Blackberry 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

10

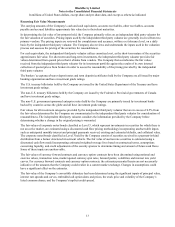

Valuation Allowance Against Deferred Tax Assets

The Company regularly assesses the need for a valuation allowance against its deferred tax assets. A valuation allowance

is required for deferred tax assets if it is more likely than not that all or some portion of the asset will not be realized. All

available evidence, both positive and negative, that may affect the realization of deferred tax assets must be identified and

considered in determining the appropriate amount of the valuation allowance. Additionally, for interim periods, the

estimated annual effective tax rate should include the valuation allowance for current year changes in temporary

differences and losses or income arising during the year. For interim periods, the Company needs to consider the

valuation allowance that it expects to recognize at the end of the fiscal year as part of the estimated annual effective tax

rate. During interim quarters, the Company uses estimates including pre-tax results and ending position of temporary

differences as at the end of the fiscal year to estimate the valuation allowance that it expects to recognize at the end of the

fiscal year. This accounting treatment has no effect on the Company’s actual ability to utilize deferred tax assets to reduce

future cash tax payments. Different judgments could yield different results.

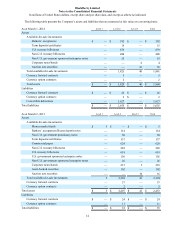

Revenue Recognition

Significant judgment is applied by the Company to determine whether shipments of devices have met the Company’s

revenue recognition criteria, as the analysis is dependent on many facts and circumstances. During fiscal 2014, the

Company shipped devices to its carrier and distributor partners to support new and continuing product launches and meet

expected levels of end customer demand. However, the sell-through levels for BlackBerry 10 devices decreased during

fiscal 2014, causing the number of BlackBerry 10 devices in the channel to increase above the Company's expectations. In

order to improve sell-through levels and stimulate global demand for BlackBerry 10 devices, the Company continued to

execute on sell-through programs and reduced the price on new shipments of BlackBerry 10 smartphones during fiscal

2014. The Company plans to implement further sell-through programs with its carrier and distributor partners, which

could be applicable to BlackBerry 10 devices shipped in fiscal 2014. As previously disclosed, the Company can no longer

reasonably estimate the amount of the potential sell-through programs that may be offered on certain BlackBerry devices

in future periods, resulting in revenues for BlackBerry 10 devices, and BlackBerry 7 devices in certain regions, being

recognized when the devices sell through to end customers.

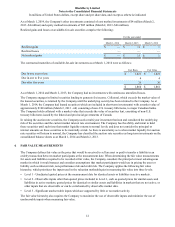

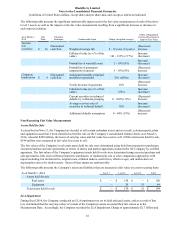

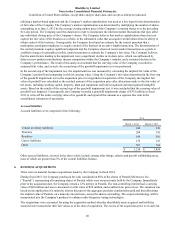

2. ADOPTION OF ACCOUNTING POLICIES

In February 2013, the Financial Accounting Standards Board issued authoritative guidance to improve the reporting of

reclassifications out of accumulated other comprehensive income (loss) (“AOCI”). The guidance requires an entity to

present changes in AOCI by component and report the effect of significant reclassifications out of AOCI on the respective

line items in net income if the amount being reclassified is required under U.S. GAAP to be reclassified in its entirety to

net income. For other amounts that are not required under U.S. GAAP to be reclassified in their entirety to net income in

the same reporting period, an entity is required to cross-reference other disclosures required under U.S. GAAP that

provide additional detail about those amounts. The new authoritative guidance became effective for annual and interim

reporting periods beginning on or after December 15, 2012, with early adoption permitted. The Company adopted this

guidance in the first quarter of fiscal 2014. As a result, the Company presents, by component, changes in AOCI and the

effect of significant reclassifications out of AOCI on the respective line items in net income in Note 14.

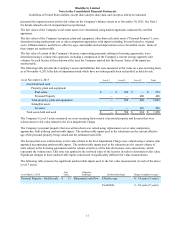

In July 2013, the Financial Accounting Standards Board issued authoritative guidance to eliminate diversity in practice

related to the financial statement presentation of an unrecognized tax benefit when a net operating loss carryforward, a

similar tax loss, or a tax credit carryforward exists. The guidance requires that under certain circumstances, an

unrecognized tax benefit is to be presented in the financial statements as a reduction to a deferred tax asset as opposed to

being presented as a liability. The new authoritative guidance will become effective for fiscal years and interim reporting

periods beginning after December 15, 2013, with early adoption and retrospective application permitted. The Company

adopted this guidance in the fourth quarter of fiscal 2014. As a result, the Company has presented the unrecognized tax

benefit as a reduction to the deferred tax asset in the consolidated balance sheets.