Blackberry 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

35

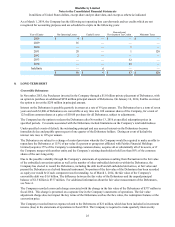

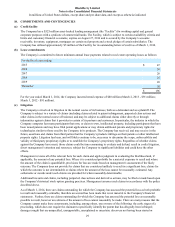

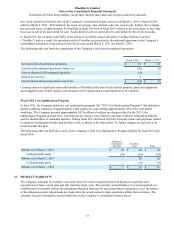

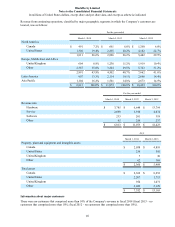

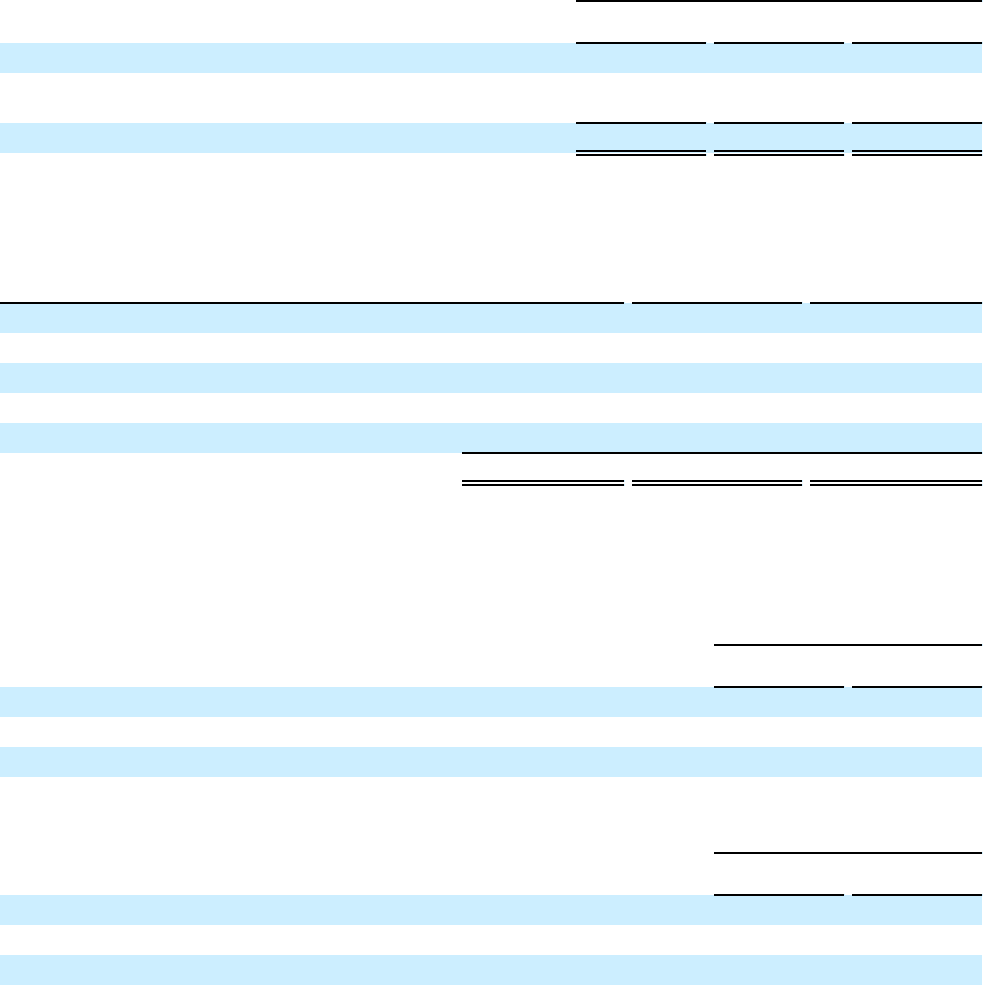

14. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive income (loss) are as follows:

As at

March 1, 2014 March 2, 2013 March 3, 2012

Accumulated net unrealized gains on available-for-sale investments $ 1 $ 2 $ 2

Accumulated net unrealized gains (losses) on derivative instruments

designated as cash flow hedges (9)(6) 38

Accumulated other comprehensive income (loss) $(8)$ (4) $ 40

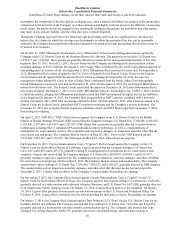

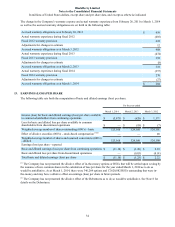

The effects on net income of amounts reclassified from AOCI into income by component for the year ended March 1,

2014 were as follows:

Location of loss reclassified from AOCI into income Gains and Losses on

Cash Flow Hedges

Gains and Losses on

Available-for-Sale

Securities Total

Revenue $(7) $ — $ (7)

Selling, marketing and administration (17) — (17)

Research and development (6) — (6)

Cost of sales (2) — (2)

Recovery of income taxes 6 — 6

Total amount reclassified into income, net of tax $(26) $ — $ (26)

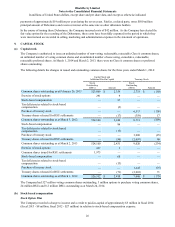

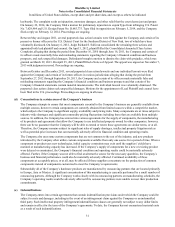

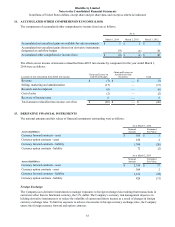

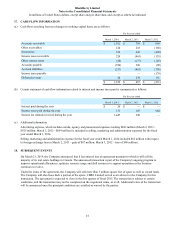

15. DERIVATIVE FINANCIAL INSTRUMENTS

The notional amounts and fair values of financial instruments outstanding were as follows:

As at March 1, 2014

Assets (Liabilities) Notional

Amount Estimated

Fair Value

Currency forward contracts - asset $ 585 $ 5

Currency option contracts - asset 186 2

Currency forward contracts - liability 1,304 (26)

Currency option contracts - liability 72 (2)

As at March 2, 2013

Assets (Liabilities) Notional

Amount Estimated

Fair Value

Currency forward contracts - asset $ 2,356 $ 57

Currency option contracts - asset 309 2

Currency forward contracts - liability 1,332 (24)

Currency option contracts - liability 426 (11)

Foreign Exchange

The Company uses derivative instruments to manage exposures to foreign exchange risk resulting from transactions in

currencies other than its functional currency, the U.S. dollar. The Company’s currency risk management objective in

holding derivative instruments is to reduce the volatility of current and future income as a result of changes in foreign

currency exchange rates. To limit its exposure to adverse movements in foreign currency exchange rates, the Company

enters into foreign currency forward and option contracts.