Blackberry 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

15

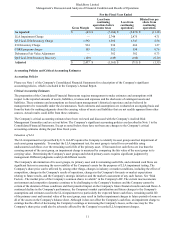

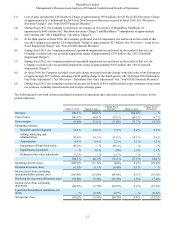

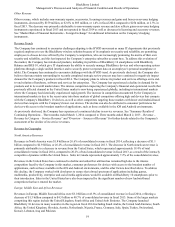

(3) Cost of sales included the Z10 Inventory Charge of approximately $934 million, the Q3 Fiscal 2014 Inventory Charge

of approximately $1.6 billion and the Q4 Fiscal 2014 Inventory Recovery incurred in fiscal 2014. See “Overview -

Inventory Charges” and “Non-GAAP Financial Measures”.

(4) During fiscal 2012, the Company recorded pre-tax charges on its inventory of BlackBerry PlayBooks of

approximately $485 million (the “PlayBook Inventory Charge”) and BlackBerry 7 smartphones of approximately

$267 million (the “2012 BlackBerry 7 Inventory Charge”).

(5) In the third quarter of fiscal 2014, the Company performed an LLA impairment test and based on the results of that

test, the Company recorded the LLA Impairment Charge of approximately $2.7 billion. See “Overview - Long-Lived

Asset Impairment Charge” and “Non-GAAP Financial Measures”.

(6) During fiscal 2013, the Company performed a goodwill impairment test and based on the results of that test, the

Company recorded a pre-tax goodwill impairment charge of approximately $335 million (the “2013 Goodwill

Impairment Charge”).

(7) During fiscal 2012, the Company performed a goodwill impairment test and based on the results of that test, the

Company recorded a pre-tax goodwill impairment charge of approximately $355 million (the “2012 Goodwill

Impairment Charge”).

(8) In fiscal 2014, the Company recorded a non-cash charge associated with the change in the fair value of the Debentures

of approximately $377 million, including a $382 million charge in the fourth quarter (the “Q4 Fiscal 2014 Debentures

Fair Value Adjustment”). See “Overview - Debentures Fair Value Adjustment” and “Non-GAAP Financial Measures”.

(9) During fiscal 2013, the Company recorded an income tax benefit of $166 million related to the settlement of uncertain

tax positions, including related interest and foreign exchange gains.

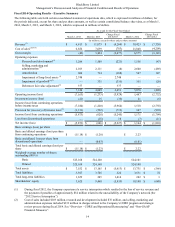

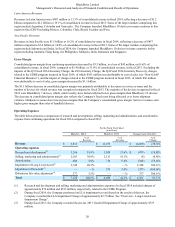

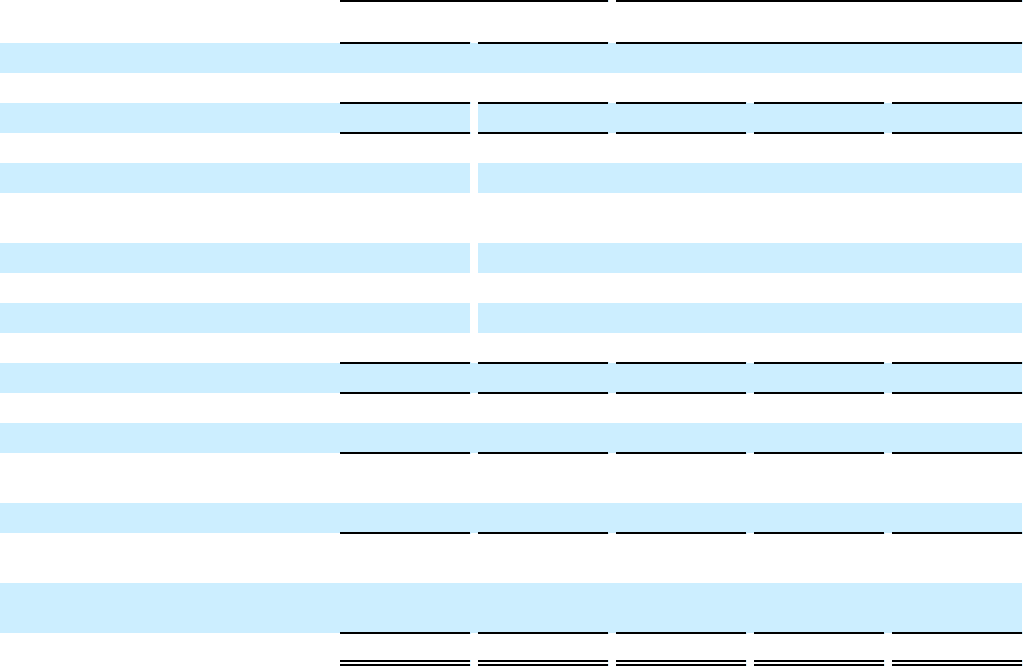

The following table sets forth certain consolidated statement of operations data expressed as a percentage of revenue for the

periods indicated:

March 1, 2014 March 2, 2013 Change Fiscal

2014/2013 March 3, 2012 Change Fiscal

2013/2012

Revenue 100.0 % 100.0 % — 100.0 % — %

Cost of sales 100.6 % 69.0 % 31.6 % 64.3 % 4.7 %

Gross margin (0.6)% 31.0 % (31.6)% 35.7 % (4.7)%

Operating expenses

Research and development 18.9 % 13.6 % 5.3 % 8.4 % 5.2 %

Selling, marketing and

administration 30.9 % 19.1 % 11.8 % 14.1 % 5.0 %

Amortization 8.9 % 6.4 % 2.5 % 3.1 % 3.3 %

Impairment of long-lived assets 40.3 % — % 40.3 % — % — %

Impairment of goodwill — % 3.0 % (3)% 1.9 % 1.1 %

Debentures fair value adjustment 5.5 % — % 5.5 % — % — %

104.5 % 42.1 % 62.4 % 27.5 % 14.6 %

Operating income (loss) (105.1)% (11.1)% (94)% 8.2 % (19.3)%

Investment income (loss) (0.3)% 0.1 % (0.4)% 0.1 % — %

Income (loss) from continuing

operations before income taxes (105.4)% (11.0)% (94.4)% 8.3 % (19.3)%

Provision for (recovery of) income taxes (19.2)% (5.3)% (13.9)% 1.9 % (7.2)%

Income (loss) from continuing

operations (86.2)% (5.7)% (80.5)% 6.4 % (12.1)%

Loss from discontinued operations, net

of tax — % (0.2)% 0.2 % — % (0.2)%

Net income (loss) (86.2)% (5.9)% (80.3)% 6.4 % (12.3)%