Blackberry 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

34

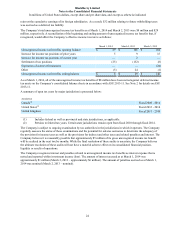

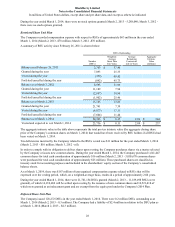

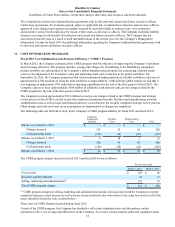

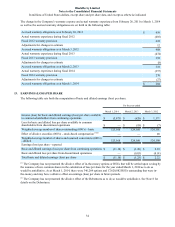

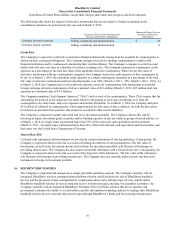

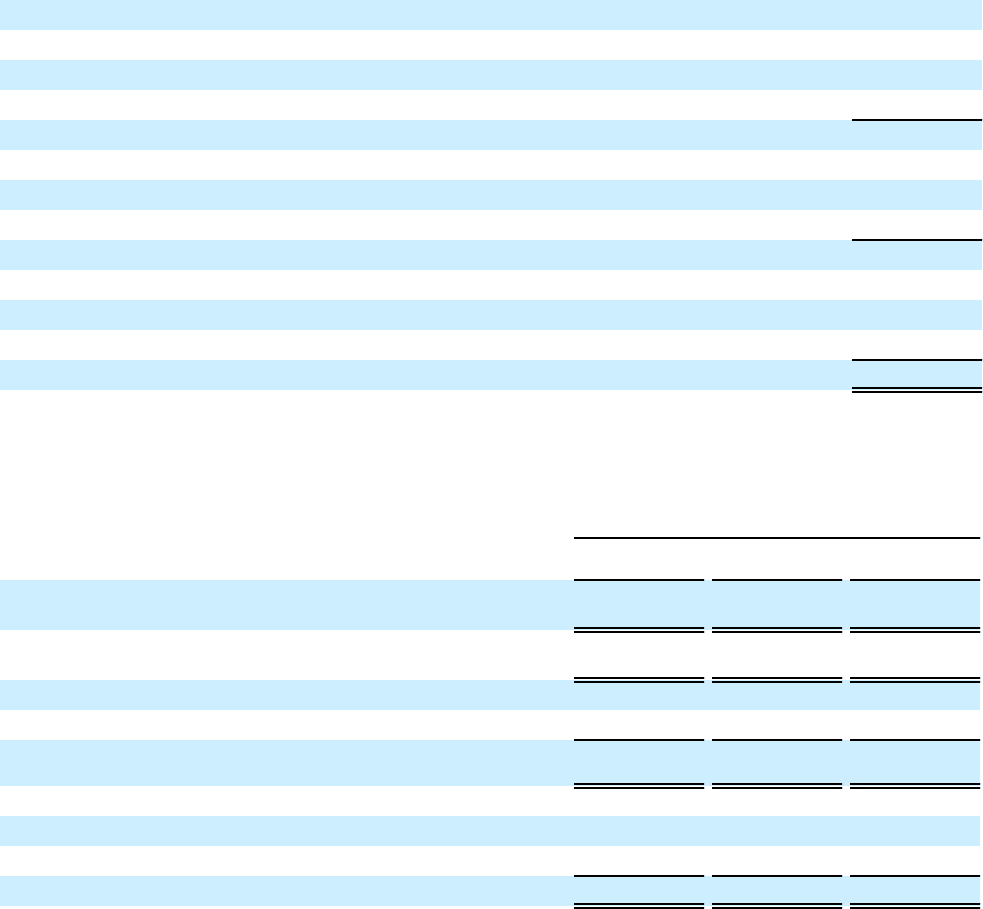

The change in the Company’s warranty expense and actual warranty experience from February 26, 2011 to March 1, 2014

as well as the accrued warranty obligations are set forth in the following table:

Accrued warranty obligations as at February 26, 2011 $ 459

Actual warranty experience during fiscal 2012 (685)

Fiscal 2012 warranty provision 622

Adjustments for changes in estimate 12

Accrued warranty obligations as at March 3, 2012 408

Actual warranty experience during fiscal 2013 (474)

Fiscal 2013 warranty provision 392

Adjustments for changes in estimate (8)

Accrued warranty obligations as at March 2, 2013 318

Actual warranty experience during fiscal 2014 (357)

Fiscal 2014 warranty provision 270

Adjustments for changes in estimate (27)

Accrued warranty obligations as at March 1, 2014 $ 204

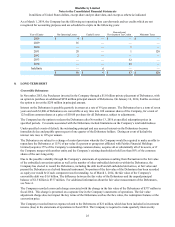

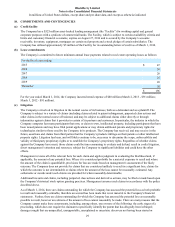

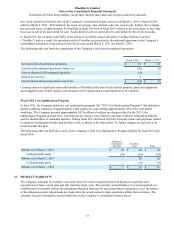

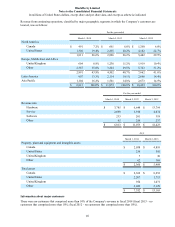

13. EARNINGS (LOSS) PER SHARE

The following table sets forth the computation of basic and diluted earnings (loss) per share:

For the year ended

March 1, 2014 March 2, 2013 March 3, 2012

Income (loss) for basic and diluted earnings (loss) per share available

to common shareholders from continuing operations $(5,873) $ (628) $ 1,171

Loss for basic and diluted loss per share available to common

shareholders from discontinued operations $ — $ (18) $ (7)

Weighted-average number of shares outstanding (000’s) - basic 525,168 524,160 524,101

Effect of dilutive securities (000’s) - stock-based compensation (1)(2) — — 89

Weighted-average number of shares and assumed conversions (000’s)

- diluted 525,168 524,160 524,190

Earnings (loss) per share - reported

Basic and diluted earnings (loss) per share from continuing operations $(11.18) $ (1.20) $ 2.23

Basic and diluted loss per share from discontinued operations —(0.03)(0.01)

Total basic and diluted earnings (loss) per share $(11.18) $ (1.23) $ 2.22

(1) The Company has not presented the dilutive effect of in-the-money options or RSUs that will be settled upon vesting by

the issuance of new common shares in the calculation of loss per share for the year ended March 1, 2014 as to do so

would be antidilutive. As at March 1, 2014, there were 346,264 options and 17,620,882 RSUs outstanding that were in-

the-money and may have a dilutive effect on earnings (loss) per share in future periods.

(2) The Company has not presented the dilutive effect of the Debentures as to do so would be antidilutive. See Note 8 for

details on the Debentures.