Blackberry 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

“Senior Creditor” means a holder or holders of Specified Senior Indebtedness and includes any representative or representatives

or trustee or trustees of any such holder or holders; and

“Specified Senior Indebtedness” means, without duplication, the Indebtedness under the Company’s existing asset-backed lending

facility and such other indebtedness as the Company shall designate as “Specified Senior Indebtedness” by notice to the Trustee

in writing; provided that the aggregate principal amount of Specified Senior Indebtedness shall not exceed $550,000,000 at any

one time outstanding; provided, further, that all Specified Senior Indebtedness must constitute:

(j) Indebtedness referred to in paragraphs (a) and (b) of the definition of Indebtedness above;

(k) renewals, extensions, restructurings, refinancings and refundings of any such Indebtedness; and

(l) guarantees of any of the foregoing.

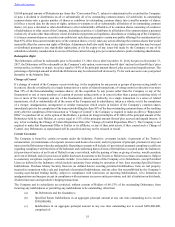

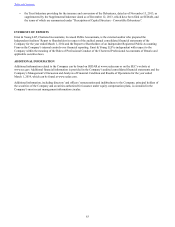

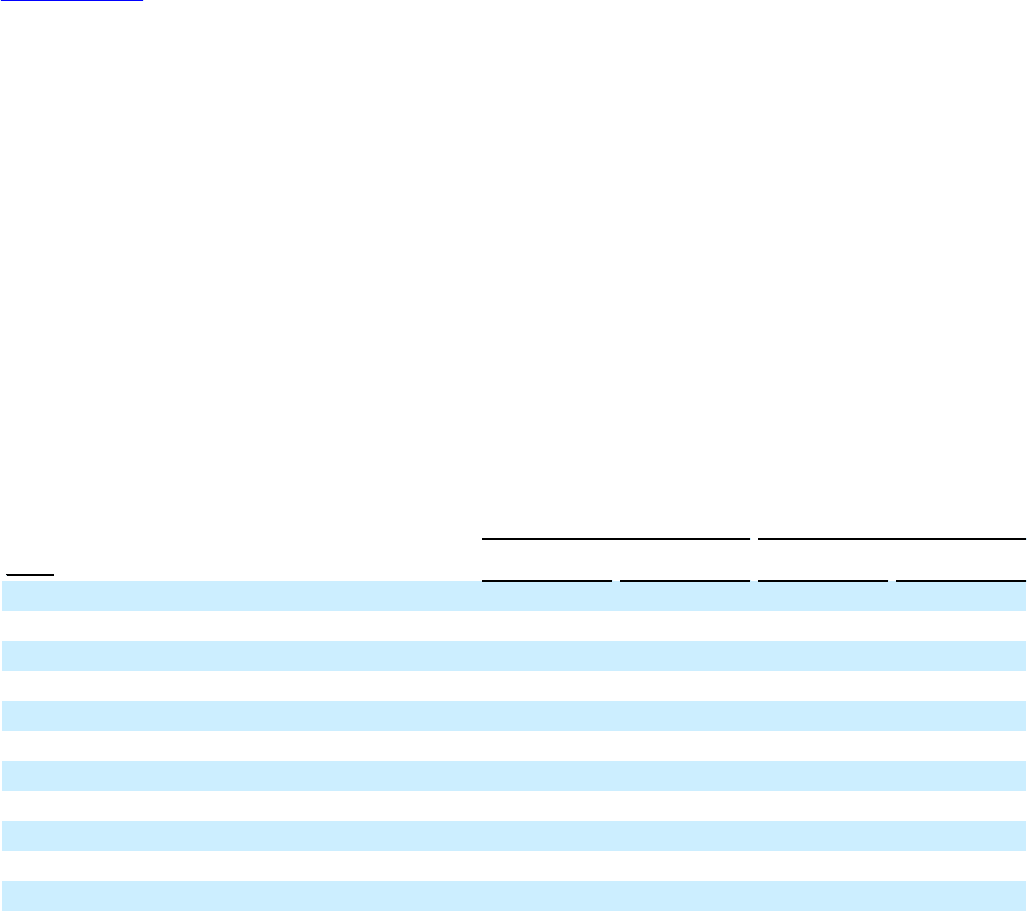

MARKET FOR SECURITIES OF THE COMPANY

The Company’s common shares are listed and posted for trading on the Toronto Stock Exchange under the symbol “BB” and

are listed on the NASDAQ Global Select Market under the symbol “BBRY”. The volume of trading and price ranges of the

