Blackberry 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

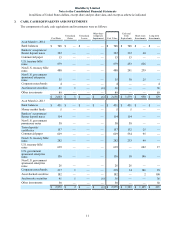

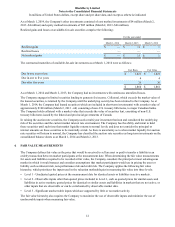

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

2

related accounts receivable to its estimated net realizable value. If circumstances related to specific customers change, the

Company’s estimates of the recoverability of accounts receivables balances could be further adjusted.

Investments

The Company’s cash equivalents and investments, other than cost method and equity method investments consist of

money market and other debt securities, which are classified as available-for-sale for accounting purposes and are carried

at fair value. Unrealized gains and losses, net of related income taxes, are recorded in accumulated other comprehensive

income until such investments mature or are sold. The Company uses the specific identification method of determining

the cost basis in computing realized gains or losses on available-for-sale investments, which are recorded in investment

income. In the event of a decline in value which is other-than-temporary, the investment is written down to fair value with

a charge to income. The Company does not exercise significant influence with respect to any of these investments.

Investments with maturities at time of purchase of three months or less, are classified as cash equivalents. Investments

with maturities of one year or less (but which are not cash equivalents), as well as any investments that management

intends to hold for less than one year, are classified as short-term investments. Investments with maturities in excess of

one year are classified as long-term investments.

The Company assesses individual investments that are in an unrealized loss position to determine whether the unrealized

loss is other-than-temporary. The Company makes this assessment by considering available evidence, including changes

in general market conditions, specific industry and individual company data, the length of time and the extent to which the

fair value has been less than cost, the financial condition, the near-term prospects of the individual investment and the

Company’s intent and ability to hold the investment. In the event that a decline in the fair value of an investment occurs

and that decline in value is considered to be other-than-temporary, an impairment charge is recorded in investment income

equal to the difference between the cost basis and the fair value of the individual investment at the consolidated balance

sheets date of the reporting period for which the assessment was made. The fair value of the investment then becomes the

new cost basis of the investment.

If a debt security’s market value is below its amortized cost and the Company either intends to sell the security or it is

more likely than not that the Company will be required to sell the security before its anticipated recovery, the Company

records an other-than-temporary impairment charge to investment income for the entire amount of the impairment. For

other-than-temporary impairments on debt securities that the Company does not intend to sell and it is not more likely

than not that the entity will be required to sell the security before its anticipated recovery, the Company would separate

the other-than-temporary impairment into the amount representing the credit loss and the amount related to all other

factors. The Company would record the other-than-temporary impairment related to the credit loss as a charge to

investment income and the remaining other-than-temporary impairment would be recorded as a component of

accumulated other comprehensive income.

Derivative financial instruments

The Company uses derivative financial instruments, including forward contracts and options, to hedge certain foreign

currency exposures. The Company does not use derivative financial instruments for speculative purposes.

The Company records all derivative instruments at fair value on the consolidated balance sheets. The fair value of these

instruments is calculated based on notional and exercise values, transaction rates, market quoted currency spot rates,

forward points, volatilities and interest rate yield curves. The accounting for changes in the fair value of a derivative

depends on the intended use of the derivative instrument and the resulting designation.

For derivative instruments designated as cash flow hedges, the effective portion of the derivative’s gain or loss is initially

reported as a component of accumulated other comprehensive income, net of tax, and subsequently reclassified into

income in the same period or periods in which the hedged item affects income. The ineffective portion of the derivative’s

gain or loss is recognized in current income. In order for the Company to receive hedge accounting treatment, the cash

flow hedge must be highly effective in offsetting changes in the fair value of the hedged item and the relationship between

the hedging instrument and the associated hedged item must be formally documented at the inception of the hedge

relationship. Hedge effectiveness is formally assessed, both at hedge inception and on an ongoing basis, to determine

whether the derivatives used in hedging transactions are highly effective in offsetting changes in the value of the hedged

items and whether they are expected to continue to be highly effective in future periods.

The Company formally documents relationships between hedging instruments and associated hedged items. This

documentation includes: identification of the specific foreign currency asset, liability or forecasted transaction being

hedged; the nature of the risk being hedged; the hedge objective; and the method of assessing hedge effectiveness. If an