Blackberry 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

The Board has also determined that Ms. Stymiest is an audit committee financial expert within the meaning of General

Instruction B(8)(a) of Form 40-F under the U.S. Securities Exchange Act of 1934, as amended. The SEC has indicated that the

designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose

any duties, obligations or liability on such person that are greater than those imposed on members of the Audit Committee and

the Board who do not carry this designation or affect the duties, obligations or liability of any other member of the audit

committee or the Board.

As set out in the Audit and Risk Management Committee’s charter, the committee is responsible for pre-approving all non-audit

services to be provided to the Company by its independent external auditor. The Company’s practice requires senior

management to report to the Audit and Risk Management Committee any provision of services by the auditors and requires

consideration as to whether the provision of the services other than audit services is compatible with maintaining the auditor’s

independence. All audit and audit-related services are pre-approved by the Audit and Risk Management Committee.

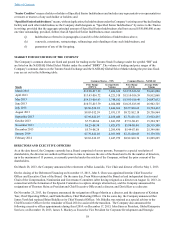

Audit Fees

The aggregate fees billed by Ernst & Young LLP (“EY”) chartered accountants, the Company’s independent external auditor,

for the fiscal years ended March 1, 2014 and March 2, 2013, respectively, for professional services rendered by EY for the audit

of the Company’s annual financial statements or services that are normally provided by EY in connection with statutory and

regulatory filings or engagements for such fiscal years were $5,128,000 and $4,195,000 respectively.

Audit-Related Fees

The aggregate fees billed by EY for the fiscal years ended March 1, 2014 and March 2, 2013, respectively, for assurance and

related services rendered by EY that are reasonably related to the performance of the audit or review of the Company’s

financial statements and are not reported above as "Audit Fees" were $167,000 and $107,000. The fees paid in this category

relate to provision of assurance services related to certain contractual compliance clauses, as well as the Company’s corporate

social responsibility disclosures.

Tax Fees

The aggregate fees billed by EY for the fiscal years ended March 1, 2014 and March 2, 2013, respectively, for professional

services rendered by EY for tax compliance, tax advice, tax planning and other services were $11,000 and $13,000 respectively.

Tax services provided included international tax compliance engagements.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

During the three-year period ending March 1, 2014 and during the current financial year up to the date hereof, none of the

Company's directors, executive officers, 10 percent shareholders or any of their associates or affiliates had a material interest,

directly or indirectly, in any transaction that has materially affected or is reasonably expected to materially affect the Company,

other than Mr. Watsa, the Chairman and Chief Executive Officer, and a significant shareholder, of Fairfax, which participated in

the Debenture Financing and continues to hold a significant proportion of the outstanding Debentures. See “General

Development of the Business” and “Description of Capital Structure - Convertible Debentures” in this AIF.

TRANSFER AGENTS AND REGISTRARS

The Company’s transfer agent and registrar in Canada is Computershare Investor Services Inc. of Canada, 100 University Ave.,

8th Fl., Toronto, Ontario M5J 2Y1. The co-transfer agent and registrar for the common shares in the United States is

Computershare Trust Company, Inc. at its offices in Denver, Colorado.

MATERIAL CONTRACTS

Other than as noted below, the Company has not entered into any material contracts, on or after January 1, 2002, that are

required to be filed pursuant to NI 51-102 of the Canadian Securities Administrators:

• the settlement agreement and licensing agreement with NTP, Inc. (the “Settlement and Licensing Agreements”), both

of which can be found under the Company’s profile on www.sedar.com. The Settlement and Licensing Agreements are

summarized in the Company’s material change report filed on SEDAR on March 10, 2006, which is incorporated by

reference in this AIF; and

Table of Contents