Blackberry 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

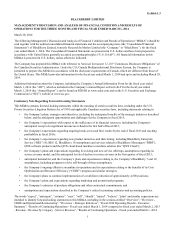

Management’s Discussion and Analysis of Financial Condition and Results of Operations

5

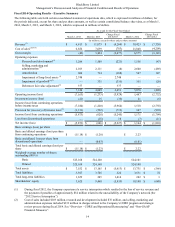

The Company has approximately $2.7 billion in cash, cash equivalents and investments as of March 1, 2014, including the

$1.25 billion of gross cash proceeds from the issuances of 6% unsecured subordinated convertible debentures on November 13,

2013 and January 16, 2014, as described below (the “Debentures”). In fiscal 2014, the Company had sales of $6.8 billion and

incurred a loss from continuing operations of $5.9 billion, or $11.18 per share diluted. The loss reflects a non-cash, pre-tax net

charge against long-lived assets of approximately $2.7 billion, primarily non-cash, pre-tax charges against inventory and supply

commitments of approximately $2.4 billion, pre-tax restructuring charges of $512 million related to the CORE program as well

as financial and legal advisory and other consulting costs related to the Company's strategic review process and a non-cash net

charge associated with the change in the fair value of the Debentures of $377 million recorded in fiscal 2014. See “Non-GAAP

Financial Measures”, “Overview – Long-Lived Asset Impairment Charge”, “Overview – Inventory Charges”, “Overview –

CORE and Operational Restructuring” and “Overview – Debentures Fair Value Adjustment”.

CORE and Operational Restructuring

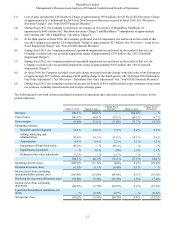

As part of the Company's operational and strategic review, the Company commenced the CORE program in March 2012. The

CORE program is a Company-wide initiative with the objective of streamlining the Company's operations and increasing

efficiency. The program includes, among other things, the optimization of the Company's global manufacturing footprint to

reduce complexity and improve delivery performance, the outsourcing of global repair services, the alignment of the

Company's sales and marketing teams to prioritize marketing efforts to effectively leverage its marketing windows and a

reduction in the global workforce, including a reduction in the number of layers of management to reduce complexity, drive

accelerated execution and decision making, improve performance and increase the transparency of accountability. The

Company continued to execute on the planned headcount reductions in fiscal 2014. Through the CORE program, the Company

reported significant savings in fiscal 2014 and has implemented plans to sustain the majority of savings in fiscal 2015. The

Company incurred charges related to the CORE program as well as the strategic review process of approximately $512 million

in fiscal 2014, including $148 million incurred in the fourth quarter of fiscal 2014.

As part of the CORE program and operational restructuring, the Company has been reviewing all aspects of its operations,

including the sale of certain assets. In fiscal 2014, certain assets were classified as held for sale and are presented separately on

the Company's consolidated balance sheet until they are disposed. Assets held for sale include property, plant and equipment

and intangible assets that are expected to be sold within the next twelve months.

The Company previously announced that it was targeting an approximate 50% reduction in operating expenditures by the end

of the first quarter of fiscal 2015, compared to its first quarter of fiscal 2014 run rate. In the fourth quarter of fiscal 2014, the

Company achieved this target and reduced quarterly operating expenditures by approximately 51% compared to the first

quarter of fiscal 2014. As previously communicated, the Company is continuing to implement a workforce reduction of

approximately 4,500 positions to bring the total workforce to approximately 7,000 full-time employees (the Company had

approximately 8,000 full-time employees at March 1, 2014). The Company expects to incur approximately $100 million in

additional cash and non-cash, pre-tax charges related to the CORE program by the end of the first quarter of fiscal 2015.

Beyond the first quarter of fiscal 2015, the Company plans to further streamline its operations and reduce its controllable spend

cost base as it continues its transformation.

Strategic Review, Debenture Financing and Management Changes

On August 12, 2013, the Company announced that its Board of Directors had formed a Special Committee to explore strategic

alternatives to enhance value and increase scale in order to accelerate BlackBerry 10 deployment. The Special Committee

engaged in a process to review potential alternatives, with the assistance of its financial and legal advisors, which included

possible joint ventures, strategic partnerships or alliances, a sale of the Company or other possible transactions. While the

Special Committee focused on exploring alternatives, the Company continued with its strategy of reducing cost, driving

efficiency and accelerating the deployment of BES 10, as well as driving adoption of BlackBerry 10 smartphones, working

towards launching the multi-platform BBM social messaging service, and pursuing mobile computing opportunities by

leveraging the secure and reliable BlackBerry Global Data Network.

On September 23, 2013, the Company announced that it had signed a letter of intent (the “LOI”) with Fairfax Financial

Holdings Limited (“Fairfax”), a Canadian company led by Prem Watsa, under which a consortium to be led by Fairfax (the

“Fairfax Consortium”) proposed to acquire the Company subject to due diligence. The LOI contemplated a transaction in which

the Company's shareholders would receive $9 in cash for each common share of the Company they held, in a transaction valued

at approximately $4.7 billion. The LOI contemplated that the Fairfax Consortium would acquire for cash all of the outstanding

shares of BlackBerry not held by Fairfax. Fairfax, which owned at the time, approximately 9.9% of the Company's outstanding

common shares, intended to contribute the shares of BlackBerry it held into the transaction. The Board of Directors, acting on

the recommendation of the Special Committee, approved the terms of the LOI. Completion of the transaction was subject to a

number of conditions, including due diligence, negotiation and execution of a definitive agreement by November 4, 2013 and

customary regulatory and shareholder approvals.