Blackberry 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

32

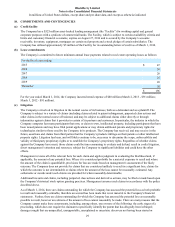

The Company has entered into indemnification agreements with its directors and current and former executive officers.

Under these agreements, the Company agreed, subject to applicable law, to indemnify its directors and executive officers

against all costs, charges and expenses reasonably incurred by such individuals in respect of any civil, criminal or

administrative action which could arise by reason of their status as directors or officers. The Company maintains liability

insurance coverage for the benefit of its directors and current and former executive officers. The Company has not

encountered material costs as a result of such indemnifications in the current year. See the Company’s Management

Information Circular for fiscal 2013 for additional information regarding the Company’s indemnification agreements with

its directors and current and former executive officers.

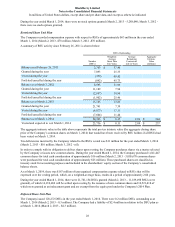

11. COST OPTIMIZATION PROGRAMS

Fiscal 2013 Cost Optimization and Resource Efficiency (“CORE”) Program

In March 2012, the Company commenced the CORE program with the objective of improving the Company’s operations

and increasing efficiency. The program includes, among other things, the streamlining of the BlackBerry smartphone

product portfolio, the optimization of the Company’s global manufacturing footprint, the outsourcing of global repair

services, the alignment of the Company’s sales and marketing teams and a reduction in the global workforce. On

September 20, 2013, the Company announced that it had commenced implementation of a further workforce reduction of

approximately 4,500 positions to bring the total workforce to approximately 7,000 full-time global employees and that it

was targeting an approximate 50% reduction in operating expenditures by the end of the first quarter of fiscal 2015. The

Company expects to incur approximately $100 million in additional cash and non-cash, pre-tax charges related to the

CORE program by the end of the first quarter of fiscal 2015.

The Company incurred approximately $512 million in total pre-tax charges related to the CORE program and strategic

review process in fiscal 2014, related to one-time employee termination benefits, facilities and manufacturing network

simplification costs as well as legal and financial advisory costs related to the recently completed strategic review process.

Other charges and cash costs may occur as programs are implemented or changes are completed.

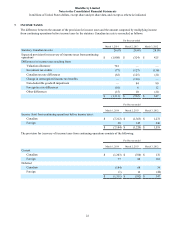

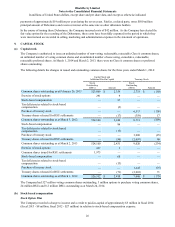

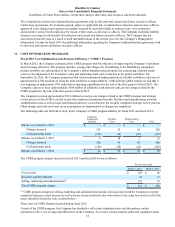

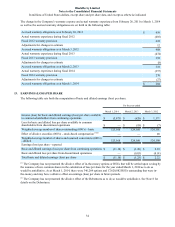

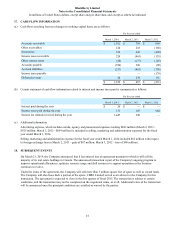

The following table sets forth the activity in the Company’s CORE program liability for fiscal 2013 and fiscal 2014:

Employee

Termination

Benefits Facilities

Costs Manufacturing

Costs Total

Balance as at March 3, 2012 $ — $ — $ — $ —

Charges incurred 123 32 65 220

Cash payments made (114)(14)(63)(191)

Balance as at March 2, 2013 9 18 2 29

Charges incurred 190 93 65 348

Cash payments made (186)(58)(41)(285)

Balance as at March 1, 2014 $ 13 $ 53 $ 26 $ 92

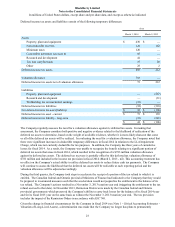

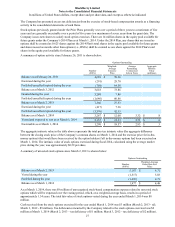

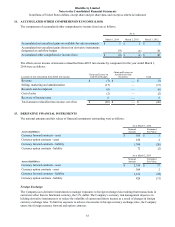

The CORE program charges incurred in fiscal 2013 and fiscal 2014 were as follows:

For the year ended

March 1, 2014 March 2, 2013

Cost of sales $ 103 $ 96

Research and development 76 27

Selling, marketing and administration(1) 333 97

Total CORE program charges $ 512 $ 220

(1) CORE program charges in selling, marketing and administration include costs associated with the Company's recently

completed strategic review process as well as losses incurred related to the write-down to fair value less costs to sell of the

assets classified as held for sale, as noted below.

There were no CORE charges incurred during fiscal 2012.

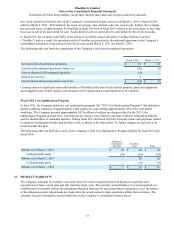

As part of the CORE program, the Company has decided to sell certain redundant assets and discontinue certain

operations to drive cost savings and efficiencies in the Company. As a result, certain property, plant and equipment assets