Blackberry 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

16

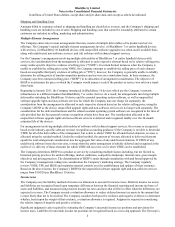

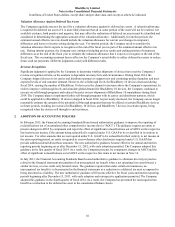

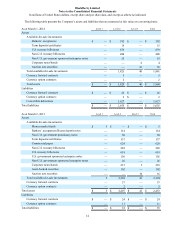

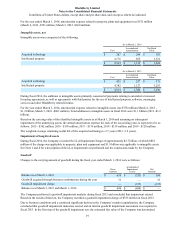

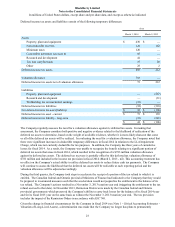

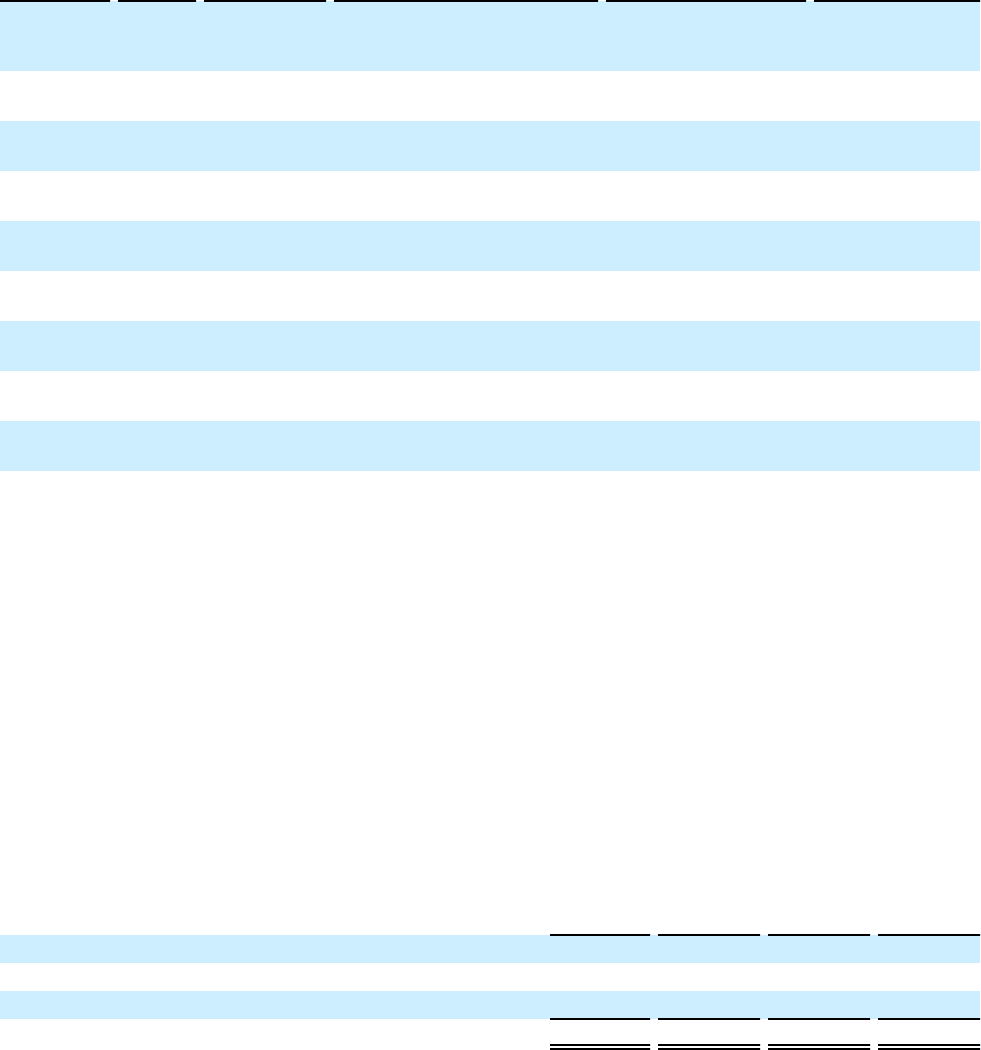

The following table presents the significant unobservable inputs used in the fair value measurement of each of the above

