Blackberry 2014 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

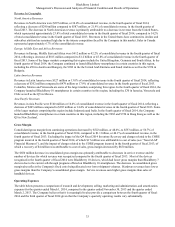

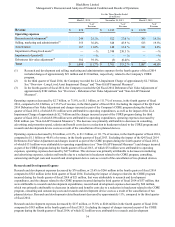

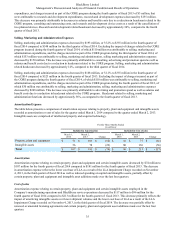

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

38

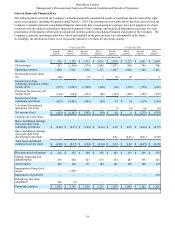

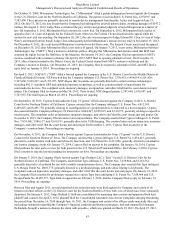

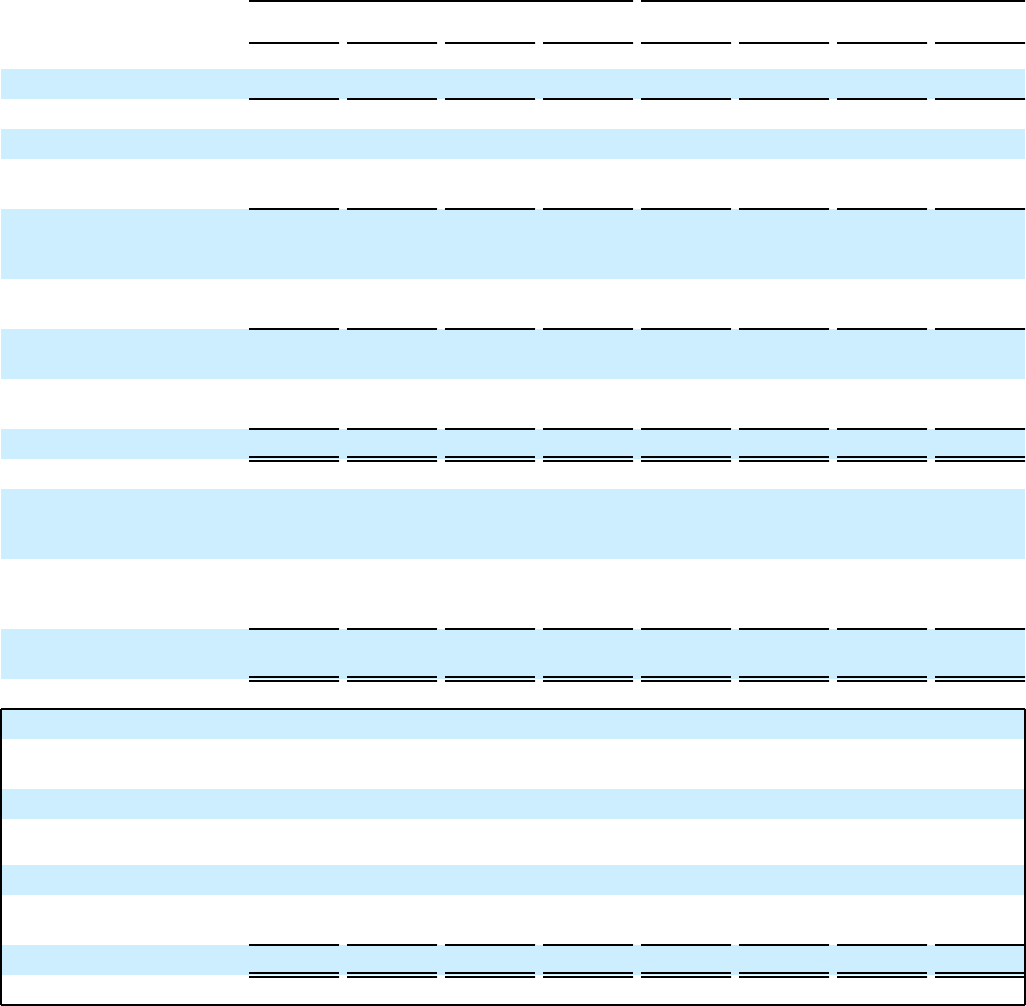

Selected Quarterly Financial Data

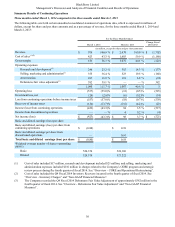

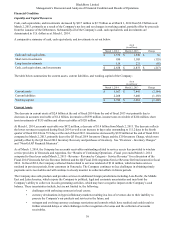

The following table sets forth the Company’s unaudited quarterly consolidated results of operations data for each of the eight

most recent quarters, including the quarter ended March 1, 2014. The information in the table below has been derived from the

Company’s unaudited interim consolidated financial statements that, in management’s opinion, have been prepared on a basis

consistent with the audited consolidated financial statements of the Company and include all adjustments necessary for a fair

presentation of information when read in conjunction with the audited consolidated financial statements of the Company. The

Company’s quarterly operating results have varied substantially in the past and may vary substantially in the future.

Accordingly, the information below is not necessarily indicative of results for any future quarter.

Fiscal Year 2014 Fiscal Year 2013

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

(in millions, except per share data)

Revenue $ 976 $ 1,193 $ 1,573 $ 3,071 $ 2,678 $ 2,727 $ 2,861 $ 2,808

Gross margin 553 (1,264) (374) 1,042 1,075 830 744 786

Operating expenses 1,090 3,761 1,058 1,211 1,087 1,060 1,102 1,421

Investment income (loss),

net (20) — (6) 5 (6) 18 — 3

Income (loss) from

continuing operations, before

income taxes (557) (5,025) (1,438)(164)(18)(212)(358)(632)

Provision for (recovery of)

income taxes (134) (624) (473)(80)(112)(226)(129)(122)

Income (loss) from

continuing operations (423) (4,401) (965)(84) 94 $ 14 (229)(510)

Loss from discontinued

operations, net of tax ———— 4 (5)(6)(8)

Net income (loss) $ (423) $ (4,401) $ (965) $ (84) $ 98 $ 9 $ (235) $ (518)

Earnings (loss) per share

Basic and diluted earnings

(loss) per share from

continuing operations $ (0.80) $ (8.37) $ (1.84) $ (0.16) $ 0.18 $ 0.03 $ (0.44) $ (0.97)

Basic and diluted earnings

(loss) per share from

discontinued operations — — — — 0.01 (0.01)(0.01)(0.02)

Total basic and diluted

earnings (loss) per share $ (0.80) $ (8.37) $ (1.84) $ (0.16) $ 0.19 $ 0.02 $ (0.45) $ (0.99)

Research and development $ 246 $ 322 $ 360 $ 358 $ 383 $ 393 $ 366 $ 367

Selling, marketing and

administration 355 548 527 673 523 487 556 547

Amortization 107 148 171 180 181 180 180 172

Impairment of long-lived

assets — 2,748 — — — — — —

Impairment of goodwill ———————335

Debentures fair value

adjustment 382 (5) — — — — — —

Operating expenses $ 1,090 $ 3,761 $ 1,058 $ 1,211 $ 1,087 $ 1,060 $ 1,102 $ 1,421