Blackberry 2014 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

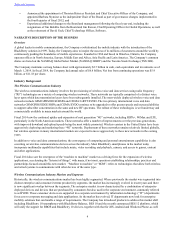

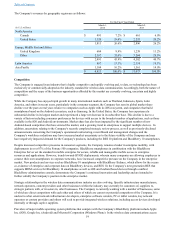

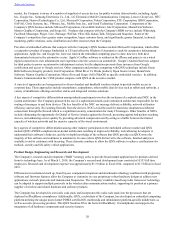

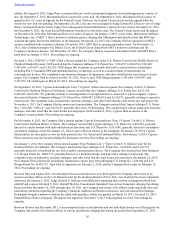

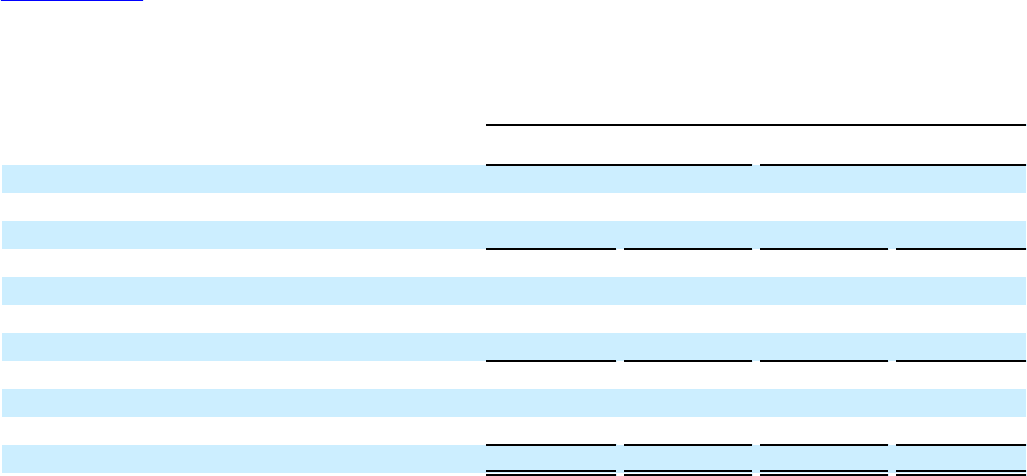

The Company’s revenues by geographic region are as follows:

For the Fiscal Year Ended

(in U.S. millions) March 1,

2014 March 2,

2013

North America

Canada $ 491 7.2% $ 661 6.0%

United States 1,320 19.4% 2,235 20.2%

1,811 26.6% 2,896 26.2%

Europe, Middle East and Africa

United Kingdom 604 8.9% 1,238 11.2%

Other 2,387 35.0% 3,264 29.5%

2,991 43.9% 4,502 40.7%

Latin America 907 13.3% 2,114 19.1%

Asia Pacific 1,104 16.2% 1,561 14.0%

$ 6,813 100.0% $ 11,073 100.0%

Competition

The Company is engaged in an industry that is highly competitive and rapidly evolving and, to date, no technology has been

exclusively or commercially adopted as the industry standard for wireless data communication. Accordingly, both the nature of

competition and the scope of the business opportunities afforded by this market are currently evolving, uncertain and highly

competitive.

While the Company has enjoyed rapid growth in many international markets such as Thailand, Indonesia, Spain, Latin

America, and others in recent years, particularly in the consumer segment, the Company has seen its global market share

decline over the past several years relative to companies such as Apple with its iOS ecosystem, and companies that build

smartphones based on the Android ecosystem, such as Samsung. In the United States, the Company has experienced a

substantial decline in its largest market and experienced a large net decrease in its subscriber base. This decline is due to a

variety of factors including consumer preferences for devices with access to the broadest number of applications, such as those

available in the iOS and Android environments. Market share has also been impacted by the significant number of new

Android-based competitors that have entered the market, and a growing trend in enterprises to support multiple devices. In

addition, uncertainty relating to the Company's recently completed strategic review process, as well as previously-disclosed

announcements concerning the Company's operational restructuring, recent Board and management changes and the

Company's workforce reductions may have increased market uncertainty as to the future viability of the Company and may

have negatively impacted demand for the Company's products, including the BES 10 platform and BlackBerry 10 smartphones.

Despite increased competitive pressures in consumer segments, the Company remains a leader in enterprise mobility, with

deployments in over 87% of the Fortune 500 companies. BlackBerry smartphones in combination with the BlackBerry

Enterprise Server set the standard in mobile enterprise for secure, reliable and manageable mobile access to enterprise

resources and applications. However, trends towards BYOD deployments, wherein many companies are allowing employees to

connect their own smartphones to corporate networks, have increased competitive pressure on the Company in the enterprise

market. New products and services such as BlackBerry 10 smartphones with BlackBerry Balance, which allows for the secure

co-existence of enterprise and corporate data on BlackBerry devices, and BES 10, the Company’s next generation BES that

supports MDM services for BlackBerry 10 smartphones as well as iOS and Android based devices through a unified

BlackBerry administration console, demonstrate the Company’s continued innovation and leadership and are intended to

further solidify the Company’s position in the enterprise market.

Strategic relationships in the wireless data communications industry are also evolving. Specific infrastructure manufacturers,

network operators, content providers and other businesses within the industry may currently be customers of, suppliers to,

strategic partners with, or investors in, other businesses. The Company is currently working with a number of businesses, some

of which are direct competitors with each other and others of which are current or potential competitors of the Company. It is

unclear to what extent network infrastructure developers, enterprise software vendors, PC or tablet vendors, key network

operators or content providers and others will seek to provide integrated wireless solutions, including access devices developed

internally or through captive suppliers.

Providers of major mobile operating system platforms that compete with the Company’s BlackBerry platform include Apple

Inc. (iOS), Google Inc. (Android) and Microsoft Corporation (Windows Phone). In the wireless data communications access

Table of Contents