Blackberry 2014 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

40

See “Cautionary Statement Regarding Forward-Looking Statements” and the “Risk Factors” section of the AIF, which is

included in the Annual Report, including the risk factor titled “The Company is subject to risks inherent in foreign operations”.

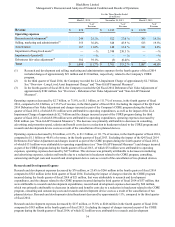

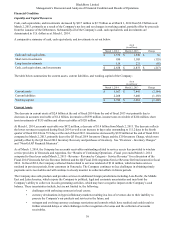

Current Liabilities

The decrease in current liabilities of $1.2 billion at the end of fiscal 2014 from the end of fiscal 2013 was primarily due to

decreases in accrued liabilities and accounts payable, partially offset by an increase in deferred revenue. As at March 1, 2014,

accrued liabilities were $1.2 billion, reflecting a decrease of $640 million compared to March 2, 2013, which was primarily

attributable to decreases in accrued royalties, employee incentives and warranty liabilities, partially offset by an increase in

vendor liabilities reflecting the Q3 Fiscal 2014 Inventory Charge, the Z10 Inventory Charge and the Q4 Fiscal 2014 Inventory

Recovery. Deferred revenue was $580 million, which reflects an increase of $38 million compared to March 2, 2013 due to an

increase in the volume of transactions that did not meet the criteria for revenue recognition as at March 1, 2014. Accounts

payable was $474 million as at March 1, 2014, reflecting a decrease of $590 million from March 2, 2013, which was primarily

attributable to timing of purchases at the end of fiscal 2014 compared to the end of fiscal 2013.

