Blackberry 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

37

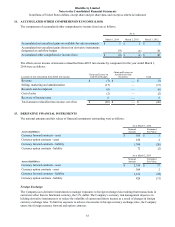

During fiscal 2014, changes in forecasts and uncertainty in the probability of cash flows caused certain forward and

option contracts hedging exposures relating to anticipated foreign currency transactions to no longer qualify for hedge

accounting, and the Company de-designated and closed these forward and option contracts. As a result, unrealized losses

of $9 million (fiscal 2013 – nil) were transferred from AOCI to selling, marketing and administration.

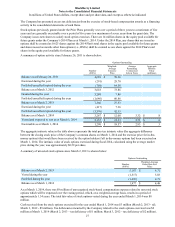

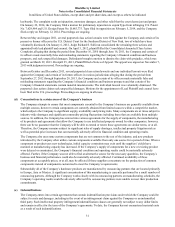

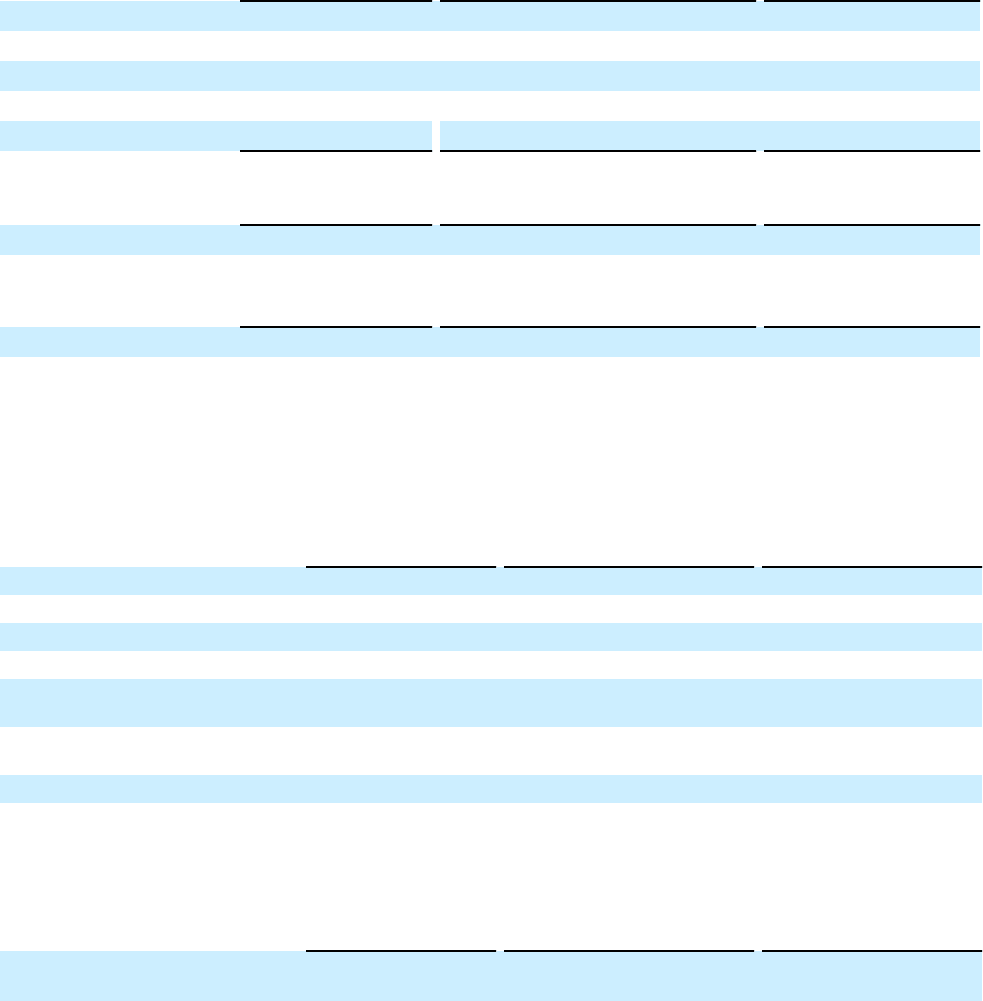

The following table shows the impact of derivative instruments designated as cash flow hedges on the consolidated

statements of operations and the consolidated statements of comprehensive income (loss) for the year ended March 1,

2014:

Amount of Gain (Loss)

Recognized in OCI on

Derivative Instruments

(Effective Portion)

Location of Gain (Loss) Reclassified

from Accumulated OCI into Income

(Effective Portion)

Amount of Gain (Loss)

Reclassified from Accumulated

OCI into Income

(Effective Portion)

Currency option contracts $ — Revenue $ (7)

Currency forward contracts (1) Cost of sales (2)

Currency forward contracts (2) Selling, marketing and administration (4)

Currency forward contracts (4) Research and development (6)

Currency option contracts (1) Research and development —

Amount of Gain (Loss)

Recognized in Income on

Derivative Instruments

(Ineffective Portion)

Location of Gain (Loss) Reclassified

from AOCI into Income (Ineffective

Portion)

Amount of Gain (Loss)

Reclassified from Accumulated

OCI into Income

(Ineffective Portion)

Currency forward contracts $ — Selling, marketing and administration $ (4)

Amount of Gain (Loss)

Recognized in Income on

Derivative Instruments

(Unqualified Portion)

Location of Gain (Loss) Reclassified

from AOCI into Income (Unqualified

Portion)

Amount of Gain (Loss)

Reclassified from Accumulated

OCI into Income

(Unqualified Portion)

Currency forward contracts $ — Selling, marketing and administration $ (9)

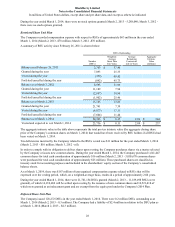

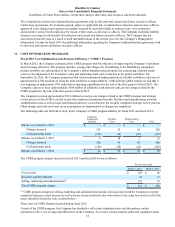

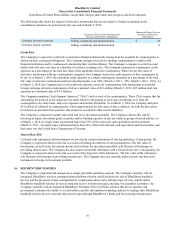

The following table shows the impact of derivative instruments designated as cash flow hedges on the consolidated

statement of operations for the year ended March 2, 2013:

Amount of Gain (Loss)

Recognized in OCI on

Derivative Instruments

(Effective Portion)

Location of Gain (Loss) Reclassified

from Accumulated OCI into Income

(Effective Portion)

Amount of Gain (Loss)

Reclassified from Accumulated

OCI into Income

(Effective Portion)

Currency forward contracts $ 7 Revenue $ 52

Currency option contracts (10) Revenue (5)

Currency forward contracts (1) Cost of sales 5

Currency option contracts — Cost of sales —

Currency forward contracts (2) Selling, marketing and

administration 5

Currency option contracts —Selling, marketing and

administration —

Currency forward contracts (1) Research and development 11

Currency option contracts (1) Research and development (1)

Amount of Gain (Loss)

Recognized in Income on

Derivative Instruments

(Ineffective Portion)

Location of Gain (Loss) Reclassified

from Accumulated OCI into Income

(Ineffective Portion)

Amount of Gain (Loss)

Reclassified from Accumulated

OCI into Income

(Ineffective Portion)

Currency forward contracts $ — Selling, marketing and

administration $ 8

In addition to the outstanding forward and option contracts hedging exposures relating to anticipated foreign currency

transactions that no longer qualify for hedge accounting, the Company has also entered into other forward and option