Blackberry 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

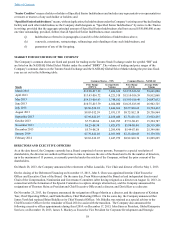

53

There could be adverse tax consequence for the Company’s shareholders in the United States if the Company is or

was a passive foreign investment company.

Under U.S. federal income tax laws, if a company is, or for any past period was, a passive foreign investment company

(“PFIC”), there could be adverse U.S. federal income tax consequences to U.S. shareholders even if the Company is no longer a

PFIC. The determination of whether the Company is a PFIC is a factual determination made annually based on various facts

and circumstances and thus is subject to change, and the principles and methodology used in determining whether a company is

a PFIC are subject to interpretation. While the Company does not believe that it is currently or has been a PFIC, there can be no

assurance that the Company was not a PFIC in the past and will not be a PFIC in the future. U.S. shareholders are urged to

consult their tax advisors concerning U.S. federal income tax consequences of holding the Company’s common shares if the

Company is or has been considered a PFIC.

The Company’s charter documents enable its directors to issue preferred shares which may prevent a takeover by a

third party.

The Company’s authorized share capital consists of an unlimited number of common shares, an unlimited number of class A

common shares and an unlimited number of preferred shares, issuable in one or more series. The Board has the authority to

issue preferred shares and determine the price, designation, rights, preferences, privileges, restrictions and conditions, including

dividend rights, of these shares without any further vote or action by shareholders. The rights of the holders of common shares

will be subject to, and may be adversely affected by, the rights of holders of any preferred shares that may be issued in the

future. Subject to the Company's compliance with applicable securities law requirements, the Company’s ability to issue

preferred shares could make it more difficult for a third party to acquire a majority of the Company’s outstanding voting shares,

the effect of which may be to deprive the Company’s shareholders of a control premium that might otherwise be realized in

connection with an acquisition of the Company.

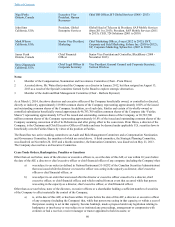

DIVIDEND POLICY AND RECORD

The Company has not paid any cash dividends on its common shares during the last three fiscal years. The Company will

consider paying dividends on its common shares in the future when circumstances permit, having regard to, among other

things, the Company’s earnings, cash flows and financial requirements, as well as relevant legal and business considerations.

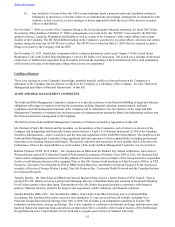

DESCRIPTION OF CAPITAL STRUCTURE

The Company’s authorized share capital consists of an unlimited number of voting common shares without par value, an

unlimited number of non-voting, redeemable, retractable class A common shares without par value, and an unlimited number of

non-voting, cumulative, redeemable, retractable preferred shares without par value, issuable in series. Only common shares are

issued and outstanding.

Common Shares

Each common share is entitled to one vote at meetings of the shareholders and to receive dividends if, as and when declared by

the Board. Dividends which the Board determine to declare and pay shall be declared and paid in equal amounts per share on

the common shares and class A common shares at the time outstanding without preference or distinction. Subject to the rights

of holders of shares of any class of share ranking prior to the class A common shares and common shares, holders of class A

common shares and common shares are entitled to receive the Company’s remaining assets ratably on a per share basis without

preference or distinction in the event that it is liquidated, dissolved or wound-up.

Class A Common Shares

The holders of class A common shares are not entitled to receive notice of, or attend or vote at, any meeting of the Company’s

shareholders, except as provided by applicable law. Each such holder is entitled to receive notice of, and to attend, any

meetings of shareholders called for the purpose of authorizing the dissolution or the sale, lease or exchange of all or

substantially all of the Company’s property other than in the ordinary course of business and, at any such meeting, shall be

entitled to one vote in respect of each class A common share on any resolution to approve such dissolution, sale, lease or

exchange. Dividends are to be declared and paid in equal amounts per share on all the class A common shares and the common

shares without preference or distinction. Subject to the rights of holders of any class of share ranking prior to the class A

common shares and common shares, in the event that the Company is liquidated, dissolved or wound-up, holders of class A

common shares and common shares are entitled to receive the remaining assets ratably on a per share basis without preference

or distinction.

Table of Contents