Blackberry 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

11

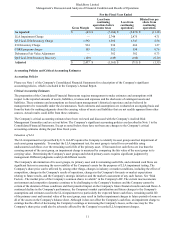

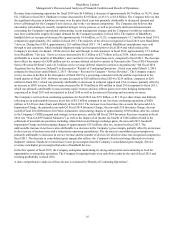

For the Fiscal Year Ended

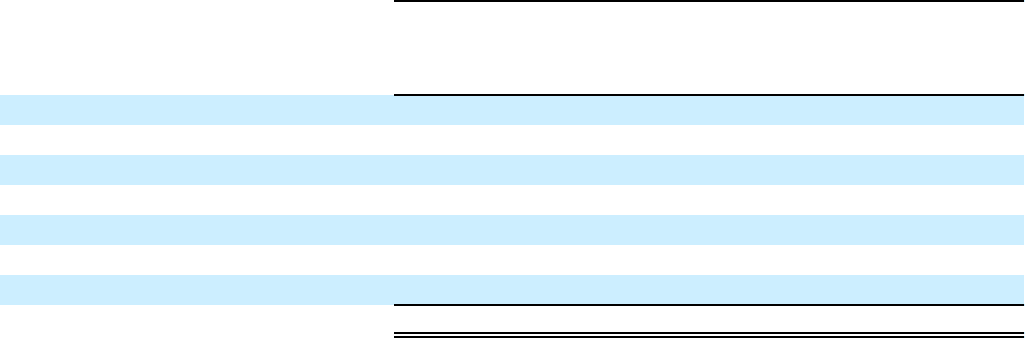

Gross Margin

Loss from

continuing

operations before

income taxes

Loss from

continuing

operations

Diluted loss per

share from

continuing

operations

As reported $(43) $ (7,184) $ (5,873) $ (11.18)

LLA Impairment Charge — 2,748 2,475 4.71

Q3 Fiscal 2014 Inventory Charge 1,592 1,592 1,347 2.56

Z10 Inventory Charge 934 934 666 1.27

CORE program charges 103 512 398 0.76

Debentures Fair Value Adjustment — 382 382 0.73

Q4 Fiscal 2014 Inventory Recovery (149)(149)(106)(0.20)

Adjusted $ 2,437 $ (1,165) $ (711) $ (1.35)

Accounting Policies and Critical Accounting Estimates

Accounting Policies

Please see Note 1 of the Company's Consolidated Financial Statements for a description of the Company's significant

accounting policies, which is included in the Company’s Annual Report.

Critical Accounting Estimates

The preparation of the Consolidated Financial Statements requires management to make estimates and assumptions with

respect to the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and

liabilities. These estimates and assumptions are based upon management’s historical experience and are believed by

management to be reasonable under the circumstances. Such estimates and assumptions are evaluated on an ongoing basis and

form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other

sources. Actual results could differ from these estimates.

The Company’s critical accounting estimates have been reviewed and discussed with the Company’s Audit & Risk

Management Committee and are set out below. The Company’s significant accounting policies are described in Note 1 to the

Consolidated Financial Statements. Except as noted below, there have not been any changes to the Company’s critical

accounting estimates during the past three fiscal years.

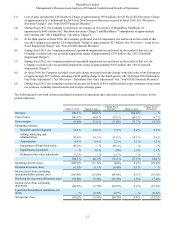

Valuation of LLA

The LLA impairment test prescribed by U.S. GAAP requires the Company to identify its asset groups and test impairment of

each asset group separately. To conduct the LLA impairment test, the asset group is tested for recoverability using

undiscounted cash flows over the remaining useful life of the primary asset. If forecasted net cash flows are less than the

carrying amount of the asset group, an impairment charge is measured by comparing the fair value of the asset group to its

carrying value. Determining the Company's asset groups and related primary assets requires significant judgment by

management. Different judgments could yield different results.

The Company's determination of its asset groups, its primary asset and its remaining useful life, and estimated cash flows are

significant factors in assessing the recoverability of the Company's assets for the purposes of LLA impairment testing. The

Company's share price can be affected by, among other things, changes in industry or market conditions, including the effect of

competition, changes in the Company's results of operations, changes in the Company's forecasts or market expectations

relating to future results, and the Company's strategic initiatives and the market's assessment of any such factors. See “Risk

Factors - The market price of the Company's common shares is volatile” in the Company's AIF. The current macroeconomic

environment and competitive dynamics continue to be challenging to the Company's business and the Company cannot be

certain of the duration of these conditions and their potential impact on the Company's future financial results and cash flows. A

continued decline in the Company's performance, the Company's market capitalization and future changes to the Company's

assumptions and estimates used in the LLA impairment test, particularly the expected future cash flows, remaining useful life

of the primary asset and terminal value of the asset group, may result in further impairment charges in future periods of some or

all of the assets on the Company's balance sheet. Although it does not affect the Company's cash flow, an impairment charge to

earnings has the effect of decreasing the Company's earnings or increasing the Company's losses, as the case may be. The

Company's share price could also be adversely affected by the Company's recorded LLA impairment charges.