Blackberry 2014 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

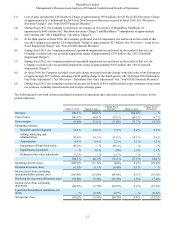

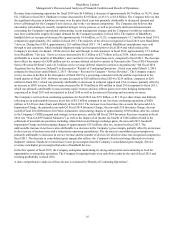

Management’s Discussion and Analysis of Financial Condition and Results of Operations

25

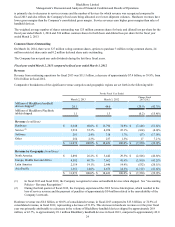

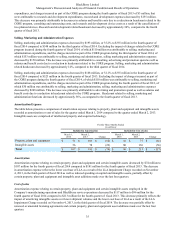

million BlackBerry handheld devices shipped in fiscal 2012. The decline in the volume of BlackBerry devices shipped was

primarily a result of decreased demand for the Company’s aging product portfolio in a very competitive environment in which

multiple competitors introduced new devices beginning in early fiscal 2013. The Company introduced the first BlackBerry 10

smartphones in certain countries starting on January 31, 2013. The overall decrease in revenue in fiscal 2013 was also

attributable to a decrease in average selling prices of BlackBerry 7 handheld devices in fiscal 2013 compared to fiscal 2012 due

to the continuation of pricing initiatives to drive sell-through, partially offset by the higher average selling prices of BlackBerry

10 devices. However, the impact of BlackBerry 10 smartphone sales on total revenue for fiscal 2013 was modest since they

were only available in certain markets for one month or less prior to the end of fiscal 2013. Delays in the introduction of the

BlackBerry 10 smartphones resulted in certain of the current BlackBerry 7 product line being in the market for over one year,

which contributed to declining unit shipments and a loss of market share in fiscal 2013 as some customers either awaited the

launch of the new BlackBerry 10 smartphones or switched to devices of the Company's competitors.

The number of BlackBerry PlayBook tablets shipped during fiscal 2013 was approximately 1.1 million, representing a decrease

of 0.2 million units compared to the prior fiscal year. Overall, BlackBerry PlayBook tablet shipments experienced lower than

anticipated sell-through to end users due mainly to intense competition in the tablet market, especially in the United States.

During fiscal 2013, the Company continued its ongoing promotional activities to encourage sell-through of the BlackBerry

PlayBook tablets.

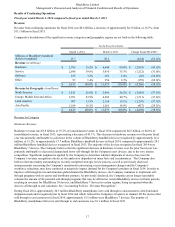

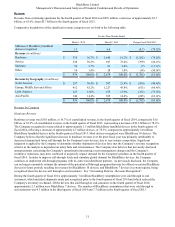

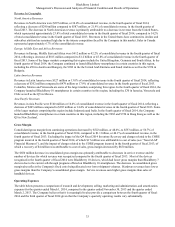

Service revenue decreased by $164 million, or 4.0%, to $3.9 billion, or 35.3% of consolidated revenue, in fiscal 2013,

compared to $4.1 billion, or 22.1% of consolidated revenue, in fiscal 2012. The decrease in service revenue was primarily due

to the net decrease in BlackBerry subscribers. The decrease in service revenue also reflected a decrease in average revenue per

user (“ARPU”). The decrease in ARPU resulted from pricing reduction programs implemented by the Company to maintain the

subscriber base as well as a shift in the mix of the Company’s subscriber base from higher tiered unlimited plans to prepaid and

lower tiered plans. BlackBerry tiered service plans continued to drive growth in the Company’s subscriber base in fiscal 2013,

specifically outside North America.

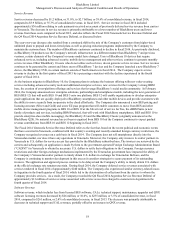

Software revenue, which includes fees from licensed BES software, CALs, technical support, maintenance and upgrades

decreased by $57 million, or 17.9%, to $261 million, or 2.4% of consolidated revenue, in fiscal 2013, compared to $318

million, or 1.7% of consolidated revenue, in fiscal 2012. This decrease was primarily attributable to a decrease in CALs and

maintenance revenue.

Other revenue, which includes non-warranty repairs, accessories, licensing revenues and gains and losses on revenue hedging

instruments, increased by $17 million to $254 million in fiscal 2013 compared to $237 million in fiscal 2012. The majority of

the increase was attributable to increases in gains on revenue hedging instruments and IP licensing, partially offset by decreases

in non-warranty repair revenues and accessories revenue. See “Market Risk of Financial Instruments - Foreign Exchange” for

additional information on the Company’s hedging instruments.

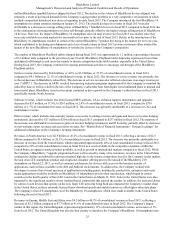

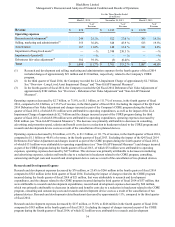

Revenues in North America were $2.9 billion or 26.2% of consolidated revenue in fiscal 2013, reflecting a decrease of $2.5

billion compared to $5.4 billion, or 29.5% of consolidated revenue in fiscal 2012. The decrease was primarily attributable to a

decrease in revenue from the United States, which represented approximately 20% of total consolidated revenue in fiscal 2013,

compared to 23% of total consolidated revenue in fiscal 2012, as a result of shifts in the competitive dynamics within the

United States, an aging in-market product portfolio, as well as growth in international markets compared to fiscal 2012. While

the Company’s BlackBerry 7 upgrade program had been well received by many of its customers, revenues in the United States

continued to decline and subscriber attrition remained high due to the intense competition faced by the Company in this market,

the lack of an LTE smartphone product and a high-end consumer offering prior to the launch of the BlackBerry Z10

smartphone on March 22, 2013, as well as consumer preferences for devices with access to the broadest number of

applications, such as those available in the iOS and Android environments. To address this, the Company worked with

developers to ensure that a broad spectrum of applications including games, multimedia, productivity, enterprise and social

media applications would be available on BlackBerry 10 smartphones prior to their introduction, which began in certain

countries in the fourth quarter of fiscal 2013 and in the United States on March 22, 2013. Sales in the United States were also

impacted by the significant number of new Android-based competitors that entered the market. In addition, the increased desire

by carriers to sell devices that operate on the new, faster LTE networks being built also impacted the Company’s market share

in the United States, as these networks featured faster download speeds and enabled carriers to offer higher-value data plans.

The Company’s first LTE smartphones were the BlackBerry 10 smartphones, which were made available in the United States

following the end of fiscal 2013.

Revenues in Europe, Middle East and Africa were $4.5 billion or 40.7% of consolidated revenue in fiscal 2013, reflecting a

decrease of $3.2 billion compared to $7.7 billion or 41.6% of consolidated revenue in fiscal 2012. The Company’s largest

market in this region, the United Kingdom, represented approximately 11% of total consolidated revenue, an increase of 1%

from fiscal 2012. The United Kingdom was also the first country to introduce the Company’s BlackBerry 10 smartphones into