Blackberry 2014 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

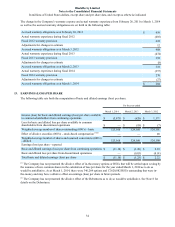

36

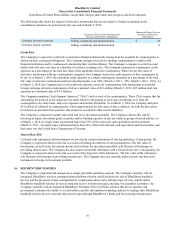

The majority of the Company’s revenues for the fiscal year ended March 1, 2014 were transacted in U.S. dollars.

However, portions of the revenues are denominated in Canadian dollars, Euros, and British Pounds. Purchases of raw

materials are primarily transacted in U.S. dollars. Other expenses, consisting of the majority of salaries, certain operating

costs and manufacturing overhead are incurred primarily in Canadian dollars. The Company enters into forward and

option contracts to hedge portions of these anticipated transactions to reduce the volatility on income associated with the

foreign currency exposures. The Company also enters into forward and option contracts to reduce the effects of foreign

exchange gains and losses resulting from the revaluation of certain foreign currency monetary assets and liabilities. At

March 1, 2014 approximately 35% of cash and cash equivalents, 26% of accounts receivables and 12% of accounts

payable and accrued liabilities are denominated in foreign currencies (March 2, 2013 – 19%, 29% and 5%).

The Company records all derivative instruments at fair value on the consolidated balance sheets. The fair value of these

instruments is calculated based on notional and exercise values, transaction rates, market quoted currency spot rates,

forward points, volatilities and interest rate yield curves. The accounting for changes in the fair value of a derivative

depends on the intended use of the derivative instrument and whether it is designated as a hedge.

The Company’s accounting policies for these instruments outline the criteria to be met in order to designate a derivative

instrument as a hedge and the methods for evaluating hedge effectiveness. Hedge effectiveness is formally assessed, both

at hedge inception and on an ongoing basis, to determine whether the derivatives used in hedging transactions are highly

effective in offsetting changes in the value of the hedged items. If an anticipated transaction is deemed no longer likely to

occur, the corresponding derivative instrument is de-designated as a hedge and any associated deferred gains and losses in

accumulated other comprehensive income are recognized in income at that time. Any future changes in the fair value of

the instrument are recognized in current income.

For any derivative instruments that do not meet the requirements for hedge accounting, or for any derivative instrument

for which hedge accounting is not elected, the changes in fair value of the instruments are recognized in income in the

current period and will generally offset the changes in the fair value of the associated asset, liability, or forecasted

transaction.

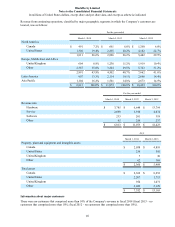

The Company enters into forward and option contracts to hedge exposures relating to foreign currency anticipated

transactions. These contracts have been designated as cash flow hedges, with the effective portion of the change in fair

value initially recorded in accumulated other comprehensive income and subsequently reclassified to income in the period

in which the cash flows from the associated hedged transactions affect income. Any ineffective portion of the change in

fair value of the cash flow hedge is recognized in current period income. For fiscal year ended March 1, 2014, there was

$4 million in realized losses on forward contracts which were ineffective upon maturity (fiscal year ended March 2, 2013

- $8 million in realized gains). As at March 1, 2014 and March 2, 2013, the outstanding derivatives designated as cash

flow hedges were considered to be fully effective. The maturity dates of these instruments range from March 2014 to

December 2014. As at March 1, 2014, the net unrealized loss on these forward and option contracts (including option

premiums paid) was $8 million (March 2, 2013 - net unrealized loss of $8 million). Unrealized gains associated with these

contracts were recorded in other current assets and accumulated other comprehensive income (loss). Unrealized losses

were recorded in accrued liabilities and AOCI. Option premiums were recorded in AOCI. As at March 1, 2014, the

Company estimates that approximately $8 million of net unrealized losses including option premiums on these forward

and option contracts will be reclassified into income within the next twelve months.

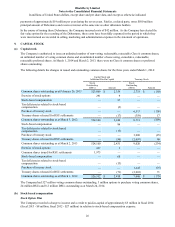

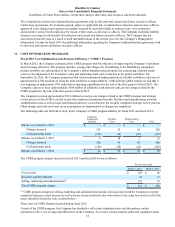

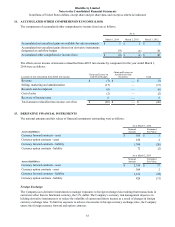

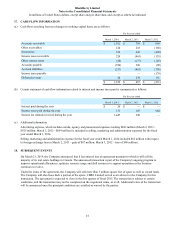

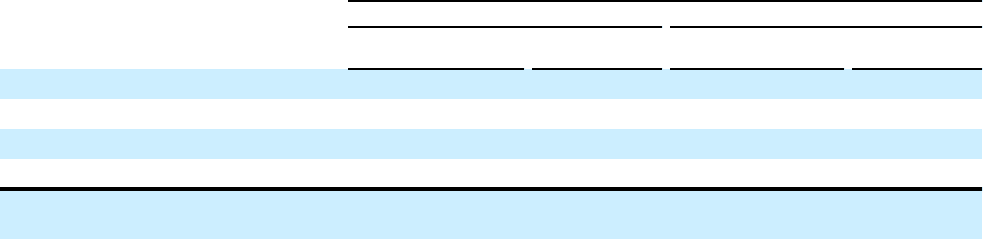

The following table shows the fair values of derivative instruments designated as cash flow hedges on the consolidated

balance sheets:

As at

March 1, 2014 March 2, 2013

Balance Sheet

Classification Fair Value Balance Sheet

Classification Fair Value

Currency forward contracts - asset Other current assets $ — Other current assets $ 13

Currency option contracts - asset Other current assets 1 Other current assets 2

Currency forward contracts - liability Accrued liabilities (7) Accrued liabilities (10)

Currency option contracts - liability Accrued liabilities (1) Accrued liabilities (10)

Currency option contracts - premiums Accumulated other

comprehensive loss (1)Accumulated other

comprehensive loss (3)