Blackberry 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

36

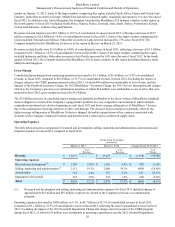

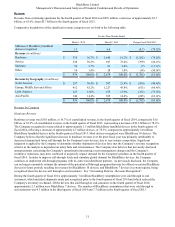

Investment Income

Investment income decreased by $14 million to a loss of $20 million in the fourth quarter of fiscal 2014 from a loss of $6

million in the fourth quarter of fiscal 2013. The decrease in investment income is primarily attributable to interest costs

associated with the Company’s Debentures, which was partially offset by difference in the recognition of the Company's

portion of investment losses in its equity-based investments. See “Financial Condition - Liquidity and Capital Resources”

below.

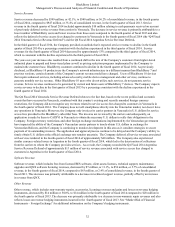

Income Taxes

For the fourth quarter of fiscal 2014, the Company’s income tax recovery from continuing operations was $134 million,

resulting in an effective income tax recovery rate of approximately 24.2%, compared to an income tax recovery from

continuing operations of $112 million and an effective income tax recovery rate of approximately 622.2% for the same period

in the prior fiscal year. The Company’s effective income tax recovery rate reflects the geographic mix of earnings in

jurisdictions with different income tax rates. The Company’s 24.2% effective income tax recovery rate in the fourth quarter of

fiscal 2014 reflects the recognition of additional deferred tax recoveries and the recognition of additional deferred tax valuation

allowance, which is more fully described below.

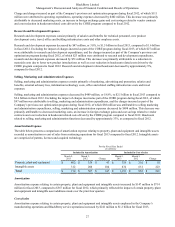

The Company regularly assesses the need for a valuation allowance against its deferred tax assets. In making that assessment,

the Company considers both positive and negative evidence related to the likelihood of realization of the deferred tax assets to

determine, based on the weight of available evidence, whether it is more-likely-than-not that some or all of the deferred tax

assets will be realized. In evaluating the need for a valuation allowance, the Company noted that there were significant

increases in deductible temporary differences in the third quarter of fiscal 2014 in relation to the LLA Impairment Charge,

which was not currently deductible for tax purposes. In addition, the Company has three years of cumulative losses for fiscal

2014. As a result, the Company was unable to recognize the benefit relating to a significant portion of deferred tax assets that

arose in the fourth quarter of fiscal 2014, which resulted in a $55 million valuation allowance against its deferred tax assets.

The deferred tax recovery is partially offset by this deferred tax valuation allowance of $55 million and included in the income

tax provision in the fourth quarter of fiscal 2014. This accounting treatment has no effect on the Company’s actual ability to

utilize deferred tax assets to reduce future cash tax payments. The Company will continue to assess the likelihood that the

deferred tax assets will be realizable at each reporting period and the valuation allowance will be adjusted accordingly.

During the third quarter, the Company took steps to accelerate the receipt of a portion of the tax refund to which it is entitled.

The Canadian federal and Ontario provincial Ministers of Finance had indicated to the Company that they would be prepared to

recommend measures such that the acceleration would not jeopardize the entitlement to the balance of its tax refund. The

Company's actions resulted in a November 3, 2013 taxation year end, which triggered the entitlement to the accrued tax refund

accrued of $696 million, which the Company received prior to November 30, 2013. In December 2013, Remission Orders were

made by the Canadian federal and Ontario provincial governments which preserved the Company's ability to carry back losses

for the balance of fiscal 2014 and for fiscal 2015 on the same basis as without the November 3, 2013 taxation year end. The

tax provision includes the impact of the Remission Orders in accordance with ASC 740 because they were made in the fourth

quarter.

The Company has provided for foreign withholding taxes of $32 million that would apply on the distribution of the earnings of

its non-Canadian subsidiaries as these earnings are no longer intended to be reinvested indefinitely by these subsidiaries.

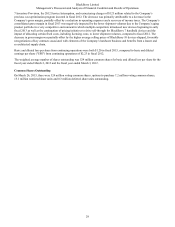

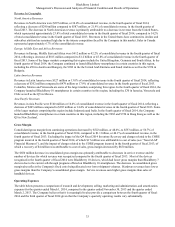

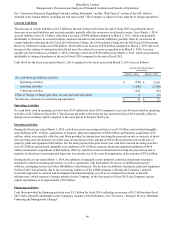

Net Income (loss)

The Company’s net loss from continuing operations for the fourth quarter of fiscal 2014 was $423 million, or $0.80 per share

(basic and diluted), reflecting an unfavourable increase in net loss of $517 million compared to net income from continuing

operations of $94 million, or $0.18 per share (basic and diluted), in the fourth quarter of fiscal 2013. The increase in net loss

from continuing operations includes the impacts in fiscal 2014 and 2013 of:

Fiscal 2014

• Q4 Fiscal 2014 Debentures Fair Value Adjustment;

• the Q4 Fiscal 2014 Inventory Recovery; and

• restructuring charges of approximately $105 million, after tax, related to the Company's CORE program and strategic

review process.

Fiscal 2013

• restructuring charges of approximately $20 million, after tax, related to the Company's CORE program incurred in the

fourth quarter of fiscal 2013.

Excluding the items noted above (see “Non-GAAP Financial Measures”), the Company's net loss reflected an unfavourable

increase of $156 million. The increase in net loss is also attributable to a decrease in the Company's gross margin, partially