Blackberry 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

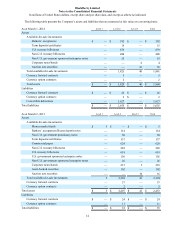

21

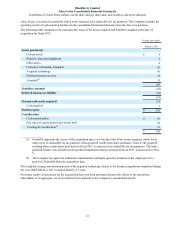

value, if any, is recorded as goodwill, which is not expected to be deductible for tax purposes. The Company includes the

operating results of each acquired business in the consolidated financial statements from the date of acquisition.

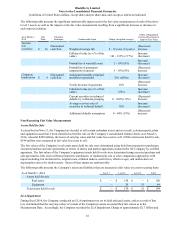

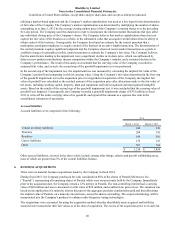

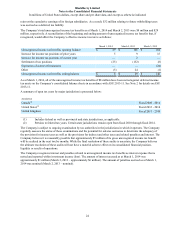

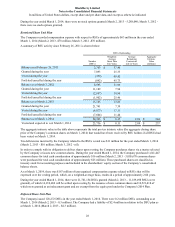

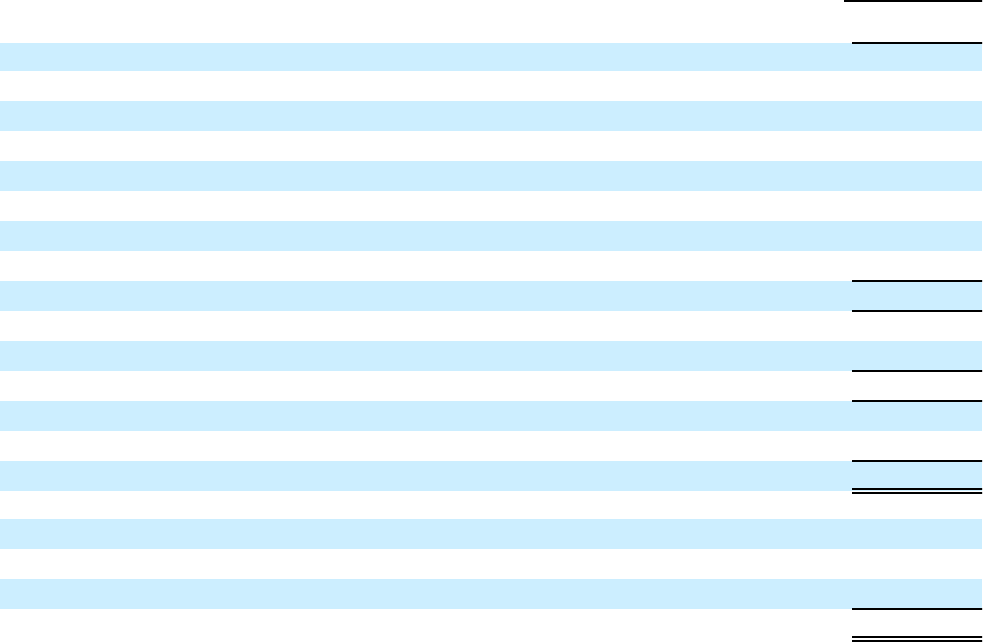

The following table summarizes the estimated fair value of the assets acquired and liabilities assumed at the date of

acquisition for fiscal 2013:

For the year ended

March 2, 2013

Assets purchased

Current assets $ 4

Property, plant and equipment 2

Other assets 4

Customer relationship intangible 10

Acquired technology 96

Deferred income tax asset 39

Goodwill(1) 31

186

Liabilities assumed (23)

Deferred income tax liability (38)

(61)

Net non-cash assets acquired 125

Cash acquired 1

Purchase price $ 126

Consideration

Cash consideration $ 93

Fair value of equity interest previously held 20

Contingent consideration(2) 13

$ 126

_______________

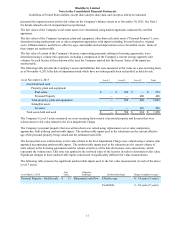

(1) Goodwill represents the excess of the acquisition price over the fair value of net assets acquired, which is not

expected to be deductible for tax purposes when goodwill results from share purchases. None of the goodwill

resulting from certain assets purchased in fiscal 2013 is expected to be deductible for tax purposes. The entire

goodwill balance was included in the goodwill impairment charge incurred in fiscal 2013, as discussed in Note

5.

(2) The Company has agreed to additional consideration contingent upon the retention of key employees for a

period of 24 months from the acquisition date.

The weighted-average amortization period of the acquired technology related to the business acquisition completed during

the year ended March 2, 2013 is approximately 4.3 years.

Pro forma results of operations for the acquisitions have not been presented because the effects of the operations,

individually or in aggregate, are not considered to be material to the Company’s consolidated results.