we cannot make a reliable esti-

mate of the period in which these obligations will be settled.

(d) Our contractual obligations do not include the commitment to invest up to $4 billion at any one time as an investor in Atairos due to our

inability to estimate the timing of this funding. In addition, we do not include any future expenditures related to the construction and

development of the proposed Universal Studios theme park in Beijing, China as we are not currently obligated to make such funding.

Comcast 2015 Annual Report on Form 10-K 66