Blackberry 2014 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

26

market on January 31, 2013. Some of the larger markets comprising this region included South Africa, France and United Arab

Emirates. Subscriber accounts in Europe, Middle East and Africa remained stable, marginally increasing by 1% since the end of

fiscal 2012. In addition to the United Kingdom, the Company launched the BlackBerry Z10 in many countries in this region in

the fourth quarter of fiscal 2013 including South Africa, Nigeria, France, Germany, Italy, Spain, Turkey, Switzerland, Kuwait,

United Arab Emirates, Lebanon, Iraq and Pakistan.

Revenues in Latin America were $2.1 billion or 19.1% of consolidated revenue in fiscal 2013, reflecting a decrease of $532

million compared to $2.6 billion or 14.4% of consolidated revenue in fiscal 2012. Some of the larger markets comprising this

region included Venezuela and Mexico. Subscriber accounts in Latin America increased by 17% since fiscal 2012. The

Company launched its first BlackBerry 10 devices in the region in Mexico on March 23, 2013.

Revenues in Asia Pacific were $1.6 billion or 14.0% of consolidated revenue in fiscal 2013, reflecting a decrease of $1.1 billion

compared to $2.7 billion or 14.5% of consolidated revenue in fiscal 2012. Some of the larger markets comprising this region

included Indonesia and India. Subscriber accounts in Asia Pacific increased by 36% since the end of fiscal 2012. In the fourth

quarter of fiscal 2013, the Company launched the BlackBerry Z10 in many countries in this region including Indonesia, India,

Malaysia and Singapore.

Gross Margin

Consolidated gross margin from continuing operations decreased by $3.1 billion, to $3.4 billion, or 31.0% of consolidated

revenue, in fiscal 2013, compared to $6.6 billion, or 35.7% of consolidated revenue, in fiscal 2012. Excluding the impact of

charges related to the CORE program incurred in fiscal 2013, of which $96 million was attributable to cost of sales, and the

impacts of the PlayBook Inventory Charge, the 2012 BlackBerry 7 Inventory Charge, the 2012 Service Interruption and charges

related to the Company’s previous cost optimization program, of which $14 million were attributable to cost of sales, that were

incurred in fiscal 2012, gross margin decreased by $3.9 billion.

The $3.9 billion decrease in consolidated gross margin was primarily attributable to the lower volume of BlackBerry handheld

devices shipped as a result of the Company’s aging product portfolio in a very competitive environment in which multiple

competitors introduced new devices beginning in early fiscal 2013 and lower average selling prices of BlackBerry 7 devices

due to the continuation of pricing initiatives to drive sell-through. The decrease in gross margin was partially offset by the

higher average selling prices of BlackBerry 10 devices shipped, favorable renegotiations of key contracts associated with

elements of the Company’s hardware business and benefits from a leaner and re-architected supply chain.

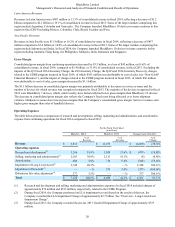

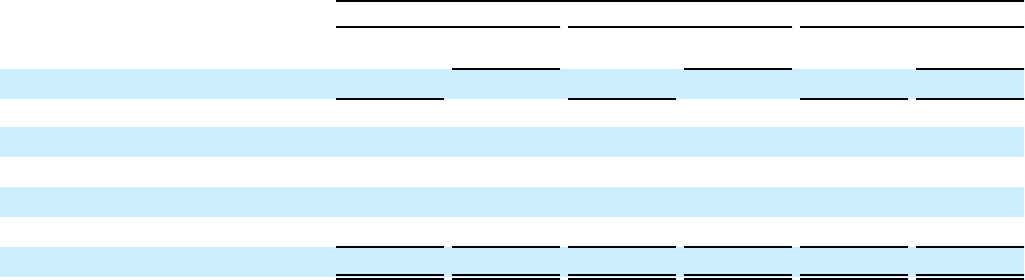

Operating Expenses

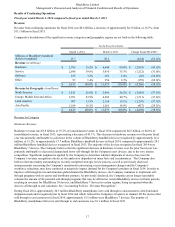

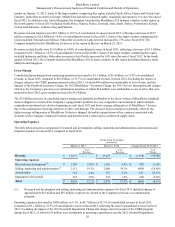

The table below presents a comparison of research and development, selling, marketing and administration, amortization and

litigation expenses for fiscal 2013 compared to fiscal 2012.

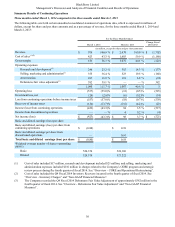

For the Fiscal Year Ended

(in millions)

March 2, 2013 March 3, 2012 Change Fiscal 2013/2012

% of

Revenue % of

Revenue % of

Change

Revenue $ 11,073 $ 18,423 $ (7,350) (39.9)%

Operating expenses

Research and development (1) $ 1,509 13.6% $ 1,556 8.4% $ (47) (3.0)%

Selling, marketing and administration (1) 2,111 19.1% 2,600 14.1% (489) (18.8)%

Amortization 714 6.4% 567 3.1% 147 25.9 %

Impairment of Goodwill 335 3.0% 355 1.9% (20) (5.6)%

Total $ 4,669 42.1% $ 5,078 27.5% $ (409) (8.1)%

(1) Research and development and selling, marketing and administration expenses for fiscal 2013 included charges of

approximately $27 million and $97 million, respectively, related to the Company's previous cost optimization

program.

Operating expenses decreased by $409 million, or 8.1%, to $4.7 billion or 42.1% of consolidated revenue in fiscal 2013,

compared to $5.1 billion or 27.5% of consolidated revenue in fiscal 2012, reflecting the lower consolidated revenue in fiscal

2013. Excluding the impact of the 2013 Goodwill Impairment Charge and charges incurred as part of the CORE program

during fiscal 2013, of which $124 million were attributable to operating expenditures, and the 2012 Goodwill Impairment