Blackberry 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

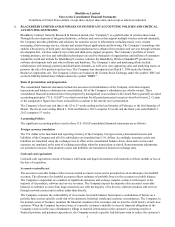

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

5

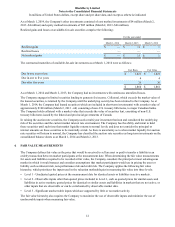

Revenue Recognition

The Company considers revenue realized or realizable and earned when the following four criteria have been met: (i)

when persuasive evidence of an arrangement exists, (ii) the product has been delivered to a customer and title has been

transferred or the services have been rendered, (iii) the sales price is fixed or determinable, and (iv) collection is

reasonably assured. In addition to this general policy, the following paragraphs describe the specific revenue recognition

policies for each of the Company’s major categories of revenue.

Hardware

Revenue for hardware products is recognized when the four criteria noted above are met. The determination of when the

price is fixed or determinable can affect the timing of revenue recognition, as discussed further below.

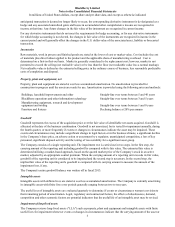

The Company records reductions to revenue for estimated commitments related to price protection, rights of return and

customer incentive programs. Price protection is accrued as a reduction to revenue provided that the future price reduction

can be reliably estimated or based on contractual caps, provided that the Company has not granted refunds in excess of

those caps and provided that all other revenue recognition criteria have been met. If refunds cannot be reliably estimated

or the contractual cap is no longer valid, revenue is not recognized until reliable estimates can be made or the price

protection period lapses. The Company also records reductions to revenue for rights of return based on contractual terms

and conditions as it relates to quality defects only and, if the expected product returns can be reasonably and reliably

estimated, based on historical experience. Where a right of return cannot be reasonably and reliably estimated, the

Company recognizes revenue when the product sells through to an end user or the return period lapses. The estimated cost

of customer incentive programs is accrued as a reduction to revenue and is recognized at the later of the date at which the

Company has recognized the revenue or the date at which the program is offered. If historical experience cannot support a

breakage rate, the maximum rebate amount is accrued and adjusted when the incentive programs end. The Company

considers several factors in determining whether it can reliably estimate future refunds or customer incentives such as

levels of channel inventory, new competitor introductions, the stage of a product in the product life cycle, and potential

cannibalization of future product offerings. If there is a future risk of pricing concessions and a reliable estimate cannot be

made at the time of shipment, the Company recognizes the related revenue and costs of goods sold when its products are

sold through to an end user. Shipments of BlackBerry 10 devices, and BlackBerry 7 devices in certain regions, are

recognized as revenue when the devices sell through to end customers.

For shipments where the Company recognizes revenue when the product is sold through to an end user, the Company

determines the point at which that happens based upon internally generated reporting indicating when the devices are

activated on the Company’s relay infrastructure.

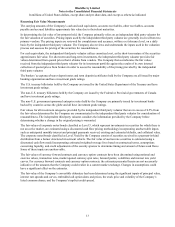

Service

Revenue from service is recognized ratably on a monthly basis when the service is provided. In instances where the

Company bills the customer prior to performing the service, the prebilling is recorded as deferred revenue. Service

revenue also includes the recognition of previously deferred revenue related to multi-element arrangements for non-

software services and software upgrade rights related to BlackBerry 10 devices.

Software

Revenue from licensed software is recognized at the inception of the license term and in accordance with industry-specific

software revenue recognition accounting guidance. When the fair value of a delivered element has not been established,

the Company uses the residual method to recognize revenue if the fair value of undelivered elements is determinable.

Revenue from software maintenance, unspecified upgrades and technical support contracts is recognized over the period

that such items are delivered or those services are provided.

Other

Other revenue consists of the sale of accessories and repair and maintenance contracts. Revenue is recognized when

persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and

collection is probable.