Blackberry 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

12

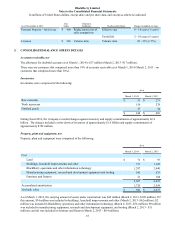

As at March 1, 2014, the Company's other investments consisted of cost method investments of $4 million (March 2,

2013 -$4 million) and equity method investments of $85 million (March 2, 2013 -$46 million).

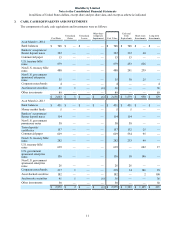

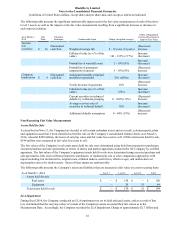

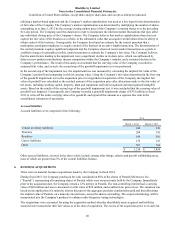

Realized gains and losses on available-for-sale securities comprise the following:

For the year ended

March 1, 2014 March 2, 2013 March 3, 2012

Realized gains $ — $ 11 $ 1

Realized losses ———

Net realized gains $ — $ 11 $ 1

The contractual maturities of available-for-sale investments as at March 1, 2014 were as follows:

Cost Basis Fair Value

Due in one year or less $ 1,821 $ 1,821

Due in one to five years 4 4

Due after five years 35 36

$ 1,860 $ 1,861

As at March 1, 2014 and March 2, 2013, the Company had no investments with continuous unrealized losses.

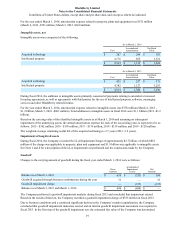

The Company engages in limited securities lending to generate fee income. Collateral, which exceeds the market value of

the loaned securities, is retained by the Company until the underlying security has been returned to the Company. As at

March 1, 2014, the Company had loaned securities (which are included in short-term investments) with a market value of

approximately $100 million (March 2, 2013 - nil) consisting of non-U.S. treasury bills/notes, to major Canadian banks.

The Company holds collateral with a market value that exceeds the value of securities lent, consisting of non-U.S.

treasury bills/notes issued by the federal and provincial governments of Canada.

In valuing the auction rate securities, the Company used a multi-year investment horizon and considered the underlying

risk of the securities and the current market interest rate environment. The Company has the ability and intent to hold

these securities until such time that market liquidity returns to normal levels, and does not consider the principal or

interest amounts on these securities to be materially at risk. As there is uncertainty as to when market liquidity for auction

rate securities will return to normal, the Company has classified the auction rate securities as long-term investments on the

consolidated balance sheets as at March 1, 2014 and March 2, 2013.

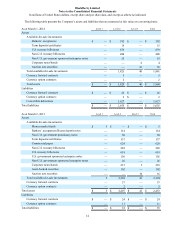

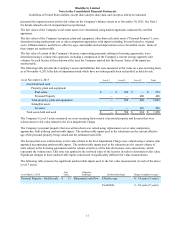

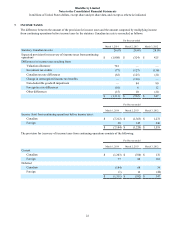

4. FAIR VALUE MEASUREMENTS

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. When determining the fair value measurements

for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous

market in which it would transact and considers assumptions that market participants would use in pricing the asset or

liability such as inherent risk, non-performance risk and credit risk. The Company applies the following fair value

hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value into three levels:

• Level 1 - Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets.

• Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and

liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets that are not active; or

other inputs that are observable or can be corroborated by observable market data.

• Level 3 - Significant unobservable inputs which are supported by little or no market activity.

The fair value hierarchy also requires the Company to maximize the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value.