Blackberry 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1

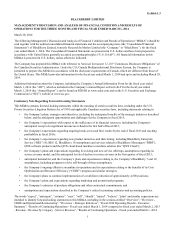

Exhibit 1.3

BLACKBERRY LIMITED

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 1, 2014

March 28, 2014

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) should be

read together with the audited consolidated financial statements and the accompanying notes (the “Consolidated Financial

Statements”) of BlackBerry Limited, formerly Research In Motion Limited (the “Company” or “BlackBerry”), for the fiscal

year ended March 1, 2014. The Consolidated Financial Statements are presented in U.S. dollars and have been prepared in

accordance with United States generally accepted accounting principles (“U.S. GAAP”). All financial information in this

MD&A is presented in U.S. dollars, unless otherwise indicated.

The Company has prepared this MD&A with reference to National Instrument 51-102 “Continuous Disclosure Obligations” of

the Canadian Securities Administrators. Under the U.S./Canada Multijurisdictional Disclosure System, the Company is

permitted to prepare this MD&A in accordance with the disclosure requirements of Canada, which are different from those of

the United States. This MD&A provides information for the fiscal year ended March 1, 2014 and up to and including March 28,

2014.

Additional information about the Company, including the Company’s Annual Information Form for the fiscal year ended

March 1, 2014 (the “AIF”), which is included in the Company’s Annual Report on Form 40-F for the fiscal year ended

March 1, 2014 (the “Annual Report”), can be found on SEDAR at www.sedar.com and on the U.S. Securities and Exchange

Commission’s (“SEC”) website at www.sec.gov.

Cautionary Note Regarding Forward-Looking Statements

This MD&A contains forward-looking statements within the meaning of certain securities laws, including under the U.S.

Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws, including statements relating to:

• the Company’s plans, strategies and objectives, including the anticipated benefits of the strategic initiatives described

below, and the anticipated opportunities and challenges for the Company in fiscal 2015;

• the Company’s expectations with respect to the sufficiency of its financial resources, including the Company's

anticipated receipt of a significant income tax refund in the first half of fiscal 2015;

• the Company's expectations regarding targeting break-even cash flow results by the end of fiscal 2015 and reaching

profitability in fiscal 2016;

• the Company’s expectations regarding new product initiatives and their timing, including BlackBerry Enterprise

Service (“BES”) 10, BES 12, BlackBerry 10 smartphones and services related to BlackBerry Messenger (“BBM”),

QNX software products and the QNX cloud-based machine to machine solution (the “QNX Cloud”);

• the Company’s plans and expectations regarding its existing and new service offerings, assumptions regarding its

service revenue model, and the anticipated levels of decline in service revenue in the first quarter of fiscal 2015;

• anticipated demand for, and the Company’s plans and expectations relating to, the Company’s BlackBerry 7 and 10

smartphones, including programs to drive sell-through of these smartphones;

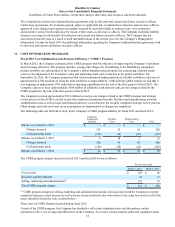

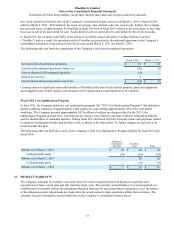

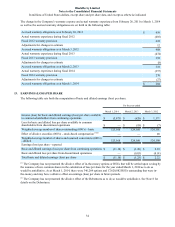

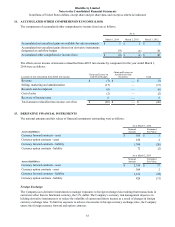

• the Company’s ongoing efforts to streamline its operations and its expectations relating to the benefits of its Cost

Optimization and Resource Efficiency (“CORE”) program and similar strategies;

• the Company's plans to continue implementation of a workforce reduction of approximately 4,500 positions;

• the Company’s plans and expectations regarding marketing and promotional programs;

• the Company’s estimates of purchase obligations and other contractual commitments; and

• assumptions and expectations described in the Company’s critical accounting estimates and accounting policies.

The words “expect”, “anticipate”, “estimate”, “may”, “will”, “should”, “intend”, “believe”, “plan” and similar expressions are

intended to identify forward-looking statements in this MD&A, including in the sections entitled “Overview”, “Overview -

CORE and Operational Restructuring”, “Overview - Strategic Initiatives”, “Fiscal 2014 Operating Results - Executive

Summary”, “Results of Continuing Operations - Fiscal year ended March 1, 2014 compared to fiscal year ended March 2, 2013

- Revenue - Revenue by Category - Service Revenue”, “Results of Continuing Operations - Fiscal year ended March 1, 2014