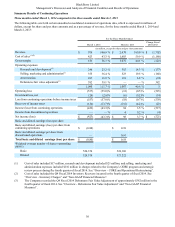

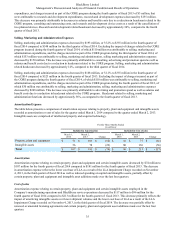

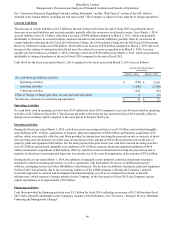

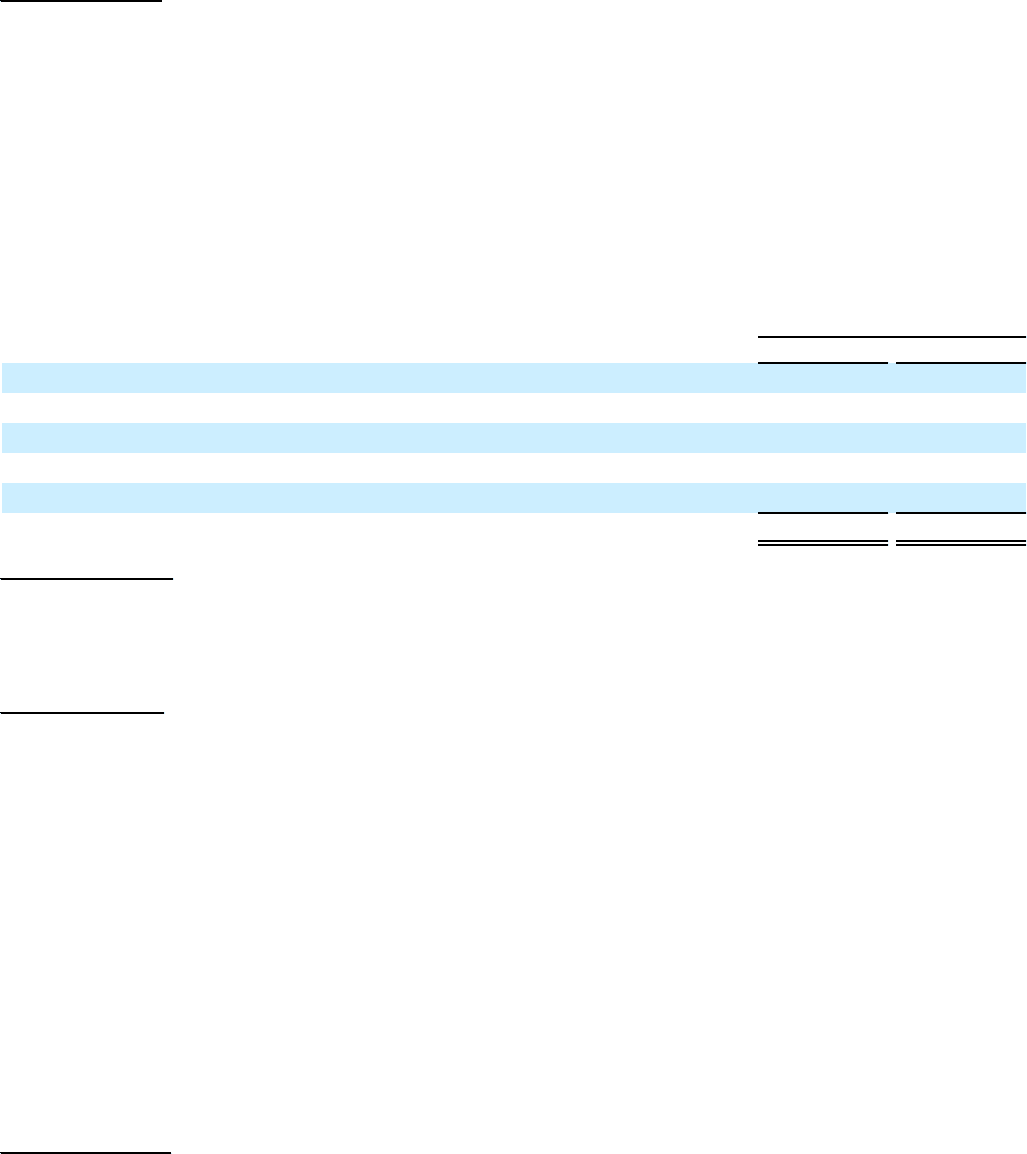

Cash flows for the fiscal year ended March 1, 2014 compared to the fiscal year ended March 2, 2013 were as follows:

For the Fiscal Year Ended

(in millions)

March 1, 2014 March 2, 2013

Net cash flows provided by (used in):

Operating activities $(159) $ 2,303

Investing activities (1,040)(2,240)

Financing activities 1,224 (36)

Effect of foreign exchange gain (loss) on cash and cash equivalents 5(5)

Net increase (decrease) in cash and cash equivalents $ 30 $ 22

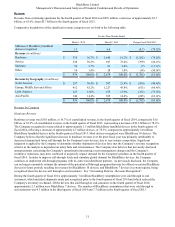

Operating Activities

Net cash flows used in operating activities were $159 million for fiscal 2014 compared to net cash flows provided by operating

activities of $2.3 billion in fiscal 2013. The decrease primarily reflects the net loss incurred in fiscal 2014, partially offset by

changes in net working capital compared to the same period in the prior fiscal year.

Investing Activities

During the fiscal year ended March 1, 2014, cash flows used in investing activities were $1.0 billion and included intangible

asset additions of $1.1 billion, acquisitions of property, plant and equipment of $283 million and business acquisitions of $7

million, which were partially offset by cash flows provided by transactions involving the proceeds on sale or maturity of short-

term and long-term investments, net of the costs of acquisitions in the amount of $281 million and proceeds on the sale of

property, plant and equipment $49 million. For the same period of the prior fiscal year, cash flows used in investing activities

were $2.2 billion and included intangible asset additions of $1.0 billion, property, plant and equipment additions of $418

million and business acquisitions of $60 million, offset by cash flows used in transactions involving the proceeds on sale or

maturity of short-term investments and long-term investments, net of the costs of acquisitions, in the amount of $762 million.

During the fiscal year ended March 1, 2014, the additions of intangible assets primarily consisted of payments relating to

amended or renewed licensing agreements, as well as agreements with third parties for the use of intellectual property,

software, messaging services and other BlackBerry related features. The decrease in additions of property, plant and equipment

for fiscal 2014 was primarily due to the cost saving initiatives of the CORE program, reflecting the Company’s targeted

investment approach in research and development and manufacturing, as well as its continued investment in network

infrastructure, which remains a strategic priority for the Company. In the first quarter of fiscal 2015, the Company expects

capital expenditures to be approximately $50 million.

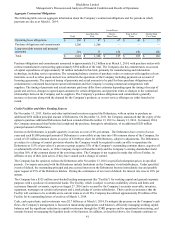

Financing Activities

Cash flows provided by financing activities were $1.2 billion for fiscal 2014, reflecting an increase of $1.3 billion from fiscal

2013 and is primarily attributable to the Company's issuance of the Debentures. See “Overview - Strategic Review, Debenture

Financing and Management Changes”.