Blackberry 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

6

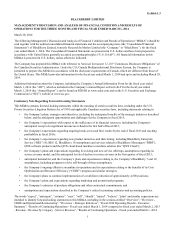

On November 4, 2013, the Company announced that, in lieu of the transaction contemplated by the LOI, it had entered into an

agreement pursuant to which Fairfax and other institutional investors (collectively, the “Purchasers”) would subscribe for $1

billion aggregate principal amount of Debentures, with an option to purchase an additional $250 million principal amount of

Debentures. The initial $1 billion investment of Debentures was completed on November 13, 2013, and the option to purchase

the additional $250 million of Debentures was completed on January 16, 2014. The Debentures are convertible into common

shares of BlackBerry at a price of $10.00 per common share, which was a 28.7% premium to the closing price of BlackBerry

common shares on November 1, 2013. The Debentures have a term of seven years. Fairfax, a related party, owns $500 million

principal amount of Debentures and receives interest at the same rate as other debenture holders. Based on the number of

common shares outstanding at March 1, 2014, if all of the $1.25 billion of Debentures were converted, the common shares

issued upon conversion would represent approximately 19.2% of the common shares outstanding after giving effect to the

conversion.

The announcement of the initial tranche of the Debenture financing on November 4, 2013 marked the conclusion of the review

of strategic alternatives previously announced on August 12, 2013.

Upon closing of the Debenture financing on November 13, 2013, John S. Chen was appointed Executive Chair of BlackBerry's

Board of Directors and, in that role, is responsible for the strategic direction, strategic relationships and organizational goals of

BlackBerry. Thorsten Heins stepped down as Chief Executive Officer and Mr. Chen was named Interim Chief Executive

Officer. Prem Watsa was appointed Lead Director and Chair of the Compensation, Nomination and Governance Committee,

and Thorsten Heins and David Kerr resigned from the Board of Directors.

In addition, the Company made additional significant organizational and personnel changes. On November 25, 2013, the

Company announced the resignation of Roger Martin as a director, and the departures of Kristian Tear, Chief Operating Officer,

and Frank Boulben, Chief Marketing Officer. On the same day, the Company announced that James Yersh had replaced Brian

Bidulka as its Chief Financial Officer. Mr. Bidulka was retained as a special advisor to the Chief Executive Officer for the

remainder of fiscal 2014 to assist with the transition. The Company also announced the following executive officer

appointments during fiscal 2014: on December 17, 2013, John Sims as President, Global Enterprise Services; on December 18,

2013, James S. Mackey as Executive Vice President for Corporate Development and Strategic Planning and Mark Wilson as

Senior Vice President, Marketing (effective January 2014); on January 6, 2014, Ron Louks as President, Devices and Emerging

Solutions; and on January 13, 2014, Eric Johnson as President, Global Sales. The Company believes that these changes will

help it continue its transition and focus on its principal strategic initiatives.

Strategic Initiatives

On December 20, 2013, the Company announced that it intends to focus on three key strategic initiatives: (1) returning the

Company to its core strengths of enterprise and security; (2) implementing changes in the Company’s Devices business to

provide operational flexibility to meet the needs of its customers and to mitigate the financial risk to the Company; and (3) its

planned transition to an operating unit organizational structure consisting of the Devices business, Enterprise Services, QNX

Embedded business and Messaging.

(1) Focus on Enterprise and Security

The Company is renewing its focus on its core strengths of enterprise and security, with a greater focus on regulated industry

customers in the government, financial services, medical and telecommunications sectors. The Company expects this renewed

focus to include additional investments in advanced security capabilities and an expansion of the Company’s product and

service offerings in the enterprise space through both organic investment and potential acquisitions of complementary

businesses and assets. The Company is further investing in its enterprise sales force and focus their efforts on regulated

industries.

(2) Changes to the Devices business

The Company is implementing changes to its hardware model, which has involved, in part, an improved approach to

manufacturing to meet the needs of the Company’s customers. The Company’s joint device development and manufacturing

agreement with Foxconn demonstrates BlackBerry’s commitment to the device market for the long-term and its determination

to remain the innovation leader in secure end-to-end wireless solutions. Under this new partnership, Foxconn is jointly

developing and manufacturing certain new BlackBerry devices and managing the inventory associated with those devices.

The initial focus of the partnership is the recently announced Z3 smartphone for Indonesia and other fast-growing markets,

expected to launch in the spring of 2014. The devices manufactured by Foxconn will be purchased and resold by BlackBerry.

The Company expects that the partnership with Foxconn will enable the Company to focus on iconic design, world-class

security, software development and enterprise mobility management while simultaneously addressing fast-growing markets,

leveraging Foxconn’s scale, efficiency and supply chain to allow the Company to compete more effectively while reducing the

Company's inventory risk. The Company’s new hardware model will also strive to provide a supply chain with speed