Blackberry 2014 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

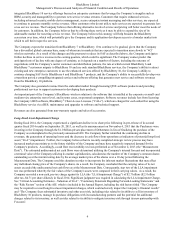

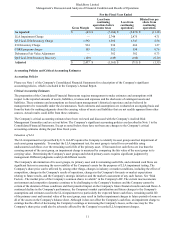

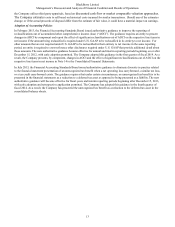

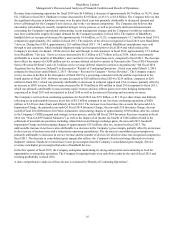

Management’s Discussion and Analysis of Financial Condition and Results of Operations

10

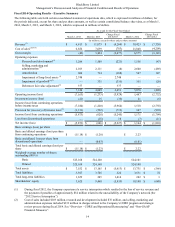

Inventory Charges

During fiscal 2014, the Company shipped devices to its carrier and distributor partners to support new and continuing product

launches and meet expected levels of end customer demand. However, the sell-through levels for BlackBerry 10 smartphones

decreased significantly during fiscal 2014 due to the maturing smartphone market, very intense competition and, the Company

believes, the uncertainty created by the Company's recently completed strategic review process. These factors caused the

number of BlackBerry 10 devices in the channel to increase above the Company's expectations, which in turn caused the

Company to reassess and revise its future demand assumptions for finished products, semi-finished goods and raw materials.

The Company also made the decision to cancel plans to launch two devices to mitigate the identified inventory risk. Based on

these revised demand assumptions, the Company recorded primarily non-cash, pre-tax charges against inventory and supply

commitments of approximately $934 million ($666 million after tax, or $1.27 per share diluted), which was primarily

attributable to BlackBerry Z10 devices (the “Z10 Inventory Charge”) in the second quarter of fiscal 2014, and approximately

$1.6 billion ($1.3 billion after tax, or $2.56 per share diluted), which was primarily attributable to BlackBerry 10 devices (the

“Q3 Fiscal 2014 Inventory Charge”) in the third quarter of fiscal 2014. The Z10 Inventory Charge and the Q3 Fiscal 2014

Inventory Charge were subsequently adjusted in the fourth quarter of fiscal 2014 to reflect increased sell through rates, relative

to the estimates and assumptions previously considered, resulting from discounted pricing and revised orders on hand for

devices and components of BlackBerry 10 products, resulting in a reduction of the original charges incurred of approximately

$149 million ($106 million after tax, or $0.20 per share diluted), which was recorded as a reduction of cost of goods sold in the

fourth quarter of fiscal 2014 (the “Q4 Fiscal 2014 Inventory Recovery”).

Debentures Fair Value Adjustment

The Company elected the fair value option to account for the Debentures, therefore periodic revaluation is required under U.S.

GAAP. The valuation is influenced by a number of embedded features within the Debentures, such as the Company’s put

option on the debt and the conversion option for the investors, among others. The primary factors that influence the fair value

adjustment are the Company’s share price as well as associated volatility driven by the fluctuation of the Company’s share

price. The fair value adjustment charge does not impact the key terms of the Debentures such as the face value, the redemption

features or the conversion price. In fiscal 2014, the Company recorded a non-cash charge associated with the change in the fair

value of the Debentures of approximately $377 million, including a $382 million ($382 million after tax, or $0.73 per share

diluted) charge in the fourth quarter (the “Q4 Fiscal 2014 Debentures Fair Value Adjustment”), partially offset by a gain of $5

million recorded in the third quarter of fiscal 2014.

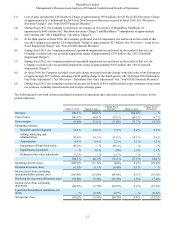

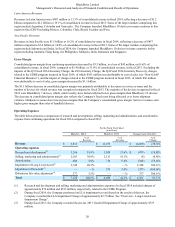

Non-GAAP Financial Measures

The Consolidated Financial Statements have been prepared in accordance with U.S. GAAP, and information contained in this

MD&A is presented on that basis. On March 28, 2014, the Company announced financial results for fiscal 2014, which

included certain non-GAAP financial measures, including adjusted gross margin, adjusted gross margin percentage, adjusted

loss from continuing operations before taxes, adjusted loss from continuing operations and adjusted diluted loss per share from

continuing operations that excluded the pre-tax LLA Impairment Charge of $2.7 billion ($2.5 billion after tax), the pre-tax Q3

Fiscal 2014 Inventory Charge of $1.6 billion ($1.3 billion after tax), the pre-tax Z10 Inventory Charge of $934 million ($666

million after tax), pre-tax restructuring charges of $512 million ($398 million after tax) related to the CORE program as well as

financial and legal advisory and other consulting costs related to the Company's strategic review process, the Debentures Fair

Value Adjustment of $382 million ($382 million after tax) and the Q4 Fiscal 2014 Inventory Recovery of $149 million ($106

million after tax) incurred in fiscal 2014. Similar non-GAAP financial measures were included in the Company’s presentation

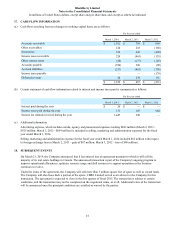

of its financial results for the fourth quarter of fiscal 2014. Certain of these charges and other items are presented in the table

below. The Company believes that presenting non-GAAP financial measures that exclude the impact of those items enables it

and its shareholders to better assess the Company’s operating performance relative to its consolidated financial results in prior

and future periods and improves the comparability of the information presented. Readers are cautioned that adjusted gross

margin, adjusted gross margin percentage, adjusted loss from continuing operations before taxes, adjusted loss from continuing

operations, adjusted diluted loss per share from continuing operations and similar measures do not have any standardized

meaning prescribed by U.S. GAAP and are therefore unlikely to be comparable to similarly titled measures reported by other

companies. These non-GAAP financial measures should be considered in the context of the U.S. GAAP results, which are

described in this MD&A. A reconciliation of these non-GAAP financial measures to the most directly comparable U.S. GAAP

measures was included in the Company’s press release, dated March 28, 2014, and is reflected in the table below.