Blackberry 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

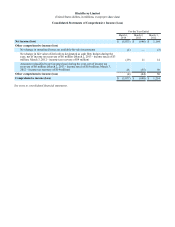

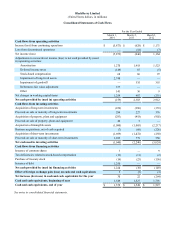

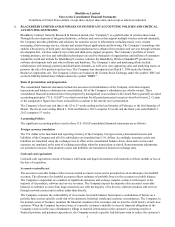

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

9

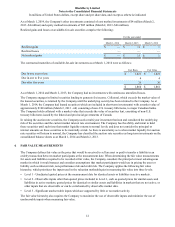

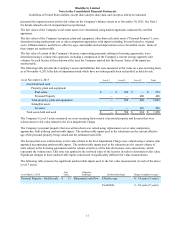

Company performs an assessment of inventory during each reporting period, which includes a review of, among other

factors, demand requirements, component part purchase commitments of the Company and certain key suppliers, product

life cycle and development plans, component cost trends, product pricing and quality issues. If customer demand

subsequently differs from the Company’s forecasts, requirements for inventory write-offs that differ from the Company’s

estimates could become necessary. If management believes that demand no longer allows the Company to sell inventories

above cost or at all, such inventory is written down to net realizable value or excess inventory is written off.

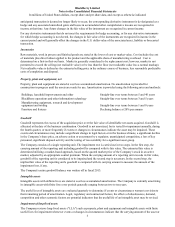

During fiscal 2014, the Company shipped devices to its carrier and distributor partners to support new and continuing

product launches and meet expected levels of end customer demand. However, the sell-through levels for BlackBerry 10

smartphones decreased significantly during fiscal 2014 due to the maturing smartphone market, very intense competition

and, the Company believes, the uncertainty created by the Company's recently completed strategic review process. These

factors caused the number of BlackBerry 10 devices in the channel to increase above the Company's expectations, which

in turn caused the Company to reassess and revise its future demand assumptions for finished products, semi-finished

goods and raw materials. The Company also made the decision to cancel plans to launch two devices to mitigate the

identified inventory risk. Based on these revised demand assumptions, the Company recorded primarily non-cash, pre-tax

charges against inventory and supply commitments of approximately $2.4 billion in fiscal 2014 related to Blackberry 10

devices.

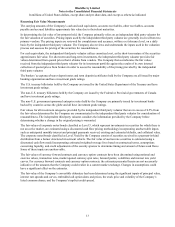

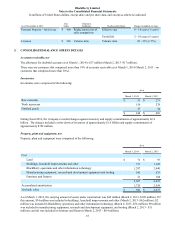

Valuation of Long-Lived Assets

The LLA impairment test prescribed by U.S. GAAP requires the Company to identify its asset groups and test impairment

of each asset group separately. To conduct the LLA impairment test, the asset group is tested for recoverability using

undiscounted cash flows over the remaining useful life of the primary asset. If forecasted net cash flows are less than the

carrying amount of the asset group, an impairment charge is measured by comparing the fair value of the asset group to its

carrying value. Determining the Company's asset groups and related primary assets requires significant judgment by

management. Different judgments could yield different results.

During fiscal 2014, the Company experienced a significant decline in its share price following its pre-release of its second

quarter fiscal 2014 results on September 20, 2013, as well as its announcement on November 4, 2013 that Fairfax

Financial Holdings Limited ("Fairfax") and other institutional investors (collectively, the “Purchasers”) were investing in

the Company through the $1.0 billion private placement of convertible debentures (the "Debentures") in lieu of finalizing

the purchase of the Company as contemplated in the previously-announced letter of intent. The Company further

identified the continuing decline in revenues, the generation of operating losses and the decrease in cash flows from

operations as indicators of potential long-lived asset (“LLA”) impairment. Further, the Company believes that its recently

completed strategic review process may have increased market uncertainty as to the future viability of the Company and

may have negatively impacted demand for the Company's products. Accordingly, a cash flow recoverability test was

performed as of November 4, 2013 (the “Measurement Date”). The estimated undiscounted net cash flows were

determined utilizing the Company's internal forecast and incorporated a terminal value of the Company utilizing its

market capitalization, calculated as the number of the Company's common shares outstanding as at the interim testing date

by the average market price of the shares over a 10 day period following the Measurement Date. The Company used this

duration in order to incorporate the inherent market fluctuations that may affect any individual closing price of the

Company's shares. As a result, the Company concluded that the carrying value of its net assets exceeded the undiscounted

net cash flows as at the Measurement Date. Consequently, step two of the LLA impairment test was performed whereby

the fair values of the Company's assets were compared to their carrying values. As a result, the Company recorded a non-

cash, pre-tax charge against its LLA (the “LLA Impairment Charge”) of $2.7 billion in fiscal 2014.