Level 3 assets, as well as the impact on the fair value measurement resulting from a significant increase or decrease in

each input in isolation:

As at March 1,

2014 Fair

Value Valuation

Technique Unobservable Input Range (weighted average)

Effect of Significant

Increase/(Decrease) in

Input on Fair Value

Auction

rate

securities $ 36 Discounted

cash flow Weighted-average life 8 - 19 years (14 years) (Decrease)/

increase

Collateral value (as a % of fair

value) 101 - 133% (117%) Increase/

(decrease)

Probability of waterfall event 5 - 10% (8%) Increase/

(decrease)

Probability of permanent

suspension of auction 5 - 10% (8%) (Decrease)/

increase

Corporate

bonds/notes $ 4 Discounted

cash flow Anticipated monthly principal

and interest payments $0.1 million Increase/

(decrease)

Yearly decrease in payments 10% (Decrease)/

increase

Collateral value (as a % of fair

value) 138% Increase/

(decrease)

Current securities in technical

default, by collateral grouping 0 - 100% (13%) (Decrease)/

increase

Average recovery rate of

securities in technical default 30% Increase/

(decrease)

Additional defaults assumption 0 - 44% (18%) (Decrease)/

increase

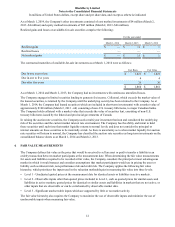

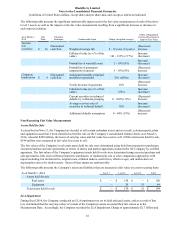

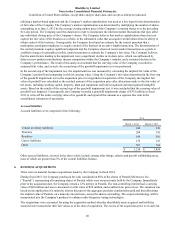

Non-Recurring Fair Value Measurements

Assets Held for Sale

As described in Note 11, the Company has decided to sell certain redundant assets and as a result, certain property, plant

and equipment assets have been classified as held for sale on the Company’s consolidated balance sheets as at March 1,

2014, valued at $209 million, the lower of carrying value and fair value less costs to sell. Of the total assets held for sale,

$194 million were measured at fair value less costs to sell.

The fair values of the Company’s real estate assets held for sale were determined using bids from prospective purchasers,

executed purchase and sale agreements or letters of intent, and market appraisals conducted for the Company by certified

appraisers. The fair values of the Company’s equipment assets held for sale were determined using executed purchase and

sale agreements, bids received from prospective purchasers, or replacement cost or sales comparison approaches with

inputs including, but not limited to, original costs, inflation indices, useful lives, effective ages, and market-derived

depreciation curves for similar assets. Some of these inputs are unobservable.

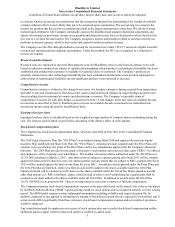

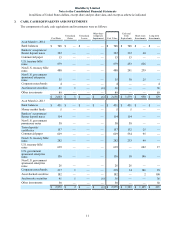

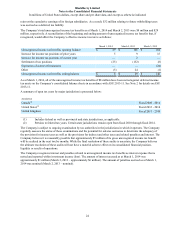

The following table presents the Company’s assets and liabilities that are measured at fair value on a non-recurring basis:

As at March 1, 2014 Level 1 Level 2 Level 3 Total

Assets held for sale

Real estate $ — $ 150 $ — $ 150

Equipment — 29 15 44

Total assets held for sale $ — $ 179 $ 15 $ 194

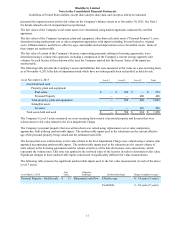

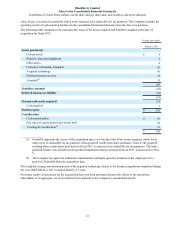

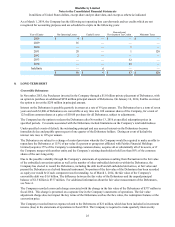

LLA Impairment

During fiscal 2014, the Company conducted an LLA impairment test on its held and used assets, and as a result of that

test, determined that the carrying values of certain of the Company's assets exceeded their fair values as at the

Measurement Date. Accordingly, the Company recorded the LLA Impairment Charge of approximately $2.7 billion and