Blackberry 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

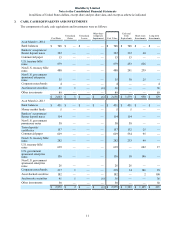

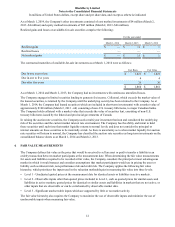

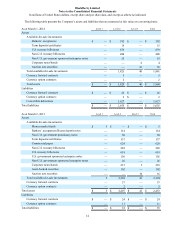

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

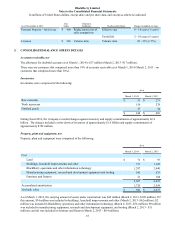

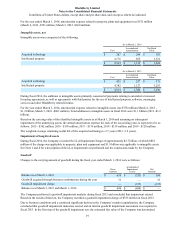

13

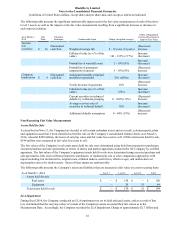

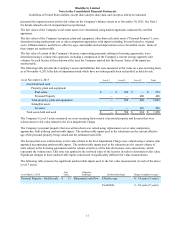

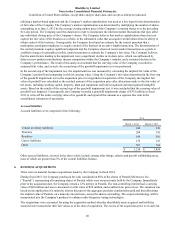

Recurring Fair Value Measurements

The carrying amounts of the Company’s cash and cash equivalents, accounts receivables, other receivables, accounts

payable and accrued liabilities approximate fair value due to their short maturities.

In determining the fair value of investments held, the Company primarily relies on an independent third party valuator for

the fair valuation of securities. Pricing inputs used by the independent third party valuator are generally received from two

primary vendors. The pricing inputs are reviewed for completeness and accuracy, within a set tolerance level, on a daily

basis by the independent third party valuator. The Company also reviews and understands the inputs used in the valuation

process and assesses the pricing of the securities for reasonableness.

For cash equivalents, the independent third party valuator utilizes amortized cost, as the short-term nature of the securities

approximates fair value. For short-term and long-term investments, the independent third party valuator provides fair

values determined from quoted prices that it obtains from vendors. The Company then corroborates the fair values

received from the independent third party valuator for its investment portfolio against the results of its own internal

collection of quoted prices from brokers in order to assess the reasonability of the pricing provided by the independent

third party valuator.

The bankers’ acceptances/bearer deposit notes and term deposits/certificates held by the Company are all issued by major

banking organization and have investment grade ratings.

The U.S. treasury bills/notes held by the Company are issued by the United States Department of the Treasury and have

investment grade ratings.

The non-U.S. treasury bills/notes held by the Company are issued by the Federal or Provincial governments of Canada

and have investment grade ratings.

The non-U.S. government sponsored enterprise notes held by the Company are primarily issued by investment banks

backed by countries across the globe and all have investment grade ratings.

Fair values for all investment categories provided by the independent third party valuator that are in excess of 0.5% from

the fair values determined by the Company are communicated to the independent third party valuator for consideration of

reasonableness. The independent third party valuator considers the information provided by the Company before

determining whether a change in the original pricing is warranted.

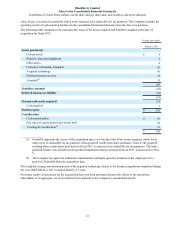

The fair values of corporate notes/bonds classified as Level 3, which represent investments in securities for which there is

not an active market, are estimated using a discounted cash flow pricing methodology incorporating unobservable inputs

such as anticipated monthly interest and principal payments received, existing and estimated defaults, and collateral value.

The corporate notes/bonds classified as Level 3 held by the Company consist of securities received in a payment-in-kind

distribution from a former structured investment vehicle. The fair value of auction rate securities is estimated using a

discounted cash flow model incorporating estimated weighted-average lives based on contractual terms, assumptions

concerning liquidity, and credit adjustments of the security sponsor to determine timing and amount of future cash flows.

Some of these inputs are unobservable.

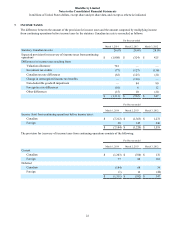

The fair values of currency forward contracts and currency option contracts have been determined using notional and

exercise values, transaction rates, market quoted currency spot rates, forward points, volatilities and interest rate yield

curves. For currency forward contracts and currency option contracts, the estimates presented herein are not necessarily

indicative of the amounts that the Company could realize in a current market exchange. Changes in assumptions could

have a significant effect on the estimates.

The fair value of the Company’s convertible debenture has been determined using the significant inputs of principal value,

interest rate spreads and curves, embedded call option dates and prices, the stock price and volatility of the Company’s

listed common shares, and the Company’s implicit credit spread.