Company’s common shares on the Toronto Stock Exchange and the NASDAQ Global Select Market during the previous fiscal

year are set out in the following table:

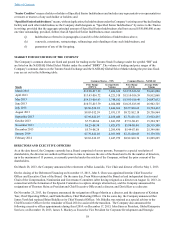

Common Shares – TSX Common Shares – NASDAQ

Month Price Range

(CDN $) Average Daily

Volume Price Range

(US $) Average Daily

Volume

March 2013 $12.90-$17.22 7,484,160 $12.55-$16.82 59,641,080

April 2013 $13.43-$16.72 4,221,518 $13.10-$16.59 30,812,068

May 2013 $14.33-$16.63 3,748,182 $13.83-$16.49 24,047,632

June 2013 $10.75-$15.79 4,024,000 $10.25-$15.09 26,902,725

July 2013 $8.80-$10.85 2,444,864 $8.57-$10.62 19,794,432

August 2013 $9.03-$12.59 2,931,133 $8.72-$12.18 28,756,964

September 2013 $7.99-$12.07 4,160,480 $7.75-$11.65 33,922,255

October 2013 $7.75-$8.84 1,841,995 $7.51-$8.45 15,394,787

November 2013 $6.25-$8.38 1,821,871 $5.98-$8.04 20,319,500

December 2013 $5.79-$8.28 2,295,430 $5.44-$7.80 25,399,986

January 2014 $7.79-$12.03 4,031,968 $7.33-$10.85 35,179,738

February 2014 $9.83-$12.07 3,447,979 $8.92-$10.76 23,899,695

DIRECTORS AND EXECUTIVE OFFICERS

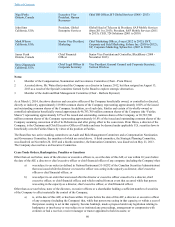

As at the date hereof, the Company currently has a Board comprised of seven persons. Pursuant to a special resolution of

shareholders, the directors are authorized from time to time to increase the size of the Board and to fix the number of directors,

up to the maximum of 15 persons, as currently provided under the articles of the Company, without the prior consent of the

shareholders.

On March 28, 2013, the Company announced the retirement of Mike Lazaridis, Vice Chair and director effective May 1, 2013.

On the closing of the Debenture Financing on November 13, 2013, John S. Chen was appointed Interim Chief Executive

Officer and Executive Chair of the Board. On the same day, Prem Watsa rejoined the Board as lead independent director and

Chair of the Compensation, Nomination and Governance Committee (after having resigned as a director on August 12, 2013, in

connection with the formation of the Special Committee to explore strategic alternatives), and the Company announced the

resignations of Thorsten Heins as President and Chief Executive Officer and a director, and David Kerr as a director.

On November 25, 2013, the Company announced the resignation of Roger Martin as a director, and the departures of Kristian

Tear, Chief Operating Officer, and Frank Boulben, Chief Marketing Officer. On the same day, the Company announced that

James Yersh had replaced Brian Bidulka as its Chief Financial Officer. Mr. Bidulka was retained as a special advisor to the

Chief Executive Officer for the remainder of fiscal 2014 to assist with the transition. The Company also announced the

following executive officer appointments during fiscal 2014: on December 17, 2013, John Sims as President, Global Enterprise

Services; on December 18, 2013, James S. Mackey as Executive Vice President for Corporate Development and Strategic

Table of Contents