Blackberry 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

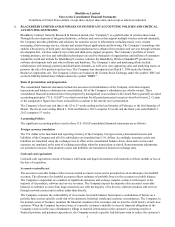

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

3

anticipated transaction is deemed no longer likely to occur, the corresponding derivative instrument is de-designated as a

hedge and any associated unrealized gains and losses in accumulated other comprehensive income are recognized in

income at that time. Any future changes in the fair value of the instrument are recognized in current income.

For any derivative instruments that do not meet the requirements for hedge accounting, or for any derivative instruments

for which hedge accounting is not elected, the changes in fair value of the instruments are recognized in income in the

current period and will generally offset the changes in the U.S. dollar value of the associated asset, liability or forecasted

transaction.

Inventories

Raw materials, work in process and finished goods are stated at the lower of cost or market value. Cost includes the cost

of materials plus direct labour applied to the product and the applicable share of manufacturing overhead. Cost is

determined on a first-in-first-out basis. Market is generally considered to be replacement cost; however, market is not

permitted to exceed the ceiling (net realizable value) or be less than the floor (net realizable value less a normal markup).

Net realizable value is defined as the estimated selling price in the ordinary course of business, less reasonably predictable

costs of completion and disposal.

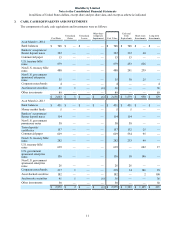

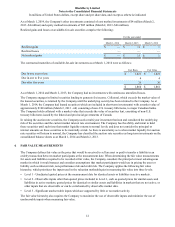

Property, plant and equipment, net

Property, plant and equipment are stated at cost less accumulated amortization. No amortization is provided for

construction in progress until the assets are ready for use. Amortization is provided using the following rates and methods:

Buildings, leasehold improvements and other Straight-line over terms between 5 and 40 years

BlackBerry operations and other information technology Straight-line over terms between 3 and 5 years

Manufacturing equipment, research and development

equipment and tooling Straight-line over terms between 1 and 8 years

Furniture and fixtures Declining balance at 20% per annum

Goodwill

Goodwill represents the excess of the acquisition price over the fair value of identifiable net assets acquired. Goodwill is

allocated at the date of the business combination. Goodwill is not amortized, but is tested for impairment annually, during

the fourth quarter, or more frequently if events or changes in circumstances indicate the asset may be impaired. These

events and circumstances may include a significant change in legal factors or in the business climate, a significant decline

in the Company’s share price, an adverse action or assessment by a regulator, unanticipated competition, a loss of key

personnel, significant disposal activity and the testing of recoverability for a significant asset group.

The Company consists of a single reporting unit. The impairment test is carried out in two steps. In the first step, the

carrying amount of the reporting unit including goodwill is compared with its fair value. The estimated fair value is

determined utilizing a market-based approach, based on the quoted market price of the Company’s stock in an active

market, adjusted by an appropriate control premium. When the carrying amount of a reporting unit exceeds its fair value,

goodwill of the reporting unit is considered to be impaired and the second step is necessary. In the second step, the

implied fair value of the reporting unit's goodwill is compared with its carrying amount to measure the amount of the

impairment loss, if any.

The Company's entire goodwill balance was written off in fiscal 2013.

Intangible assets

Intangible assets with definite lives are stated at cost less accumulated amortization. The Company is currently amortizing

its intangible assets with finite lives over periods generally ranging between two to ten years.

The useful lives of intangible assets are evaluated quarterly to determine if events or circumstances warrant a revision to

their remaining period of amortization. Legal, regulatory and contractual factors, the effects of obsolescence, demand,

competition and other economic factors are potential indicators that the useful life of an intangible asset may be revised.

Impairment of long-lived assets

The Company reviews long-lived assets ("LLA") such as property, plant and equipment and intangible assets with finite

useful lives for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset or