Comcast 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Comcast annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

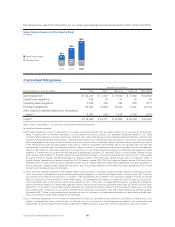

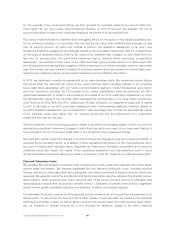

Consolidated Other Income (Expense) Items, Net

Year ended December 31 (in millions) 2015 2014 2013

Interest expense $ (2,702) $ (2,617) $ (2,574)

Investment income (loss), net 81 296 576

Equity in net income (losses) of investees, net (325) 97 (86)

Other income (expense), net 320 (215) (364)

Total $ (2,626) $ (2,439) $ (2,448)

Interest Expense

Interest expense increased in 2015 primarily due to an increase in our debt outstanding and $47 million of

additional interest expense associated with the early redemption in June 2015 of our $750 million aggregate

principal amount of 5.85% senior notes due November 2015 and our $1.0 billion aggregate principal amount

of 5.90% senior notes due March 2016. Interest expense increased in 2014 primarily due to the effect of our

interest rate derivative financial instruments.

Investment Income (Loss), Net

The change in investment income (loss), net in 2015 was primarily due to a $154 million gain related to the

sale of our shares of Arris Group common stock in 2014. The change in investment income (loss), net in 2014

was primarily due to a $443 million gain related to the sale of our investment in Clearwire Corporation in

2013. The components of investment income (loss), net are presented in a table in Note 7 to Comcast’s

consolidated financial statements.

Equity in Net Income (Losses) of Investees, Net

The change in equity in net income (losses) of investees, net in 2015 was primarily due to TWCC Holding

Corp. (“The Weather Channel”) recording impairment charges related to goodwill. We recorded expenses of

$333 million in 2015 that represent NBCUniversal’s proportionate share of these impairment charges. The

change in 2015 was also due to an increase in our proportionate share of losses in Hulu, LLC (“Hulu”), which

were driven by Hulu’s higher programming and marketing costs. In 2015 and 2014, we recognized our pro-

portionate share of losses of $106 million and $20 million, respectively, related to our investment in Hulu.

The change in equity in net income (losses) of investees, net in 2014 was primarily due to $142 million of total

equity losses recorded in 2013 attributable to our investment in Hulu. In July 2013, we entered into an

agreement to provide capital contributions totaling $247 million to Hulu, which we had previously accounted

for as a cost method investment. This represented an agreement to provide our first capital contribution to

Hulu since we acquired our interest in it as part of our acquisition of a controlling interest in NBCUniversal in

2011 (the “NBCUniversal transaction”); therefore, we began to apply the equity method of accounting for this

investment. The change in the method of accounting for this investment required us to recognize our propor-

tionate share of Hulu’s accumulated losses from the date of the NBCUniversal transaction through July 2013.

Other Income (Expense), Net

Other income (expense), net for 2015 included gains of $335 million on the sales of a business and an invest-

ment, $240 million recorded on the settlement of a contingent consideration liability with General Electric

Company (“GE”) related to the acquisition of NBCUniversal, and $43 million related to an equity method

investment. These gains were partially offset by $236 million of expenses related to fair value adjustments to

a contractual obligation. See Note 11 to Comcast’s consolidated financial statements for additional

information on this contractual obligation.

Other income (expense), net for 2014 included a $27 million favorable settlement of a contingency related to

the AT&T Broadband transaction in 2002, which was more than offset by $208 million of expenses related to

61 Comcast 2015 Annual Report on Form 10-K