Blackberry 2014 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2014 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

41

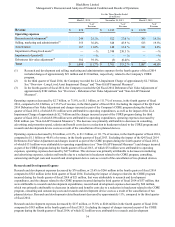

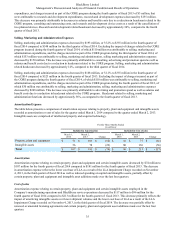

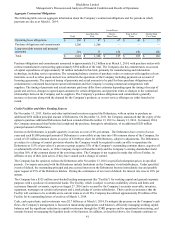

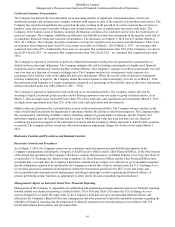

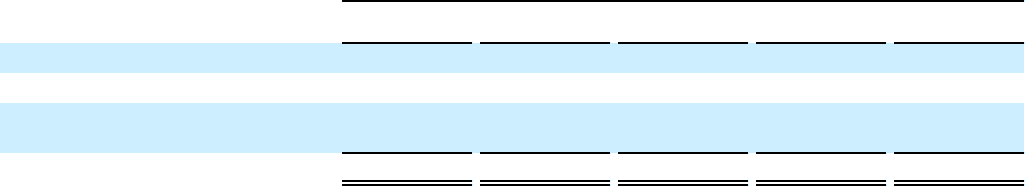

Aggregate Contractual Obligations

The following table sets out aggregate information about the Company’s contractual obligations and the periods in which

payments are due as at March 1, 2014:

(in millions)

Total Less than One

Year One to

Three Years Four to Five

Years Greater than

Five Years

Operating lease obligations $ 196 $ 47 $ 67 $ 45 $ 37

Purchase obligations and commitments 1,206 1,206 — — —

Long-term debt interest and principal

payments 501 75 150 150 126

Total $ 1,903 $ 1,328 $ 217 $ 195 $ 163

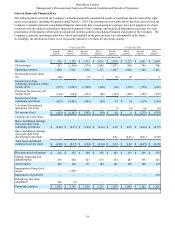

Purchase obligations and commitments amounted to approximately $1.2 billion as at March 1, 2014, with purchase orders with

contract manufacturers representing approximately $586 million of the total. The Company also has commitments on account

of capital expenditures of approximately $9 million included in this total, primarily for manufacturing and information

technology, including service operations. The remaining balance consists of purchase orders or contracts with suppliers of raw

materials, as well as other goods and services utilized in the operations of the Company including payments on account of

licensing agreements. The expected timing of payments and actual amounts to be paid for these purchase obligations and

commitments is estimated based upon current information and the Company’s existing contractual arrangements with

suppliers. The timing of payments and actual amounts paid may differ from estimates depending upon the timing of receipt of

goods and services, changes to agreed-upon amounts for certain obligations, and payment terms or changes to the contractual

relationships between the Company and its suppliers. The Company’s purchase obligations and commitments generally

increase or decrease along with the demand for the Company’s products, or as new service offerings are either launched or

exited.

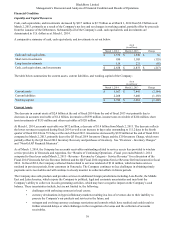

Credit Facilities and Other Funding Sources

On November 13, 2013, Fairfax and other institutional investors acquired the Debentures, with an option to purchase an

additional $250 million principal amount of Debentures. On December 12, 2013, the Company announced that the expiry of the

option to purchase additional Debentures had been extended from December 13, 2013 to January 13, 2014. In January 2014,

the Company announced that Fairfax had completed the purchase, through its subsidiaries, of an additional $250 million

principal amount of Debentures.

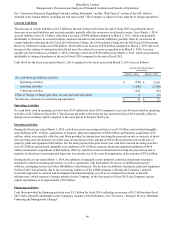

Interest on the Debentures is payable quarterly in arrears at a rate of 6% per annum. The Debentures have a term of seven

years and each $1,000 principal amount of Debentures is convertible at any time into 100 common shares of the Company, for

a total of 125 million common shares at a price of $10.00 per share for all Debentures, subject to adjustments. The Debentures

are subject to a change of control provision whereby the Company would be required to make an offer to repurchase the

Debentures at 115% of par value if a person or group acquires 35% of the Company’s outstanding common shares, acquires all

or substantially all of its assets, or if the Company merges with another entity and the Company’s existing shareholders hold

less than 50% of the common shares of the surviving entity. The Company is not required to make that offer to Fairfax, its

affiliates or any of their joint actors, if they have caused such a change of control.

The Company has the option to redeem the Debentures after November 13, 2016 at specified redemption prices in specified

periods. Covenants associated with the Debentures include limitations on the Company’s total indebtedness. Under specified

events of default, the outstanding principal and any accrued interest on the Debentures become immediately due and payable

upon request of 25% of the Debenture holders. During the continuance of an event of default, the interest rate rises to 10% per

annum.

The Company has a $525 million asset-backed lending arrangement (the “Facility”) for working capital and general corporate

purposes with a syndicate of commercial banks. The Facility, which is subject to certain availability criteria and limits and

customary financial covenants, expires on August 27, 2016 and is secured by the Company’s accounts receivable, inventory,

equipment, mortgages on certain real property and a stock pledge of certain subsidiaries. There can be no assurance that the

Facility will continue to be available on its current terms or at all. The Company has utilized approximately $5 million of the

Facility for its outstanding letters of credit as of March 1, 2014.

Cash, cash equivalents, and investments were $2.7 billion as at March 1, 2014. To mitigate the pressure on the Company's cash

flows, the Company's management is focused on maintaining appropriate cash balances, efficiently managing working capital

balances and the significant reduction in capital investments through the CORE program and its operational restructuring, and

remains focused on managing the liquidity needs of the business. In addition, as described above, the Company continues to