Blackberry 2014 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

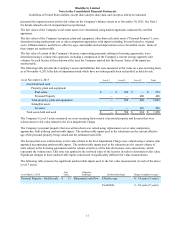

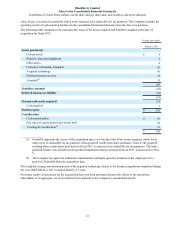

20

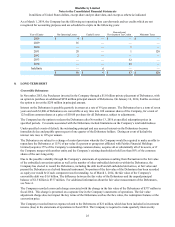

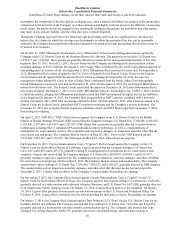

utilizing a market-based approach and the Company’s market capitalization was used as a key input for the determination

of fair value of the Company. The Company’s market capitalization was determined by multiplying the number of shares

outstanding as at June 2, 2012 by the average closing market price of the Company’s common shares over the preceding

five-day period. The Company used this duration in order to incorporate the inherent market fluctuations that may affect

any individual closing price of the Company’s shares. The Company believes that market capitalization alone does not

capture the fair value of the business as a whole, or the substantial value that an acquirer would obtain from its ability to

obtain control of the business. Consequently, the Company developed an estimate for the control premium that a

marketplace participant might pay to acquire control of the business in an arm’s-length transaction. The determination of

the control premium requires significant judgment and the Company observed recent market transactions as a guide to

establish a range of reasonably possible control premiums to estimate the Company’s fair value. The Company believes

that the main factors leading to the impairment were a significant decline in its share price, which was influenced by

delays in new product introductions, intense competition within the Company’s industry and a sustained decline in the

Company’s performance. The result of this analysis concluded that the carrying value of the Company exceeded its

estimated fair value, and as such, the second step of the goodwill impairment test was performed.

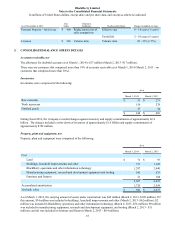

In the second step of the impairment test, the impairment loss was measured by estimating the implied fair value of the

Company’s goodwill and comparing it with its carrying value. Using the Company’s fair value determined in the first step

of the goodwill impairment test as the acquisition price in a hypothetical acquisition of the Company, the implied fair

value of goodwill was calculated as the residual amount of the acquisition price after allocations made to the fair value of

net assets, including working capital, property, plant and equipment and both recognized and unrecognized intangible

assets. Based on the results of the second step of the goodwill impairment test, it was concluded that the carrying value of

goodwill was impaired. Consequently, the Company recorded a goodwill impairment charge of $335 million in fiscal

2013 to write-off the entire carrying value of its goodwill, and reported this amount as a separate line item in the

consolidated statements of operations.

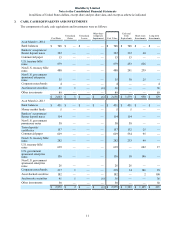

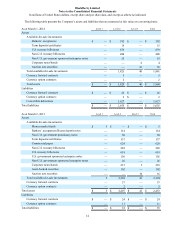

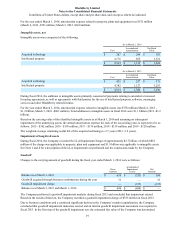

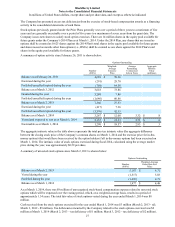

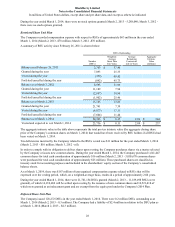

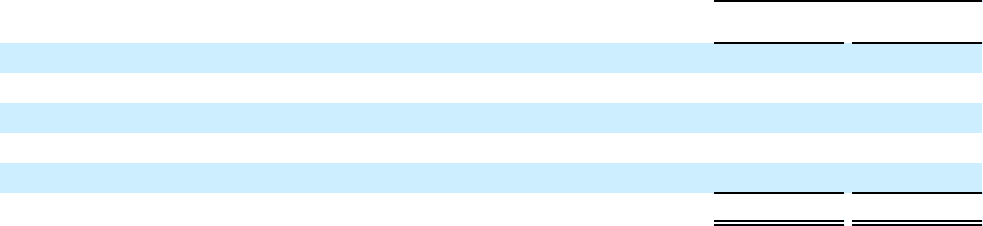

Accrued liabilities

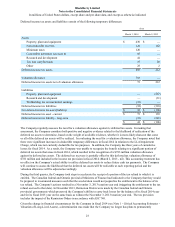

Accrued liabilities were comprised of the following:

As at

March 1, 2014 March 2, 2013

Vendor inventory liabilities 244 130

Warranty 204 318

Royalties 106 501

Carrier liabilities 153 141

Other 507 764

$ 1,214 $ 1,854

Other accrued liabilities, as noted in the above table, include, among other things, salaries and payroll withholding taxes,

none of which are greater than 5% of the current liabilities balance.

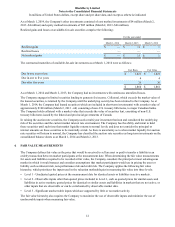

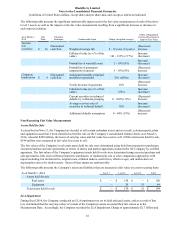

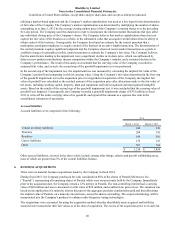

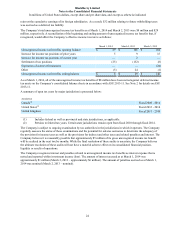

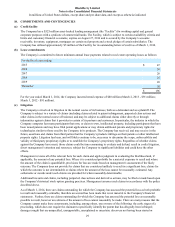

6. BUSINESS ACQUISITIONS

There were no material business acquisitions made by the Company in fiscal 2014.

During fiscal 2013, the Company purchased for cash consideration 88% of the shares of Paratek Microwave Inc.

(“Paratek”), representing all remaining shares of Paratek which were not previously held by the Company. Immediately

prior to the acquisition date, the Company owned a 12% interest in Paratek. The non-controlling interest had a carrying

value of $20 million and was re-measured at a fair value of $20 million, and resulted in no gain or loss. The valuation was

based on the application of a minority interest discount to the aggregate purchase consideration paid and then allocating

the implied value of Paratek, on a minority interest basis, across the shares outstanding. The acquired technology will be

incorporated into the Company’s products to enhance radio frequency tuning technologies.

The acquisitions were accounted for using the acquisition method whereby identifiable assets acquired and liabilities

assumed were measured at their fair values as of the date of acquisition. The excess of the acquisition price over such fair