Chrysler 2011 Annual Report Download - page 386

Download and view the complete annual report

Please find page 386 of the 2011 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

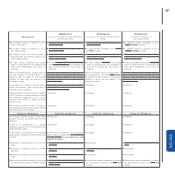

385

Auditors’ Reports

Motions for AGM

Current text

Modified text

in case of conversion of both preference

and savings shares

Modified text

in case of conversion of only preference

shares

Modified text

in case of conversion of

only savings shares

In the event of an increase in share capital, the

holders of each class of shares are entitled to

receive newly issued shares in the same class

pro rata to the number of shares already held,

or of another class (or classes) if shares of the

class already held are not offered or the number

offered is insufficient.

The Company’s share capital may also be

increased by issuing ordinary and/or preference

and/or savings shares in exchange for

contributions in kind or receivables.

Resolutions authorizing the issuance of new

preference or savings shares having the

same characteristics as those already in issue

for the purposes of a capital increase or the

conversion of shares of another class do not

require the further approval in a Special Meeting

of Shareholders of either of those classes.

In the event that the savings shares are

delisted, any bearer shares shall be converted

into registered shares and shall have the right to

a higher dividend increased by €0.1225, rather

than €0.1085, with respect to the dividend

received by the ordinary and preference shares.

In the event that the ordinary shares are

delisted, the higher dividend received by the

savings shares with respect to the dividend

received by ordinary and preference shares

shall be increased by €0.140 per share.

Any expenditure required for the safeguarding

of the common interests of the holders of

preference and savings shares, in relation to

which dedicated funds are approved in the

respective Special Meetings of Shareholders,

shall be borne by the Company up to a

maximum annual amount of €30,000 for each

class.

In order to ensure that the Common

Representatives of the holders of preference

and savings shares have adequate information

on transactions which could influence the

market price of those shares, the Company’s

legal representatives must provide the Common

Representatives with any such information in a

timely manner.

In the event of an increase in share capital, the

holders of each class of shares are entitled to

receive newly issued shares in the same class

pro rata to the number of shares already held,

or of another class (or classes) if shares of the

class already held are not offered or the number

offered is insufficient.

The Company’s share capital may also be

increased by issuing ordinary and/or preference

and/or savings shares in exchange for

contributions in kind or receivables.

Resolutions authorizing the issuance of new

preference or savings shares having the

same characteristics as those already in issue

for the purposes of a capital increase or the

conversion of shares of another class do not

require the further approval in a Special Meeting

of Shareholders of either of those classes.

In the event that the savings shares are

delisted, any bearer shares shall be converted

into registered shares and shall have the right to

a higher dividend increased by €0.1225, rather

than €0.1085, with respect to the dividend

received by the ordinary and preference shares.

In the event that the ordinary shares are

delisted, the higher dividend received by the

savings shares with respect to the dividend

received by ordinary and preference shares

shall be increased by €0.140 per share.

Any expenditure required for the safeguarding

of the common interests of the holders of

preference and savings shares, in relation to

which dedicated funds are approved in the

respective Special Meetings of Shareholders,

shall be borne by the Company up to a

maximum annual amount of €30,000 for each

class.

In order to ensure that the Common

Representatives of the holders of preference

and savings shares have adequate information

on transactions which could influence the

market price of those shares, the Company’s

legal representatives must provide the Common

Representatives with any such information in a

timely manner.

In the event of an increase in share capital, the

holders of each class of shares are entitled to

receive newly issued shares in the same class

pro rata to the number of shares already held,

or of another class (or classes) if shares of the

class already held are not offered or the number

offered is insufficient.

Unchanged

Resolutions authorizing the issuance of new

preference or savings shares having the

same characteristics as those already in issue

for the purposes of a capital increase or the

conversion of shares of another class do not

require the further approval in a Special Meeting

of Shareholders of either of those classes.

In the event that the savings shares are

delisted, any bearer shares shall be converted

into registered shares and shall have the right

to a higher dividend increased by €0.1225,

0.12425, rather than €0.1085 0.11005 with

respect to the dividend received by the ordinary

and preference shares.

In the event that the ordinary shares are

delisted, the higher dividend received by the

savings shares with respect to the dividend

received by ordinary and preference shares

shall be increased by €0.140 0.142 per share.

Any expenditure required for the safeguarding

of the common interests of the holders of

preference and savings shares, in relation to

which a dedicated funds are is approved in the

respective Special Meetings of Shareholders,

shall be borne by the Company up to a

maximum annual amount of €30,000 for each

class.

In order to ensure that the Common

Representatives of the holders of preference and

savings shares hasve adequate information on

transactions which could influence the market

price of those shares, the Company’s legal

representatives must provide the Common

Representatives with any such information in a

timely manner.

In the event of an increase in share capital, the

holders of each class of shares are entitled to

receive newly issued shares in the same class

pro rata to the number of shares already held,

or of another class (or classes) if shares of the

class already held are not offered or the number

offered is insufficient.

Unchanged

Resolutions authorizing the issuance of new

preference or savings shares having the

same characteristics as those already in issue

for the purposes of a capital increase or the

conversion of shares of another class do not

require the further approval in a Special Meeting

of Shareholders of either of those classes.

In the event that the savings shares are

delisted, any bearer shares shall be converted

into registered shares and shall have the right to

a higher dividend increased by €0.1225, rather

than €0.1085, with respect to the dividend

received by the ordinary and preference shares.

In the event that the ordinary shares are

delisted, the higher dividend received by the

savings shares with respect to the dividend

received by ordinary and preference shares

shall be increased by €0.140 per share.

Any expenditure required for the safeguarding

of the common interests of the holders of

preference and savings shares, in relation to

which a dedicated funds are is approved in the

respective Special Meetings of Shareholders,

shall be borne by the Company up to a

maximum annual amount of €30,000 for each

class.

In order to ensure that the Common

Representatives of the holders of preference and

savings shares hasve adequate information on

transactions which could influence the market

price of those shares, the Company’s legal

representatives must provide the Common

Representatives with any such information in a

timely manner.