Comcast 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Comcast Corporation

these arrangements, we record the advertising that is sold in revenue and the fees paid to representation

firms and multichannel video providers in other operating and administrative expenses.

Revenue earned from other sources, such as our home security and automation services, is recognized when

services are provided or events occur. Under the terms of our cable franchise agreements, we are generally

required to pay to the cable franchising authority an amount based on our gross video revenue. We normally

pass these fees through to our cable services customers and classify the fees as a component of revenue

with the corresponding costs included in other operating and administrative expenses.

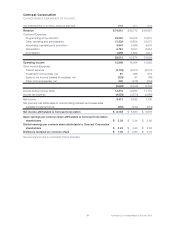

Cable Networks and Broadcast Television Segments

Our Cable Networks segment generates revenue primarily from the distribution of our cable network program-

ming to multichannel video providers, from the sale of advertising on our cable networks and related digital

media properties, from the licensing of our owned programming through various distribution platforms, from

the sale of our owned programming through digital distribution services such as iTunes, and from the pro-

gramming our cable production studio sells to third-party networks and subscription video on demand

services. Our Broadcast Television segment generates revenue primarily from the sale of advertising on our

broadcast networks, owned local broadcast television stations and related digital media properties, from the

licensing of our owned programming through various distribution platforms, including to cable and broadcast

networks, from the fees received under retransmission consent agreements and from the programming our

broadcast television production studio sells to third-party networks and subscription video on demand serv-

ices. We recognize revenue from distributors as programming is provided, generally under multiyear

distribution agreements. From time to time, the distribution agreements expire while programming continues

to be provided to the distributor based on interim arrangements while the parties negotiate new contract

terms. Revenue recognition is generally limited to current payments being made by the distributor, typically

under the prior contract terms, until a new contract is negotiated, sometimes with effective dates that affect

prior periods. Differences between actual amounts determined upon resolution of negotiations and amounts

recorded during these interim arrangements are recorded in the period of resolution.

Advertising revenue for our Cable Networks and Broadcast Television segments is recognized in the period in

which commercials are aired or viewed. In some instances, we guarantee audience ratings for the commer-

cials. To the extent there is a shortfall in the ratings that were guaranteed, a portion of the revenue is deferred

until the shortfall is settled, primarily by providing additional advertising units. We recognize revenue from the

licensing of our owned programming and programming produced by our studios for third parties when the

content is available for use by the licensee, and when certain other conditions are met. When license fees

include advertising time, we recognize the component of revenue associated with the advertisements when

they are aired or viewed.

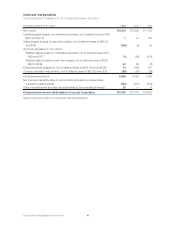

Filmed Entertainment Segment

Our Filmed Entertainment segment generates revenue primarily from the worldwide distribution of our pro-

duced and acquired films for exhibition in movie theaters, from the licensing of our owned and acquired films

through various distribution platforms, and from the sale of our owned and acquired films on standard-

definition video discs and Blu-ray discs (together, “DVDs”) and through digital distribution services. Our

Filmed Entertainment segment also generates revenue from producing and licensing live stage plays, from the

distribution of filmed entertainment produced by third parties, and from Fandango, our movie ticketing and

entertainment business. We recognize revenue from the distribution of films to movie theaters when the films

are exhibited. We recognize revenue from the licensing of a film when the film is available for use by the

licensee, and when certain other conditions are met. We recognize revenue from DVD sales, net of estimated

returns and customer incentives, on the date that DVDs are delivered to and made available for sale by

retailers.

83 Comcast 2015 Annual Report on Form 10-K