Blackberry 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

25

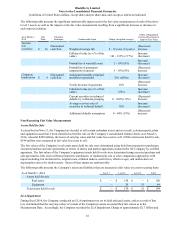

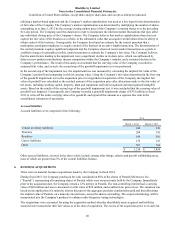

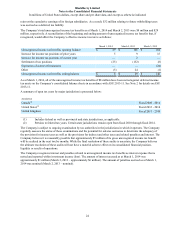

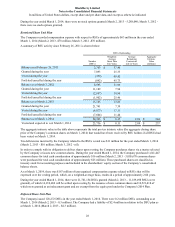

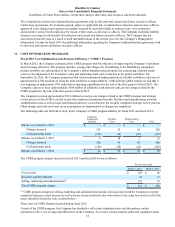

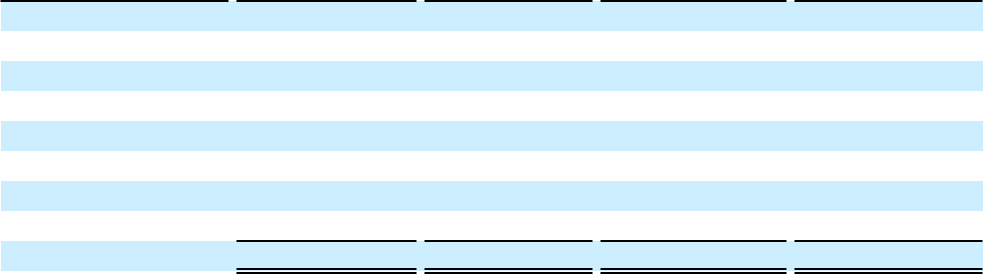

As at March 1, 2014, the Company has the following net operating loss carryforwards and tax credits which are not

recognized for accounting purposes and are scheduled to expire in the following years:

Year of Expiry Net Operating Losses Capital Losses Research and

Development Tax Credits Minimum Taxes

2026 $ 4 $ — $ — $ —

2029 16 — — —

2030 — — 1 —

2031 28 — 1 120

2032 2 — — —

2033 — — 32 —

2034 — — 29 —

Indefinite — 6 — —

$ 50 $ 6 $ 63 $ 120

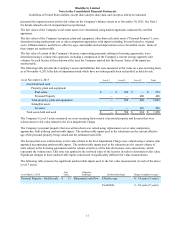

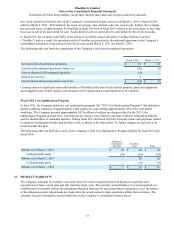

8. LONG-TERM DEBT

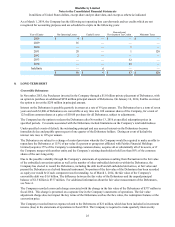

Convertible Debentures

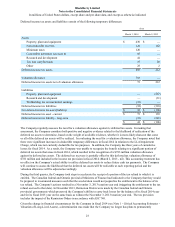

In November 2013, the Purchasers invested in the Company through a $1.0 billion private placement of Debentures, with

an option to purchase an additional $250 million principal amount of Debentures. On January 16, 2014, Fairfax exercised

the option to invest the $250 million in principal amount.

Interest on the Debentures is payable quarterly in arrears at a rate of 6% per annum. The Debentures have a term of seven

years and each $1,000 of Debentures are convertible at any time into 100 common shares of the Company, for a total of

125 million common shares at a price of $10.00 per share for all Debentures, subject to adjustments.

The Company has the option to redeem the Debentures after November 13, 2016 at specified redemption prices in

specified periods. Covenants associated with the Debentures include limitations on the Company’s total indebtedness.

Under specified events of default, the outstanding principal and any accrued interest on the Debentures become

immediately due and payable upon request of one quarter of the Debenture holders. During an event of default the

interest rate rises to 10% per annum.

The Debentures are subject to a change of control provision whereby the Company would be required to make an offer to

repurchase the Debentures at 115% of par value if a person or group (not affiliated with Fairfax Financial Holdings

Limited) acquires 35% of the Company’s outstanding common shares, acquires all or substantially all of its assets, or if

the Company merges with another entity and the Company’s existing shareholders hold less than 50% of the common

shares of the surviving entity.

Due to the possible volatility through the Company’s statements of operations resulting from fluctuation in the fair value

of the embedded conversion option as well as the number of other embedded derivatives within the Debentures, the

Company has elected to record the Debentures, including the debt itself and all embedded derivatives, at fair value and

present the Debentures as a hybrid financial instrument. No portion of the fair value of the Debentures has been recorded

as equity nor would be if each component was freestanding. As of March 1, 2014, the fair value of the Company's

convertible debt was $1.6 billion. The difference between the fair value of the Debentures and the unpaid principal

balance of $1.3 billion is $377 million. For additional information about the fair value measurement of the Debentures,

see Note 4.

The Company recorded a non-cash charge associated with the change in the fair value of the Debentures of $377 millon in

fiscal 2014. This charge is presented on a separate line in the Company’s statements of operations. The fair value

adjustment charge does not impact the key terms of the Debentures such as the face value, the redemption features or the

conversion price.

The Company recorded interest expense related to the Debentures of $21 million, which has been included in investment

income (loss) in the statements of operations in fiscal 2014. The Company is required to make quarterly interest-only